Introduction

Healthcare practices can no longer stick to the old-school methods of providing patient care, these methods are not only time consuming but make it harder to track your revenue cycle management (RCM).

These days, practices are switching to automation to simplify their RCM process. A report by the American Health Association revealed that about 74% of health systems and hospitals are implementing some form of automated revenue cycle solution to streamline their operations (from patient registration to insurance verification to collection of payments).

This blog will give you a complete rundown on What is RCM in healthcare, the challenges it faces, why it’s important, and how digital solutions like CERTIFY Health can help you streamline payments, boost staff efficiency, and improve your revenue cycle management.

Understanding Revenue Cycle Management

What is revenue cycle management (RCM) in healthcare?

Healthcare providers use revenue cycle management (RCM), a financial procedure, to track patient care episodes. This covers everything, from making appointments and confirming insurance to managing invoices and completing payments.

A well-structured RCM process includes:

- Patient Registration: collecting accurate patient details such as their name, contact info, and insurance.

- Insurance verification: carrying out the insurance eligibility verification process.

- Charge Capture & Claims Submission: Converts medical codes into billable charges, ensuring accurate coding to minimize denials.

- Claims Processing & Insurance Reimbursement: Submitting claims to facilitate claim approvals and payment settlement.

- Denial Management & Follow-Ups: Proactively identifying and resolving claim denials, ensuring timely payments.

- Reporting & Financial Analysis: Uses analytics to track cash flow, identify inefficiencies, and improve financial performance.

An effective revenue cycle management system not only maintains a steady cash flow for healthcare practices but also reduces claim denials and administrative burdens for staff, leading to a more efficient healthcare practice.

Pro Tip:

Implementing revenue cycle management best practices is crucial to streamline operations, reduce errors, and improve cash flow.

Comprehensive solutions like CERTIFY Health bring all these practices into one unified platform, simplifying tasks such as patient registration, claims submission, and denial management. This not only enhances efficiency but also minimizes administrative burdens, ensuring a smoother financial cycle for healthcare providers.

