Table of Contents

Introduction

Medical insurance verification is no longer just a box to tick—it’s a make-or-break moment in your revenue cycle.

Yet, many practices still rely on manual verification methods—phone calls, paper forms, and fax machines. Not only are they time-consuming, but they are also error-prone and drag down staff efficiency.

In this blog, we walk you through a step-by-step guide to transforming your workflow using digital health insurance tools—designed to make insurance eligibility verification faster, easier, and much more accurate.

Why Medical Insurance Verification is Essential in Healthcare

Before diving into the digital workflow, let’s understand why verifying medical insurance is a foundational step in healthcare delivery:

Ensures eligibility: Verifies if the patient’s insurance is current and pays for the treatments they want.

Prevents claim denials: Accurate medical insurance verification reduces costly denials and delays.

Determines patient cost: Helps estimate copays, deductibles, and out-of-pocket expenses upfront.

Facilitates prior authorization: Identifies services that require insurer approval before treatment.

Improves patient satisfaction: Transparent communication about coverage builds trust.

Despite its importance, many healthcare providers still rely on manual verification methods-phone calls, faxes, and paper forms-that are inefficient and error-prone. This creates bottlenecks in patient flow, increases administrative burden, and risks revenue loss.

The Real Problem with Manual Insurance Verification

Manual verification might seem manageable—until it isn’t.

What does a day look like for your front-desk team?

- Contacting insurance providers by phone or logging into multiple payer portals.

- Manually entering patient and insurance information.

- Waiting hours or days for confirmation.

- Monitoring requests for prior authorization via the phone or by fax.

- Handling discrepancies and errors after the fact.

This isn’t just tedious—it’s risky. One small insurance mistake and you are looking at delayed payments or denied claims.

Did you know? 🤔

Tiny slip-ups like a wrong plan code or a missing modifier are behind over 60% of first-time billing denials—and nearly half of those get written off for good. Empty fields, outdated benefits, and out-of-network hassles are silent killer of healthcare revenue.

Manual processes just can’t keep up. You need a digital solution that flags errors instantly, validates coverage in real time, and keeps your claims moving forward—not stuck in denial limbo.

Enter Digital Solutions: Medical Insurance Verification That Actually Works

The good news is that the game is evolving due to digital tools.

Modern digital health insurance tools use real-time data exchange to automate everything that slows you down.

By integrating with payer APIs and clearinghouses, these solutions offer:

- Instant insurance eligibility verification in real time.

- Automated alerts for coverage changes or prior authorization needs.

- Secure, HIPAA-compliant data handling.

- Reduced manual work and fewer errors.

- Transparent patient cost estimation.

- Seamless integration with EHRs and PMS.

This digital-first approach ensures healthcare providers can verify insurance quickly and accurately, improving operational efficiency and patient satisfaction.

This isn’t just automation—it’s transformation.

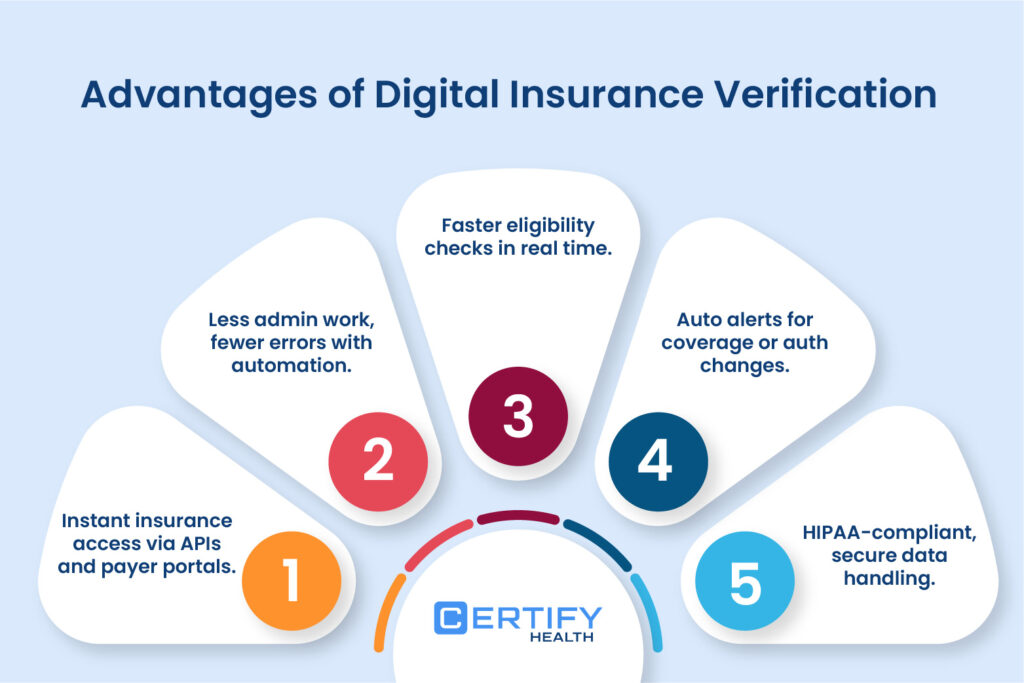

Advantages of Digital Insurance Verification over Manual Processes

Imagine a world where eligibility checks take seconds, prior authorizations self-submit, and patient data stays secure without endless paperwork.

