Table of Contents

Introduction

Struggling to keep your practice financially healthy—even with a full schedule?

You’re not imagining it. Patient collections in healthcare are harder than ever, and it’s hitting practices right where it hurts: the bottom line.

Here’s a bitter truth: the healthcare revenue cycle has evolved over the years. And if your collections strategy hasn’t evolved, you’re probably bleeding revenue without realizing it.

Welcome to the New Era of Patient Collections. Remember when insurance companies took care of most payments? Yeah… those days are long gone. Thanks to the rise of high-deductible health plans, patients are now footing a much larger share of their medical bills—and many are struggling to pay.

Let that sink in: patients are now your biggest payers. Yet, most practices still use systems built for a time when insurers were in the driver’s seat. That mismatch? It’s costing you money. Big time.

Why Patient Collections in Healthcare Are Now Make-or-Break

Think about it. From the moment a patient books an appointment to the time that the final dollar hits your account, revenue cycle management in healthcare has become more complex—and more dependent on patient collections than ever.

The result? Skyrocketing patient balances, cash flow problems, and mounting financial pressure on providers have already stretched thin.

And it’s not just a finance issue—it’s a survival issue.

Did you know? 💡

Bad debt and charity care deduction increased over 20% over Q1 2023 to Q1 2025, as per a study — that’s real money slipping through the cracks.

Want to stop that revenue leak? Start by tracking the metrics that matter:

- Days in A/R: How long money sits before being collected.

- Patient contact rate: Are you actually reaching patients with balances?

- Bad debt rate: What percentage of bills gets written off.

Spotting issues early means you can plug the gaps—before they turn into permanent losses.

Why Measuring Patient Collections Is No Longer Optional

“You can’t improve what you don’t measure.” It’s a classic management truth—and in the present world of patient collections, it’s practically gospel.

Because let’s be honest: How would you even know if your collection strategy is working… or silently sinking your revenue without measuring?

Numbers Don’t Lie—But Ignoring Them Might. Revenue cycle management in healthcare isn’t just about billing and hoping for the best. It’s about tracking the right metrics—consistently—so you can spot red flags before they hit your bank account.

Think about it: Are unpaid patient balances piling up after insurance adjustments? Is bad debt creeping up month after month? Without data, these issues stay hidden—until they explode into full-blown cash flow chaos.

Track. Analyze. Improve. Repeat.

Here’s the reality check: Practices that track their patient collections outperform those that don’t. Every single time. Why? Because they:

- Catch collection leaks early

- Communicate clearly about financial expectations

- Fine-tune their collection strategy with laser precision

If you’re flying blind, it’s time to flip the switch.

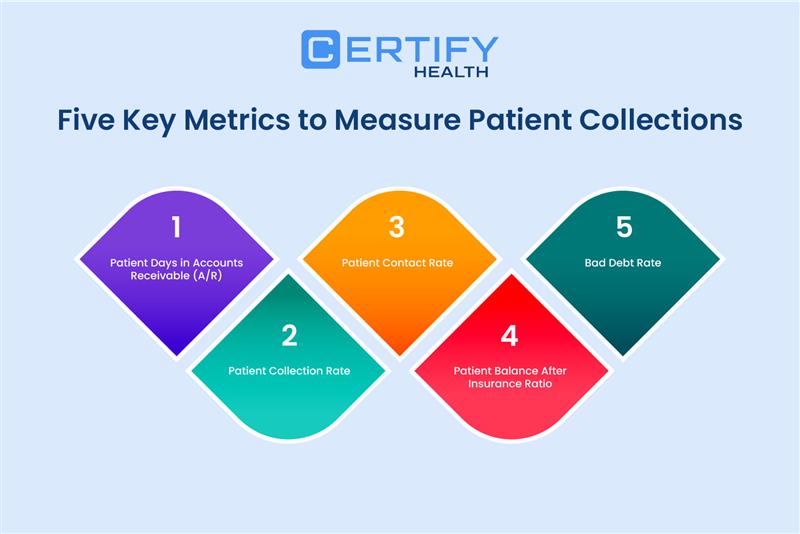

The 5 Important Metrics That Transform Patient Collections Process

TL; DR

What are the most important patient collection metrics your practice should track to improve cash flow?

