Picture this: Your front desk team is trying to handle ringing phones, scheduling issues, and patients filling out forms all at once. At the same time, your Accounts Receivable (payment that has to be collected from your patients or insurers for the service taken) keep going up.

Meanwhile, your accounts receivable keep climbing.

Sound familiar?

The good news! is It doesn’t have to be this way. With proven strategies and solutions like those offered by CERTIFY Health, you can increase point-of-service collections and finally tame bad debt. But before we do that, let’s understand why is pos collection is important and the role of healthcare payment platforms in POS collections.

Importance of Point-of-Service Collections in Healthcare?

Point-of-service or POS collection is where patients pay some amount from their medical bills during or before their visit. It has a vital role in keeping your financial health in check in today’s healthcare landscape. Let’s understand it better through the below-given pointers:

1. Rising Patient Responsibility

Your patients wouldn’t love to pay out-of-pocket cost or high deductibles. Inaccurate insurance verification or surprise medical billings at the later stage of the patient’s journey usually results in this nuisance.

Therefore, hospitals and clinics can no longer rely solely on insurers to collect payments. The best option – is upfront point-of-service collections in healthcare. Streamline cash flow and say good bye to the bad debt risk.

2. Declining Reimbursements

Not collecting healthcare payments upfront means – delayed or missed payments. And yes, this is not only going to make it harder for you to get reimbursed but thin your already thin margins.

Did you know?

The denial rate on inpatient claims increased by 50% over years, resulting in a nearly $1.2 billion revenue loss for hospitals and health systems. This sharp rise directly impacts the insurance reimbursement rate—the percentage of billed services successfully paid by insurers. A lower reimbursement rate not only affects the financial stability of healthcare providers but also delays access to care improvements, staffing, and operational efficiency. In an environment where margins are tight, optimizing reimbursement is critical to sustaining quality care and regulatory compliance.

This is the reason why POS collection is necessary. As soon as patients walk into your facility, collect their details, verify their insurance, determine co-pays & deductibles and collect payment using self-service kiosks at your facility.

3. Improved Revenue Cycle Efficiency

Collecting payments after service is hard, you will have to send multiple follow-up emails or SMS to your patients, and follow-up with insurers on claims submitted, this will make your payment cycle long.

POS Collections reduces billing errors, minimizes follow-up work, and shortens the payment cycle. It also decreases the administrative overload related and frees up your team for high value tasks.

4. Digital Payment Expectations

Patients expect to pay online these days, as they do for shopping, travelling, etc. So, why not digital payment solutions for healthcare?

Patients expect you to offer fast, digital, and mobile payment experiences. Offering POS collection options through self-service kiosks that can read cards or support other payment options can make your patients more likely to pay.