That’s the reality digital health insurance verification tools create. Let’s break down their advantages:

Instant Access, Fewer Headaches

Gone are the days of calling insurers or waiting on hold. Digital solutions pull real-time insurance eligibility verification in a matter of seconds by connecting directly to payer databases using APIs. This instant access slashes wait times and ensures providers have the latest coverage details before treatment begins.

Pro Tip: Use the medical insurance verification software from CERTIFY Health to ensure instant eligibility checks. No burnout. No no-shows. Just smooth operations.

Less Work, Fewer Errors

Manual data entry isn’t just tedious-it’s risky. A claim can be rejected even if there is a single typo in a patient name, policy number, etc. Automated tools validate information at the point of entry, flagging mismatches and reducing errors by up to 80% – reducing front-desk burnouts and improving patient care quality.

Pro Tip: Let CERTIFY Health’s patient intake software do the heavy lifting—auto-collect, auto-validate, and auto-flag bad data before it messes with your claims.

Auto-Alerts for Smarter Workflows

Digital systems monitor coverage changes automatically. If a patient’s policy expires or prior authorization is needed, the software triggers alerts, ensuring nothing falls through the cracks. This feature of digital tools prevents last-minute hassles and keeps revenue cycles smooth.

Compliance Built-In

HIPAA-compliant platforms encrypt data end-to-end, safeguarding sensitive patient details during transmission and storage. Digital tools also auto-document every medical insurance verification step, creating audit trails that simplify compliance reporting.

Pro Tip: CERTIFY Health is HIPAA compliant—keeping patient data locked down and your practice protected from costly penalties or legal slip-ups.

Step-by-Step Guide to Verifying Medical Insurance Using Digital Tools

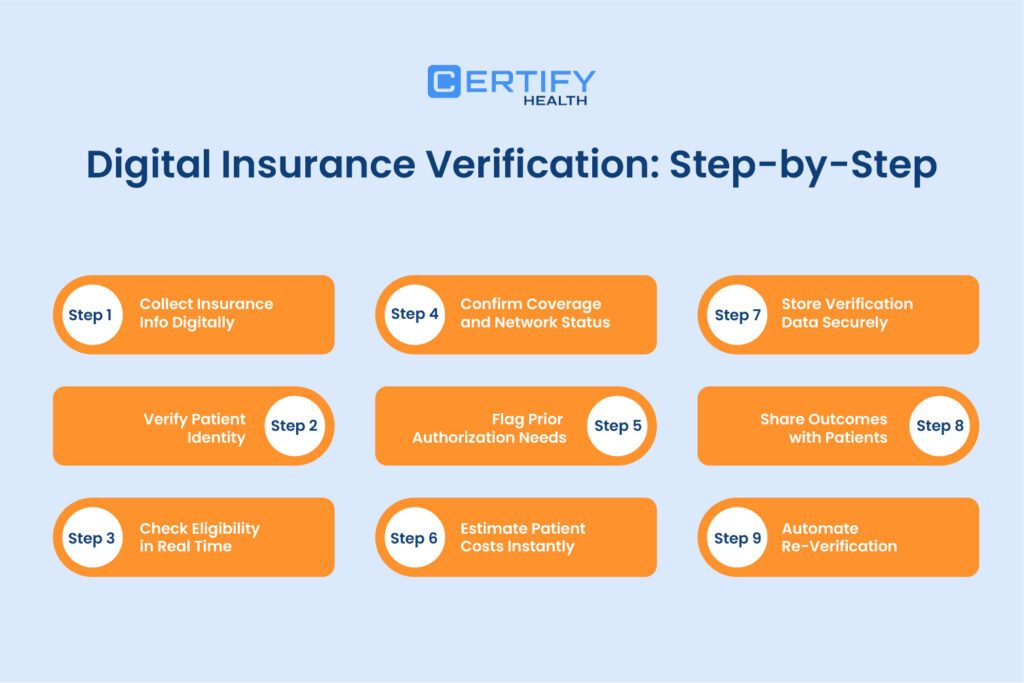

Step 1: Collect Insurance Info Digitally

Start by gathering patient and insurance information through digital registration forms or patient portals. These online forms capture:

- Patient demographics (name, DOB, contact info)

- Insurance provider name

- Policy number and group number

- Contact information for the insurer

Digital data validation at the point of entry reduces errors, such as typos or missing information, which are common in manual forms. This step ensures accurate medical insurance verification to avoid any complications later on.