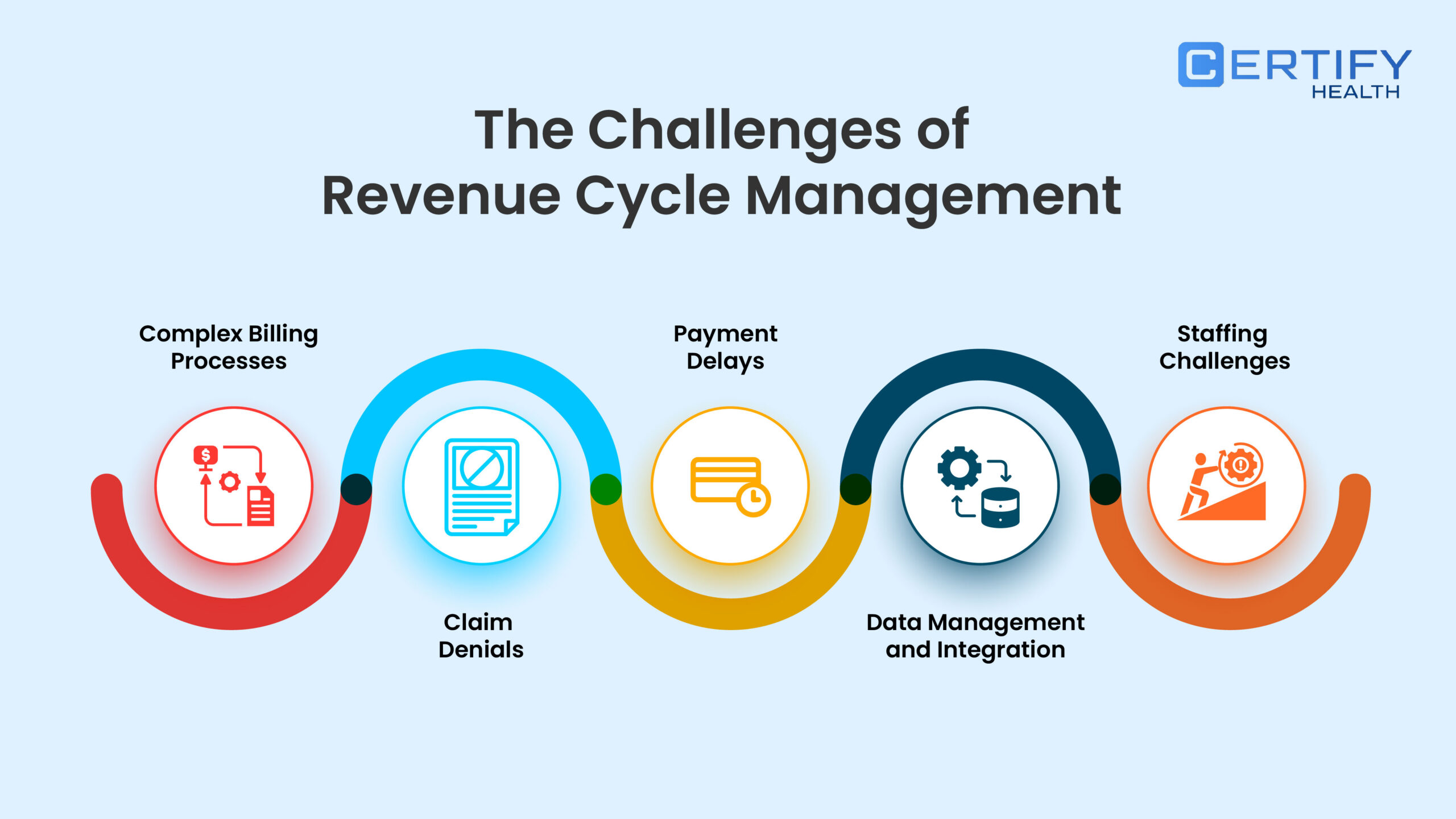

The Challenges of Revenue Cycle Management

Managing an efficient RCM process comes with its fair share of challenges, including:

Inaccurate Patient Data

A simple error in name when collecting patient intake details can disrupt your whole revenue cycle. Your patient’s name and other details should match when verifying insurance verification, and incorrect details or outdated information can make your claims process hectic and result in payment delays. Ensuring data accuracy from the start is crucial for smooth RCM operations.

Complex Insurance Policies and Regulations

Changes in healthcare policies, insurance requirements, and compliance are another big challenge in revenue cycle management. Healthcare practices that fail to stay updated or meet regulatory requirements result in financial losses and penalties.

Claim Denials and Rejections

Inefficiency among your staff can significantly impact your Revenue Cycle Management (RCM). During the insurance claims process, submitting incorrect information, missing documents, or making coding errors can lead to claim rejections. It requires your staff to repeat the claims process, which wastes valuable time and negatively affects patient experience, ultimately resulting in lost revenue.

Delayed or Uncollected Patient Payments

Educating patients about payment policies is crucial to avoid confusion and distrust, which can lead to delayed or unpaid bills. Providing clear billing details and flexible payment options helps collect payments upfront. Additionally, missed payment follow-ups can cause further delays, so many healthcare practices use automated solutions for reminders and efficient payment collection.

Inefficient Billing and Coding Processes

Incorrect diagnosis or medical coding can impact your healthcare practice’s financial performance and patient satisfaction. These errors arise due to a lack of proper training for your staff members or documentation.

Lack of Integration Between Systems

Many healthcare facilities face significant challenges in Revenue Cycle Management (RCM) due to the reliance on outdated or fragmented systems for managing patient records, billing, and claims processing. These disconnected systems create barriers to seamless data flow, leading to inefficiencies and increased errors that can compromise patient care.

Time-Consuming Manual Processes

Manual tasks like paperwork, manual insurance verification, and billing consume a lot of time for your staff. Your staff faces burnout, so they cannot deliver proper patient care and make errors that directly impact the revenue cycle. Automating key RCM functions like patient intake, insurance verification, and payment collection improves staff efficiency and reduces operational costs.

Limited Financial Visibility and Reporting

Healthcare providers struggle to track revenue performance and identify inefficiencies without real-time financial insights. Advanced RCM analytics help optimize cash flow and financial decision-making.

