Table of Contents

Introduction

Revenue collection in healthcare is kind of a mess, agreed?

Many practices are still stuck chasing payments, juggling unclear insurance info, and guessing what the patient owes… after the visit is over.

The real problem isn’t billing systems or patient behavior. It’s this—most practices wait too long to determine patient responsibility.

And by the time they determine patient financial responsibility? It’s already too late.

Today’s patients expect clarity, speed, and convenience. If your practice still leans on outdated methods and manual verifications, you are not just slowing down payments—you are losing them.

In this blog, we will uncover:

- What is patient responsibility in medical billing (and why most people misunderstand it).

- Why you need to provide patients with early financial clarity.

- How CERTIFY Health is helping practices with upfront collections – faster and with less friction

So, let’s get started!

What is Patient Responsibility in healthcare?

Patient responsibility is a process where practices identify and communicate out-of-pocket cost for patients after their insurance coverage has been applied. It represents the financial obligation that falls directly on the patient rather than their insurance provider – and plays a critical role in determining how and when your practice gets paid.

But what exactly makes up this patient financial responsibility? Let’s break it down:

Components of Patient Financial Responsibility

Co-payment

Co-payments are fixed amounts that need to be paid by your patients before their appointment. For example, $30 for a primary care visit or $50 for a specialist consult free; if co-payments are not collected before the appointment, these can cause revenue leakage.

If your front desk team is not collecting it upfront, you lose thousands of dollars over time. Not only that, but it also results in awkward follow-up calls after the visit is over.

Deductible

A deductible is a fixed amount patients owe you before their insurance kicks in. If your staff doesn’t collect this upfront, as soon as the patient walks into your practice, you will chase payments later.

Therefore, you should verify and educate patients about their deductible obligations upfront to avoid conflicts and improve cash flow.

Coinsurance

Patients might cover 20% or 30% of the remaining bill while their insurance picks up the rest. Failing to address coinsurance early turns into a full-blown operational headache. Your staff is forced into damage control—spending hours explaining benefits, fielding frustrated patient calls, chasing down overdue balances, and negotiating payment plans.

What about uninsured patients?

For them patient responsibility encompasses 100% of medical costs, making accurate cost estimates and transparent billing particularly crucial for this population.

Understanding how costs break down isn’t just helpful—it’s essential. For patients, it means fewer surprises and smarter choices. For providers, it’s the secret sauce behind smoother revenue collection and a healthier bottom line.

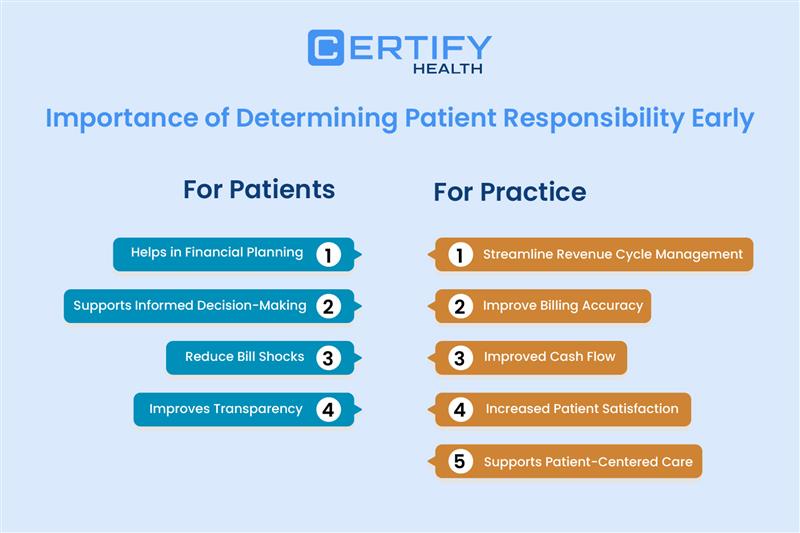

Importance of Determining Patient Responsibility Early

Want to know a secret top healthcare practice won’t tell you? They discuss the charges right away, without waiting until after the appointment.

Nope—successful practices handle patient financial responsibility before the stethoscope even comes out.

Here’s why early determination matters:

For Patients:

Financial Planning: When patients know their share of the costs upfront, your team avoids follow-up confusion and improves payment reliability. That’s real financial planning.