Step 2: Verify Patient Identity

Next, confirm the patient’s identity by cross-checking the insurance card details with your patient database. Use digital verification tools that can:

- Scan patient’s insurance cards using technologies like Optical Character Recognition (OCR)

- Match patient photos or government-issued IDs

- Integrate with existing electronic health records to update patient profiles

This step ensures the patient is the rightful policyholder, preventing fraud and billing errors.

Step 3: Check Eligibility in Real Time

Using automated eligibility verification software, initiate a real-time insurance eligibility verification by connecting to payer databases through APIs or clearinghouses. This step confirms:

- Active policy status

- Coverage start and end dates

- Benefit limitations or restrictions

Instant eligibility checks help avoid scheduling patients without valid coverage, reducing no-show rates and denied claims.

Step 4: Confirm Coverage and Network Status

Digital tools extract detailed coverage information, including:

- Covered services and exclusions

- In-network vs. out-of-network status

- Deductibles, copays, and coinsurance details

This information helps providers align treatments with patient benefits and avoid out-of-network billing surprises.

Step 5: Flag Prior Authorization Needs

Some insurance plans may require prior authorization for some specific medical procedure or medications. Automated insurance verification tools analyze payer rules and flag those services that require authorization. They can also:

- Submit authorization requests electronically

- Track approval status in real time

- Alert your staff of denied or pending authorizations.

Administrative tasks are reduced and claims approved are expedited when you leverage the power of automation.

Step 6: Estimate Patient Costs Instantly

One of the most patient-friendly features of digital insurance verification is the ability to calculate patient cost instantly. Using data on deductibles, copays, and coinsurance, digital tools provide:

- Accurate out-of-pocket cost estimates

- Transparent billing information shared via patient portals or SMS

- Financial counseling opportunities before treatment

This transparency in billing and estimation reduces disputes and improves patient trust.

Step 7: Store Data for Verification Securely

All medical insurance verification results should be stored securely within your EHR or practice management system. Digital platforms offer:

- HIPAA-compliant encryption and secure storage

- Automatic documentation of verification steps

- Easy retrieval for billing audits or appeals

Healthcare compliance and operational workflows are streamlined by this well-organized data management.

Step 8: Share Outcomes with Patients Digitally

Communicate verification outcomes through automated notifications via email, SMS, or patient portals. Provide patients with:

- Coverage details and financial responsibility summaries

- Information on any pending prior authorizations

- Insurance update requests for continued care without disruptions.

Digital communication is a step that will not only enhances patient engagement but ensure your patients understand their responsibility and act fast.

Step 9: Automate Re-Verification

Insurance details can change frequently and if your system is not updated with the patient’s current coverage details, you are going to face challenges in claims settlement. Set up automated reminders to:

- Re-verify insurance eligibility periodically for active patients

- Send your team automatic alerts when patient’s policy is near to expiration or there are coverage changes.

- Maintain up-to-date insurance information before every visit

To avoid surprises and claim denials, this step is essential when doing medical insurance verification.

Let’s be honest—waiting around for insurance checks during intake? That’s so last decade.

Real-time verification and eligibility checks should be lightning-fast—we’re talking seconds, not coffee breaks. Whether it’s through your EMR/EHR or part of a smarter pre-reg workflow, this step should be smooth and nearly invisible.

Explore CERTIFY Health—your secret weapon for instant, reliable insurance checks.

No manual hassle, only fast and accurate verification that lets your team focus on what matters most: your patients.

How Digital Solutions Reduce Work and Errors

By shifting from manual to digital verification, healthcare providers experience:

- Less work: Automation reduces repetitive tasks like phone calls and data entry.

- Few errors: Errors are reduced by digital validation and real-time assessments.

- Faster processing: Instant eligibility verification accelerates patient flow.

- Better compliance: safeguarding and secure data handling helps to remain HIPAA compliant.

- Improved patient experience: Transparent cost estimates and communication build trust.

The Future of Medical Insurance Verification is Digital

The healthcare industry is rapidly embracing digital health insurance verification tools. These technologies not only improve operational efficiency but also enhance patient satisfaction by providing clarity and reducing administrative burdens.

If your practice still relies on manual verification, now is the time to explore digital platforms that offer:

- Real-time insurance eligibility verification

- Automated prior authorization management

- Instant patient cost estimation

- Digital registration/patient intake/check-in

- Auto alerts for coverage changes

Conclusion

Medical insurance verification is an essential—yet frequently annoying—aspect of healthcare management. Manual hassles further complicates the operations by making verification error prone, slow, and time-consuming. By adopting digital insurance verification solutions, healthcare providers can enjoy instant access to insurance data, fewer errors, faster eligibility checks, automated alerts, and secure data handling-all while improving the patient experience.

This step-by-step guide has outlined how to implement a digital-first workflow for verifying medical insurance-from collecting patient info to automating re-verification. The benefits are clear: less work, fewer errors, and happier patients.

Take action today-Explore Digital Insurance Verification Tools to streamline your workflow, reduce administrative burden, and enhance your practice’s financial health. The future of medical insurance verification is digital, and it’s waiting for you.