These are the five important patient collection metrics you should track:

- Days in A/R → How fast you turn care into cash.

- Patient Collection Rate → What % of billed payments you actually collect.

- Patient Contact Rate → How often you’re successfully reaching patients with balances.

- Patient Balance After Insurance Ratio → How much responsibility shifts to patients post-coverage.

- Bad Debt Rate → The % of charges you’ll never collect.

If you’re ready to take control of your healthcare revenue cycle, it starts with knowing what to measure. Here are five essential metrics that’ll give you crystal-clear visibility into your patient collections—so you can stop the leaks and start boosting your bottom line.

1. Days in Patient Accounts Receivable

How fast is your practice turning care into cash? If you’re shrugging… that’s the problem.

Days in patient accounts receivable measures the average time it takes your practice to collect payments from both patients and insurance payers after services are provided. And here’s the kicker: the longer that balance lingers, the less likely you are to collect it—at all.

When your days in accounts receivable stretch beyond 30 to 35 days, you risk slowing cash flow, increasing collection efforts, and facing higher chances of bad debt write-offs.

Monitoring this metric closely is essential to spotting bottlenecks and accelerating your revenue cycle before it impacts your financial stability.

The formula’s simple:

Days in Patient Accounts Receivable = Total patient A/R ÷ Average daily charges

Example:

- Total patient A/R = $600,000

- Average daily charges = $20,000

Calculation:

- Days in Patient A/R = 600,000 ÷ 20,000

Days in Patient A/R = 30 days

How to Bring That Number Down?

- Communicate clearly—before the patient walks out the door.

- Send timely, friendly follow-ups (automation helps!)

- Use patient portals that make bill-pay as smooth as one-click shopping.

Bottom line? The faster you collect payments, the healthier your revenue cycle will be. and these metrics will tell you how well you are doing.

2. Patient Collection Rate

You can’t optimize what you’re not actually collecting. If healthcare revenue cycle optimization is the goal, start with patient collection rates—but go deeper. CERTIFY Health’s RCM dashboard breaks down data by payer, service, and visit type for sharper insights.

Think of it like this: You bill patients $100,000… but only collect $50,000. That’s a 50% collection rate—and a massive chunk of revenue slipping right through your fingers.

Why It Matters:

This metric shows how much of your expected patient revenue you’re actually collecting.

- Low percentage = cash flow chaos.

- High percentage = healthy, predictable patient collections.

Formula for calculating patient collection rate:

Patient Collection Rate (%) = (Total patient payments collected ÷ Total patient payments due) x 100

Example: Your practice collected $20,000 in patient payments, and $50,000 is the balance to be collected.

In this example, the patient collection rate is calculated as 40% ($20,000 ÷ 50,000) x 100.

How to improve patient collection rate?

- Offer flexible payment plans—meet patients where they are financially.

- Send crystal-clear billing statements (ditch the jargon!)

- Use automated, polite payment reminders that nudge without annoying.

When your collection strategy aligns with patients’ realities, your revenue improves—and your stress levels drop.

3. Patient Contact Rate

Here’s the truth: You can’t collect from patients you haven’t actually reached. That’s why your patient contact rate is one of the most crucial yet overlooked metrics in revenue cycle management.

Patient Contact Rate measures how effectively your billing team connects with patients who have outstanding balances.

Think about it—if patients don’t know they owe money or don’t understand their bills, expecting timely payment is unrealistic.

Improving contact rates through proactive, clear communication makes collecting balances easier, boosts cash flow, and helps reduce bad debt. Tracking and optimizing this metric can transform your collections success.

A high contact rate = higher collections and lower bad debt. Period.

Here’s the math:

Patient Contact Rate (%) = (Number of patients contacted about outstanding balances ÷ Total number of patients with balances) x 100

Example:

- Total patients with outstanding balances = 200

- Patients successfully contacted = 150

Calculation:

- Patient Contact Rate = (150 ÷ 200) × 100

- Patient Contact Rate = 75%

Want to Raise That Rate (Without Burning Out Your Staff)?