These challenges affect profitability and patient satisfaction. When patients experience confusion about their medical bills or struggle to pay, it impacts the practice’s overall trust and efficiency.

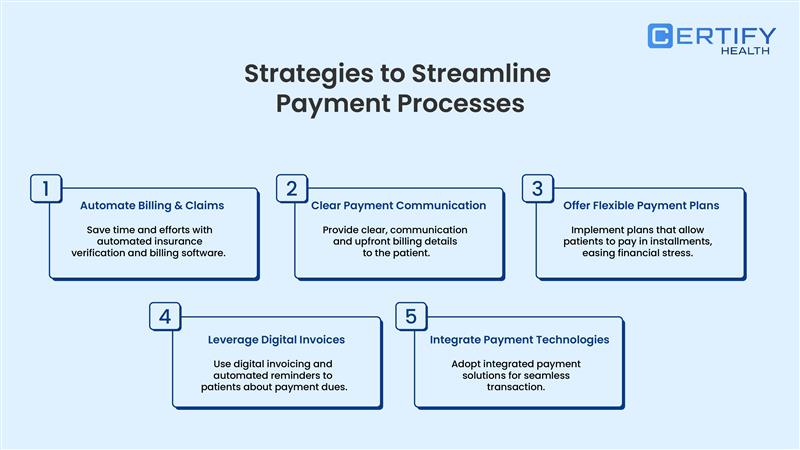

Leveraging Technology to Streamline Payment Processes in RCM

Automating Administrative Tasks

Automation reduces the burden of repetitive administrative work, allowing staff to focus on higher-value tasks. Implementing technology in patient intake, appointment scheduling, insurance verification, and payment collection streamlines operations and minimizes human errors.

By integrating technology like CERTIFY Health, healthcare practices can automate workflows. This will improve billing accuracy, accelerate reimbursements, and enhance overall efficiency.

Boosting Patient Communication for Faster Payments

Clear and timely communication with patients about their bills is crucial in ensuring prompt payments. Providing digital statements, automated reminders, and easy-to-understand breakdowns of charges can eliminate confusion and encourage faster settlements.

When patients are well-informed about their financial responsibilities, they are more likely to make timely payments, thereby improving cash flow. Leverage tools like CERTIFY Health’s patient communication platform to send automated reminders and digital invoices via email or text, ensuring seamless and hassle-free payment collection.

Offering Various Payment Options for Convenience

Patients today expect flexible and convenient payment solutions. Offering multiple payment options—including credit/debit cards, flexible spending account, ACH transfers, and installment plans—makes it easier for patients to pay their bills on time.

CERTIFY Health’s patient payment platform supports flexible payment options and contactless payment collections methods, which boost collection rates and reduce outstanding balances.

The Value of Investing in RCM Software

Training Staff for Optimal Utilization

While technology plays a key role in streamlining RCM, proper staff training is equally vital. Equipping employees with the knowledge to use digital tools effectively ensures seamless implementation and maximized benefits.

CERTIFY Health offers robust training and resources for training your staff on how to effectively use the solution to overcome Revenue cycle management challenges, boost staff efficiency, and drive revenue growth.

Leveraging Data Analytics for Continuous Improvement

Conclusion

Improving Revenue Cycle Management (RCM) goes beyond billing; it strives to make payments easy and quick both for patients and providers. By automating key processes, providing flexible payment options, and employing advanced RCM, healthcare practices boost collections, reduce denial of claims and reap more financial benefit.

CERTIFY Health’s patient payment solution simplifies payment collection with automated insurance verification, automated billing, and payment collection for a more seamless experience of both providers and patients.

Now is the time to rethink your RCM strategy and embrace digital solutions for a more efficient, profitable, and patient-friendly practice. Know More about CERTIFY Health.

FAQs

What is RCM in healthcare?

What is the goal of RCM?

How can we improve revenue cycle management?

Revenue Cycle Management best practices, focus on making billing faster and more accurate, ensuring patient details are spot on, minimizing claim denials, and staying on top of overdue payments. Using the right technology and encouraging communication across departments also helps everything run more efficiently.