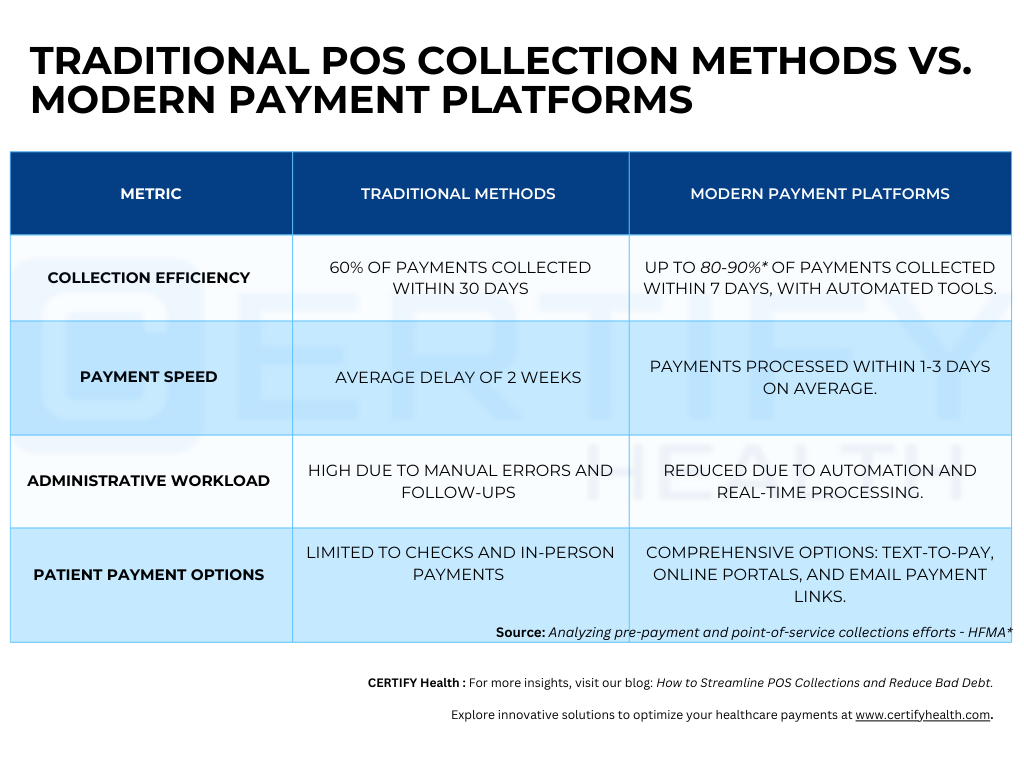

The Role of Healthcare Payment Solutions in POS Collections

Let’s face it: outdated payment processes can hold your practice back. Healthcare payment solutions simplify point-of-service collections by streamlining insurance verification, offering cost estimation, and providing multiple payment options. These systems reduce friction for both staff and patients, making upfront point-of-service collections more efficient and reliable.

Suggested Article:

Implementing digital intake processes can streamline patient registration and payment collections.

Learn more about the benefits of digital intake in medical practices.

Why Point-of-Service (POS) Collections Matter

Here’s the thing: the longer it takes to collect payment from a patient, the less likely you are to get paid. It’s a harsh truth. Studies show that POS collections are far more successful than post-visit collection.

Why?

Patients are more likely to settle balances when they’re in your practice are offered digital payment solutions. Waiting until later often means chasing payments that’ve slipped through the cracks of everyday life.

Did You Know?

Point-of-service collections are 70% more successful than post-visit billing when patients are provided upfront cost estimates and clear payment options. This not only boosts immediate revenue capture but also significantly improves the Accounts Receivable (AR) Turnover Rate by reducing outstanding balances and speeding up the payment cycle—ultimately strengthening your practice’s financial health.

Challenges in Collecting Patient Payments at the Point of Service

Collecting payments on the spot isn’t always straightforward. Insurance complexities, manual errors, and patient hesitations often get in the way. Addressing these challenges with clear communication and automated systems can significantly improve outcomes, keeping both your revenue cycle and patient satisfaction intact.

How Transparent Payment Options Reduce Patient Hesitation

When patients know what to expect, they’re more likely to pay promptly. Providing upfront cost estimates and clear payment plans eliminates surprises, building trust and easing concerns about financial obligations.

Start With a Clear Financial Policy

Let’s face it: patients aren’t mind readers. If your financial policy isn’t crystal clear, you’re setting yourself up for misunderstandings. Display your policy prominently—on your website, in the office, and in appointment reminders.

Explain terms like co-pays, deductibles, and outstanding balances in plain language. Patients appreciate straightforward communication, and it sets the stage for smoother POS interactions.

Hot Topic:

A lack of price transparency is one of the top reasons patients delay payments, contributing to a 5-30% increase in no-show rates.

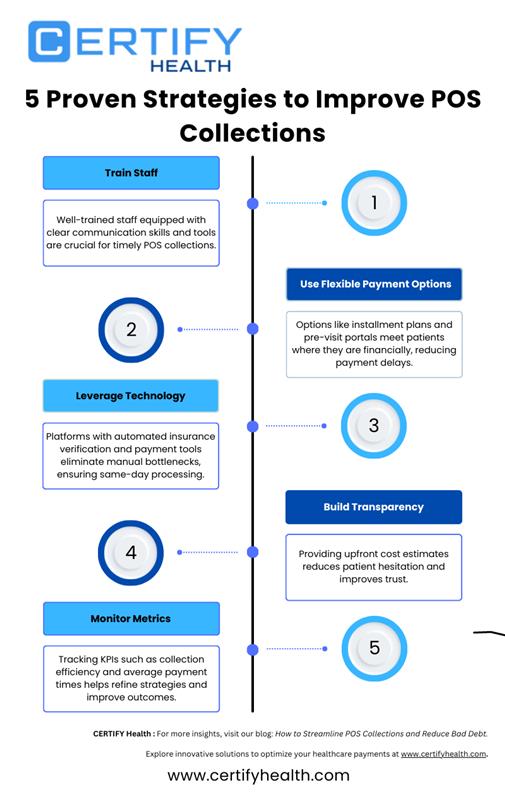

Train Your Front Desk Team Like Pros

Your front desk staff aren’t just schedulers; they’re financial ambassadors. Give them the tools and training to confidently discuss payment expectations with patients. Role-play scenarios, provide scripts for tricky conversations, and empower them to handle objections gracefully.

For example, instead of saying, “Your balance is $200. Can you pay that today?” try, “We’ll take care of your $200 balance today. Will that be on a card?” Smartly playing with words can make a lasting impact and bring a change.