- Use automated communication systems to send friendly, personalized reminders via text or email.

Automation only works when your data does. Outdated contacts, invalid numbers, and missing consents can derail your outreach. CERTIFY Health solves this by embedding real-time contact validation and consent tracking into your workflows—ensuring every message reaches the right patient and drives action.

- Send monthly statements that are actually easy to read and act on.

- Make strategic follow-up calls for large balances—sometimes a human voice makes all the difference.

This one simple metric could be the missing link in your collections game. Ignore it, and you’re chasing dollars in the dark.

4. Patient Balance After Insurance Ratio

Want to spot collection problems before they hit your cash flow? Start tracking your patient balance after insurance ratio—because this one reveal how much of your revenue now relies on patients, not payers.

While patients are becoming more aware of their financial responsibility, most practices still lack real-time tools to verify eligibility and patient financial obligation before services. That’s exactly where CERTIFY Health’s automated verification workflow bridges the gap—by providing up-to-date deductible and co-pay insights at check-in.

And thanks to the rise of high-deductible health plans, that number’s only going up.

Why It Matters:

This ratio shows what percentage of your total charges gets pushed to the patient after insurance does its part. The higher the number, the more your revenue cycle management in healthcare depends on effective patient balance collections—not reimbursements.

Formula:

Total patient balances after insurance ÷ Total patient balances = Your ratio

Example:

- Total patient balances after insurance = $80,000

- Total patient balances (overall) = $200,000

Calculation:

- Your Ratio = 80,000 ÷ 200,000 = 0.4 or 40%

This means 40% of balances are patient responsibility after insurance, a key number to track for collections planning.

A rising ratio = Time to tighten up your collection strategies.

How to Keep It in Check:

- Verify insurance before the appointment.

- Communicate financial responsibility clearly and early.

- Set proper expectations—patients are far more likely to pay when they’re not caught off guard.

Think of this metric as your early warning system. Ignore it, and you’re flying blind in today’s patient-pays-first world.

5. Bad Debt Rate

Let’s talk about the one metric no one wants to look at—but absolutely has to: bad debt rate. Why? Because it tells you exactly how much revenue is slipping through the cracks—never to be seen again.

What Is It?

Your bad debt rate is the percentage of patient accounts that end up being uncollectible and written off for good. And a high bad debt rate? That’s more than just a cash drain—it’s a red flashing warning light across your healthcare revenue cycle.

It usually means something’s broken:

- Missed chances to offer payment plans.

- Poor communication regarding patient financial responsibilities.

Formula time:

(Total bad debt ÷ Total gross charges) x 100 = Bad Debt Rate (%)

Example:

In a practice with $3,000,000 in total gross charges and $150,000 in total bad debt, the bad debt rate would be:

(150,000 ÷ 3,000,000) × 100 = 5%.

In other words, 5% of the practice’s charges ended up as bad debt.

How to Stop the Bleed:

- Confirm insurance details every time a patient walks through your door

- Offer flexible pay options as they improve patient payment collections.

- Set and stick to clear collection policies—transparency builds trust and results

Because here’s the deal: Preventing bad debt is always cheaper (and smarter) than chasing it down after it’s too late. And that’s a patient collections truth worth remembering.

Tools That Revolutionize Patient Collections

TL; DR

How can practices boost collections without burning out staff?

You can boost collections using modern tools that automate, integrate, and simplify the process:

- Integrated RCM Platforms – End system silos, cut errors, and get a full view of balances, adjustments, and histories.

- Automated Eligibility Verification – Check coverage in real time to prevent surprise bills and unpaid balances.

- Patient Portals – Give patients 24/7 access, online payments, flexible plans, and instant confirmations.

- Automated Communication Systems – Send personalized reminders via text, email, or mail to match patient preferences.

Now that you understand what to measure, let’s talk about how technology can transform your patient payment collections process within your healthcare revenue cycle.