Informed Decision-Making: When patients understand their financial obligations ahead of time, they can make healthcare choices that fit both their health needs and their wallets. That’s true patient-centered care in action.

Reduced Bill Shocks: Let’s face it, nothing undermines trust more quickly than an unexpected bill. Early clarity in patient responsibility stops those patient dissatisfaction before it start.

Improved Patient Experience: You know what builds trust? Transparency. When patients understand what they owe and why, they feel respected—and that leads to a seriously improved patient experience.

For Healthcare Providers:

Revenue Cycle Management: When you know what’s owed before providing care, you can forecast more accurately, allocate resources smarter, and strengthen your revenue cycle management.

Streamlined Billing: Want to make your back-office smile? Pre-service clarity means less back-and-forth and cleaner claims. Say hello to streamlined billing.

Upfront Collections: The best time to collect a patient payment? Before or during care—not 30 days later with a friendly reminder and a prayer. Early identification of their financial obligations makes upfront collections easier, not awkward.

Patient-Centered Care: Money talk doesn’t have to be uncomfortable. Proactively discussing costs and offering payment options removes financial fear and keeps the focus on care. That’s next-level patient-centered care.

But here’s the reality—determining patient responsibility early is easier said than done. Let’s explore the challenges and solutions.

How to Determine Patient Payment Responsibility Early

Stuck in the stone age of healthcare billing? Yep, we’re talking about manual insurance verification and paper trails that move slower than a fax machine on a Monday.

Here’s how the outdated system usually plays out:

- A patient books an appointment.

- Your front desk collects basic insurance info—but doesn’t verify eligibility in real time.

- The patient receives treatment without knowing what they owe.

- Weeks later, a bill is sent out—by then, the chance of upfront collection is gone.

This old-school method doesn’t just cause patient confusion—it creates major delays in patient payment collection and leaves patient responsibility hanging in the air like a bad punchline.

Did You Know? 💡

As per one study, 34% of adults received a surprise or unexpected medical bill after undergoing a test or procedure that wasn’t covered by their insurance. Surprise medical bills don’t just leave patients frustrated—they also damage trust, harm your practice’s reputation, and often make patients hesitant to seek future medical care.

So how do today’s high-performing practices break the cycle? The answer lies in tech-based healthcare solutions that facilitate:

- Accurate patient authentication to prevent identity errors

- Real-time insurance verification before appointments

- Automated calculations of patient financial responsibility

- Convenient options for patient payment collection

This is where CERTIFY Health’s comprehensive platform enters the picture, revolutionizing how practices determine patient responsibility and collect payments upfront.

Determining Patient Responsibility & Improving Upfront Collections with CERTIFY Health

Think of this: the whole patient journey—from check-in to check-out—was smoother, faster, and more transparent. That’s exactly what CERTIFY Health does.

Their integrated platform isn’t just another tech tool—it’s innovation in itself that simplifies financial workflows without compromising on what matters most: regulatory compliance and a seamless patient journey.

Let’s break down the key components that make this possible—and why they matter to both patients and providers.

A. Patient Authentication: FaceCheck

Imagine a world where checking in patients takes seconds, not minutes, and identity errors virtually disappear. That’s the reality for practices using CERTIFY Health’s FaceCheck technology.

FaceCheck uses biometric facial recognition for patient authentication, ensuring the right person receives the right care and is billed correctly. This technology:

- Prevents identity fraud that can lead to incorrect billing and reduces identity-related claim denials.

- Streamlines the check-in process for returning patients, cutting average check-in times significantly.

- Enhances security and regulatory compliance, minimizing audit risks.

- Creates a foundation for accurate patient responsibility determination, leading to fewer billing disputes and faster collections.

The patient simply smiles for the camera, and within seconds, they’re authenticated—no ID cards or paperwork needed. This technology marks the beginning of a seamless financial journey.

B. Real-Time Insurance Verification

Let’s face it—insurance verification has traditionally been one of the most time-consuming and error-prone aspects of determining patient responsibility. CERTIFY Health’s insurance verification software transforms this process through automated, real-time insurance verification that:

- Instantly checks patient eligibility against payer databases, reducing eligibility-related claim rejections and improving insurance reimbursement rates.