Leveraging Patient Payment Platforms to Empower Staff

How Training and Technology Work Together to Boost Collections

Well-trained teams equipped with the right tools can work wonders for POS collections. Combining digital payment solutions with patient communication ensures a seamless experience that benefits everyone!

You might also like to read: 5 Proven Techniques to Enhance Patient Payment Collection in your Practice

Leverage Technology to Simplify Payments

Let’s talk tech for a minute. Platforms like CERTIFY Health make it ridiculously easy to collect payments at the point of service. From contactless payments to automatic insurance verification, modern tools eliminate many of the hurdles that slow down collections.

Imagine a patient walks in, and their insurance details are already verified in your system. You can confidently explain what’s covered and collect the balance right then and there. No guesswork, no awkward delays—just seamless transactions.

Payment Plans: A Solution to Minimize Bad Debt

Not every patient can pay in full on the spot, and that’s okay. Offering flexible payment options like payment plans, , makes payments manageable for patients while ensuring your practice gets paid overtime.

Payment Options Patients Prefer

Patients appreciate flexible payment options like text-to-pay, pre-visit portals, and installment plans make it easier for them to settle their balances without added stress.

Offer Flexible Payment Options

We’re not saying you need to be a bank, but offering flexibility goes a long way. Installment plans, pre-visit payment portals, or even text-to-pay options can make life easier for patients. It’s about meeting them where they’re at.

Let’s say a patient balks at a $500 balance. Instead of letting them walk away, offer a solution: “Would you like to set up a payment Aplan today? We can start with $100.” You’ve secured a commitment, and they leave feeling cared for, not pressured.

Tip:

When patients receive cost estimates upfront, 60% are more likely to pay at the point of service

The Impact of Payment Transparency on Patient Trust

Financial surprises don’t sit well with anyone. Transparent payment systems like self-service kiosks provide accurate cost estimates upfront build trust and confidence, encouraging patients to settle payments promptly using digital payment solutions.

Tools That Make Transparency Easy

Automated tools for cost estimation and insurance verification help practices provide patients with accurate information in seconds, reducing awkward financial conversations.

Transparency Is Non-Negotiable

No one likes financial surprises—least of all patients. Use tools that provide cost estimates upfront, so patients know what to expect before they arrive. Platforms like CERTIFY Health’s patient payment management platform shine here, offering price transparency features that make awkward conversations a thing of the past.

When patients trust that you’re being upfront about costs, they’re more likely to pay promptly. It’s a win-win.

Why Monitoring POS Collection Metrics Is Essential

If you don’t measure your collection metrics, you cannot improve it.

Tracking KPIs like collection rates, average payment times, and patient balances gives you the insights needed to refine your revenue cycle strategies and improve outcomes.

Key Metrics to Monitor for Healthcare Payment Success

Collection efficiency, time-to-payment, and outstanding balances are just a few metrics that reveal how well your payment systems are working—and where you can improve.

Track, Measure, and Adjust

You wouldn’t ignore patient outcomes—so don’t ignore your POS collection metrics. Track key performance indicators (KPIs) like average collection period (ACP), average payment times, and outstanding balances. Use this data to refine your approach.

For instance, if you notice that a particular time of day results in lower collections, adjust staffing or processes to address the issue. A little fine-tuning can yield big results.

Balancing Empathy and Efficiency in Patient Payment Solutions

Patients want to feel understood, especially when finances are involved. Combining empathetic communication with efficient payment tools ensures a smoother experience for everyone while keeping collections on track.

How Flexible Payment Systems Address Financial Concerns

Flexible payment options like installment plans and pre-visit payment portals meet patients where they are financially, easing the burden of large medical bills and increasing the likelihood of payment.

The Human Element: Empathy and Understanding

We’ve focused a lot on strategy, but let’s not forget the human side of healthcare. Patients aren’t just balances to collect; they’re people with worries, questions, and sometimes financial struggles. A little empathy goes a long way.

If someone is hesitant to pay, take a moment to listen. Maybe they’re navigating a high-deductible plan or unexpected medical expenses. By showing understanding and offering solutions, you build trust—and trust often translates to payment.

Wrapping It All Up

Increasing POS collections isn’t rocket science, but it does require a thoughtful, patient-centered approach. With clear policies, well-trained staff, and the right technology like CERTIFY Health you can drive revenue, reduce collection times, and minimize bad debt.

So, what’s your next move?

Maybe it’s revisiting your financial policy or exploring a platform like CERTIFY Health.

Whatever it is, the key is to start. After all, every step you take today is one less dollar chasing tomorrow.