Table of Contents

Executive Summary

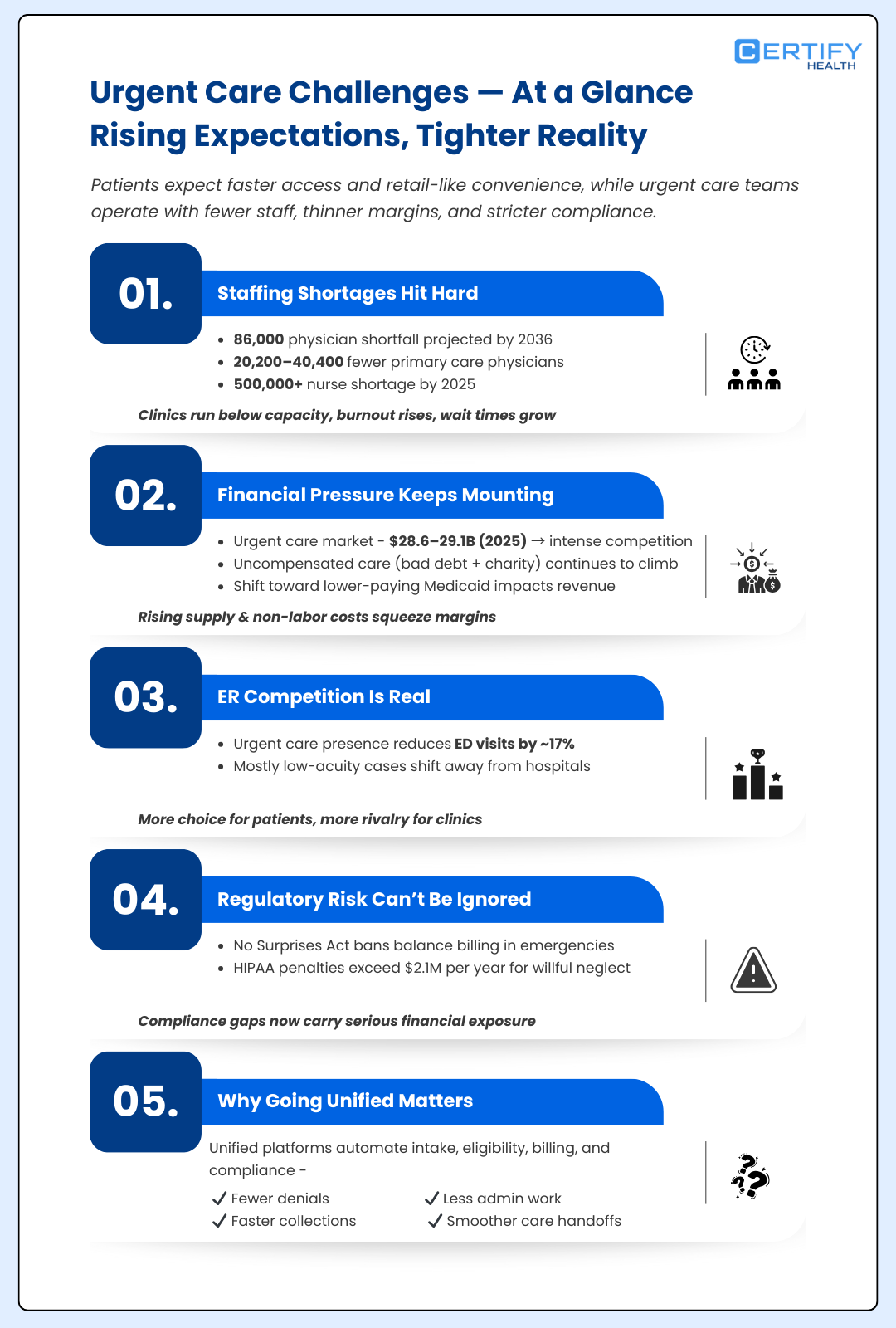

Urgent care centers are being squeezed from every side:

- A projected 86,000-physician shortage, declining margins from rising non-labor costs, 10–15% appointment no-shows

- HIPAA penalties are now exceeding $2.1M per violation year.

- At the same time, ER diversion is accelerating, intensifying competition.

This 2026 Tech Adaptation Guide outlines a 12-week, practice-size-specific rollout to combat these pressures, reducing no-shows, cutting denials, accelerating collections, and easing staff burnout through a unified platform like CERTIFY Health.

And map your 12-week rollout with CERTIFY Health.