- Retrieves up-to-date information about coverage, deductibles, co-payments, and coinsurance.

- Calculates the expected patient financial responsibility before services are rendered, shortening the average collection period.

- Ensures compliance with the No Surprises Act and price transparency regulations—helping mitigate patient disputes and lower the risk of malpractice claims tied to billing misunderstandings.

This capability eliminates guesswork and delays, allowing front office staff to have informed financial discussions with patients before care is provided. No more awkward post-service billing surprises or collection challenges.

C. Automated Billing and Payment Collection

Once patient responsibility is determined, CERTIFY Health makes collecting payments remarkably straightforward with:

Patient Payment Management: The system generates clear, accurate bills reflecting the patient’s financial obligation based on their specific insurance coverage and the services scheduled—reducing billing confusion and increasing revenue per patient.

Flexible Payment Options: Understanding that financial circumstances vary, CERTIFY Health offers:

- Custom payment plans tailored to patient needs.

- Card-on-file functionality for recurring payments.

- Secure one-click payments for convenience.

- Multiple payment methods to accommodate patient preferences.

This flexibility transforms the often-stressful experience of paying medical bills into a manageable, patient-friendly process that accelerates the AR turnover rate, and improves patient satisfaction simultaneously.

D. Patient Engagement Tools

CERTIFY Health recognizes that effective patient payment collection requires meeting patients where they are—which increasingly means digital and mobile channels. CERTIFY Health’s patient engagement tools offers:

- Text2Pay: Patients receive automated reminders for pending balances. Digital invoices & Text2Pay links enable instant payments from any device –reducing no-show rates by encouraging earlier financial commitment and improving collection efficiency.

- Digital Invoices: Clear, itemized electronic statements help patients understand exactly what they’re paying for, reducing confusion and payment delays.

- Self-Service Kiosks: On-site payment options streamline the check-in and checkout process – reducing appointment wait times and enabling faster upfront collections of co-payments and outstanding balances.

These tools don’t just facilitate payments—they enhance the entire patient journey by providing transparency, convenience, and control over financial interactions.

E. Revenue Cycle Management (RCM) Solution

Tying everything together is CERTIFY Health’s Revenue Cycle Management solution that supports the entire revenue cycle from patient scheduling through final payment. This integrated approach:

- Ensures accurate identification of patient responsibility at every stage – helping improve clean claims rate and reduce downstream denials.

- Automates workflows for eligibility verification, claims submission, and payment posting – cutting down days in AR and accelerating the revenue cycle.

- Provides analytics to monitor collection performance and identify improvement opportunities.

- Reducing administrative burden with automated RCM solutions.

The result? Faster payment cycles, fewer denied claims, and improved financial outcomes for healthcare providers.

Why Healthcare Practices Trust CERTIFY Health

CERTIFY Health solutions deliver measurable improvements in key areas:

- 100% Accurate Patient Identification: FaceCheck technology ensures positive patient identification, eliminating a major source of billing errors and claim denials.

- 60% Faster Payment Cycles: By determining patient responsibility early and offering convenient payment options, CERTIFY Health helps practices collect payments quicker resulting in improved cash flow and financial stability.

- 25% Fewer Outstanding Balances: Through transparent communication about patient financial responsibility and flexible payment options, practices see significant reductions in overdue accounts.

- Enhanced Patient Experience: Financial clarity combined with convenient payment options creates a better overall experience, turning a traditionally negative aspect of healthcare into a positive differentiator.

Conclusion

In conclusion, waiting and hoping patients will pay later is an outdated approach. And honestly, it’s hurting your practice more than you think.

Today accurately determining patient responsibility and collecting payments upfront isn’t just smart move but survival.

CERTIFY Health isn’t just another solution—it’s an essential upgrade your practice needs to stay financially healthy, operationally efficient, and future ready. From the moment of patient authentication, CERTIFY’s platform gets to work to streamline every step — reducing delays, improving collections, and creating a frictionless, transparent financial journey.

The result?

- Smoother revenue cycle management

- Happier patients

- Bulletproof regulatory compliance

- And a truly patient-centered care model

Stop falling behind on your finances. Discover how CERTIFY Health can change the way your practice manages patient responsibility and streamlines payment collection. Book a Demo Now!