Integrated RCM Platforms

Let’s face it—disjointed billing systems are a thing of the past (or at least, they should be). Modern revenue cycle management (RCM) platforms like CERTIFY Health’s revenue cycle management software are built to talk to your existing practice management and EHR systems or in-house systems—so you’re not juggling data across five different screens.

What’s the Big Deal? This kind of integration:

- Breaks down data silos

- Reduces costly errors

- You get 360° view of the financial journey of your patients

No more guessing. No more disjointed systems and communications.

With the RCM platform like CERTIFY Health, your team can instantly see:

- Outstanding patient balances

- Real-time insurance adjustments

- Complete payment histories

That kind of clarity? It doesn’t just streamline operations—it fuels smarter, more confident financial conversations with patients. Let’s See How it Works.

Automated Eligibility Verification

Stop Collection Issues Before They Start!

Let’s cut to the chase—insurance verification errors are one of the top reasons behind stubborn collection issues.

When coverage details are unclear or incorrect, your staff ends up delivering care without knowing what the patient actually owes. And guess what? That confusion leads straight to unpaid bills and mounting bad debts.

The Fix? Automated eligibility verification tools like CERTIFY Health’s insurance verification software. These let you check coverage in real-time—so you can calculate the patient’s financial responsibility before the appointment even starts.

Here’s what that changes:

- No more sticker shock after the visit

- More accurate estimates

- Transparent, upfront financial conversations

The result? A smoother patient collections process, fewer billing surprises, and more payments collected on time. Because when patients know what to expect, they’re far more likely to pay.

Patient Portals

Modern patients don’t want to write checks, call your office, or wait for paper statements. They expect the same convenience from healthcare that they get from every other part of their lives.

That’s where patient portals come in. Digital tools that offer patient portals like CERTIFY Health’s patient engagement software turn the traditional patient collections process on its head—in the best way possible.

What Makes a Great Patient Portal?

- 24/7 access to account info

- Online payments in just a few clicks

- Digital statements that actually make sense

- Flexible payment plan options

- Instant payment confirmations

When paying a medical bill is as simple as ordering takeout or booking an Uber, guess what? People pay faster—and more often. Of course, not every patient prefers digital tools. Older patients or those in underserved communities may need printed options or in-clinic assistance.

CERTIFY Health supports a hybrid approach—offering both online self-service tools and staff-enabled options to maximize patient satisfaction and collection efficiency. Grab This Opportunity to Explore Our Solutions.

Automated Communication Systems

Want to Boost Contact Rates Without Hiring More Staff? If you’re looking to improve your patient contact rate, automated communication systems like CERTIFY Health’s patient communication software are your secret weapon.

These platforms send personalized payment reminders through the channel each patient actually prefers—text, email, or even traditional mail.

Why It Works:

Because one-size-fits-all communication? It doesn’t work anymore.

- Some patients respond instantly to a short, friendly text

- Others need a clear, detailed email

- And yes, some still like that old-school printed reminder

The best automated communication systems like CERTIFY Health let you customize both the schedule and the message—so every touchpoint feels personal, not robotic. When you improve patient communications, you improve collections. It’s that simple. See How It Works!

Putting It All Together

Today patients aren’t just receiving care—they’re paying more of it out-of-pocket than ever before. That shift has made patient collections a make-or-break factor in your overall healthcare revenue cycle.

If your collection strategies aren’t airtight, your cash flow will feel it. Hard. So, where do you start? With measurements. Track performance of your RCM these five essential metrics:

- Days in patient accounts receivable

- Patient collection rate

- Patient contact rate

- Patient balance after insurance ratio

- Bad debt rate

Each one gives you visibility into the real story behind your numbers. And once you know what’s working—and what’s not—you can make strategic moves that reduce financial instability and boost performance.

Patient collection isn’t just about getting paid. It’s about delivering a financial experience that’s as clear and compassionate as the care you provide. When patients understand their bills—and have flexible, convenient ways to pay—everyone wins.

Are you ready to take the first step?

Start by tracking these five metrics. Then layer in the right tech—tools that solve your specific pain points. Read our blog on – How to Determine Patient Responsibility & Collect Payments Upfront with CERTIFY Health