Urgent Care Challenges Overview

As patient expectations rise and care shift away from traditional hospital settings, urgent care centers are being pushed to do more with less, faster access, tighter margins, and flawless compliance.

Staffing Shortages Hit Hard

The U.S. faces a projected physician shortage of up to 86,000 by 2036, with primary care gaps of 20,200 to 40,400, and over 500,000 registered nurses short in 2025 alone.

Urgent care centers feel this acutely, as broader healthcare systems report operating below full capacity due to these deficits. A unified healthcare platform for tech adaptation can ease this by automating routine tasks like check-ins and verifications, freeing clinicians for what matters.

Financial Pressures Add Another Layer Of Stress

Hospital operating margins faced headwinds from rising non-labor expenses like supplies in 2025, with uncompensated care surging via higher bad debt and charity cases; outpatient volumes ticked up but margins declined month-to-month.

Urgent care relies heavily on commercial payers, shifts to lower-paying Medicaid exacerbate squeezes amid these costs. Market oversaturation is real too; the urgent care market reached about USD 28.6-29.1 billion in 2025, projected to grow nearly to $42 billion by 2035 at 4.1% CAGR, fueling competition.

Adopting a unified healthcare platform simplifies front-desk and clinical workflows while strengthening RCM to reduce denials and accelerate collections.

Don't Overlook Regulatory Hurdles

The No Surprises Act demands no balance billing for emergencies, while HIPAA penalties have intensified in 2026, with inflation-adjusted fines now exceeding $2.1 million per violation year for willful neglect, often tied to weak risk assessments and delayed breach response.

ER Competition Diverts Patients

Research shows that when urgent care centers are open in a ZIP code, total emergency department visits drop by around 17%, largely due to fewer less-emergent cases being seen at the ED, reflecting real patient migration to urgent care and intensifying competition.

Poor primary care coordination leaves gaps, with inconsistent info and long holds frustrating everyone. This urgent care guide shows how tech adaptation addresses these, using integrated tools for compliance and seamless handoffs.

Tech Adoption Framework for Urgent Care Centers

Adopting tech in urgent care centers isn’t a one-size-fits-all deal; it’s smart, phased tech adaptation over 12 weeks.

Drawn from proven models like the Consolidated Framework for Implementation Research (CFIR), which maps barriers across domains like inner settings and stakeholder buy-in, and the Quality Implementation Framework (QIF), synthesizing 25 frameworks into 14 steps for high-fidelity rollouts. This urgent care guide tailors a consolidated framework for implementation, blending pre-implementation, core rollout, and post-implementation phases to your practice size.

- For small independents (1-3 locations), focus low-cost basics

- Mid-size multi-units (4-20 spots) sync sites

- Large networked (20+ locations) scale enterprise-wide

- Pediatric or Level I-IV accredited tweak for specialties like pediatric Medicaid verifications.

The 12-week timeline fits neatly:

- Weeks 1-4 pre-implementation (assess, plan)

- 5-10 implementation (rollout core features)

- 11-12 post-implementation (optimize)

This tech adaptation approach improves efficiency amid staffing shortages and ER competition.

I. Pre-Implementation Phase (Weeks 1-4)

Kick off your urgent care tech adaptation with thorough prep, it’s the foundation for smooth rollout. Across all sizes, start with an infrastructure readiness checklist: assess hardware (tablets, kiosks), internet bandwidth, and EHR compatibility; run lean audits to spot workflow waste; secure stakeholder alignment via town halls; and assign POCs for accountability.

Small/Single-Unit Independents (1-3 locations, no affiliation)

- Lean audits target high-turnover roles like front desks, prioritizing cheap fixes like mobile check-in software.

- Pilot training for 1-2 POCs on digital intake to combat staffing shortages without big spends.

- Expect 80% readiness by week 4, focusing regional compliance for local regulations.

Mid-Size/Multi-Unit (4-20 locations, private equity)

- Map workflows across sites, eyeing payer mixes heavy on Medicaid for financial pressures.

- Align regional compliance needs, like state-specific consents, using the consolidated framework for implementation research to benchmark against market oversaturation peers.

Large/Networked (20+ locations, hospital-affiliated)

- Identify everyone involved in decisions and workflows, clinical leaders, ops, IT, revenue cycle, compliance, and execs, before making tech or process changes.

- Any new platform or workflow must plug into the systems you already use, not replace or fragment them.

- Measure: ED wait times and overflow, Urgent care vs ER visit mix, and Capacity utilization by location. This helps understand how ER competition is affecting demand and where growth or leakage exists.

Pediatric-Specialized or Level I-IV Accredited

- Customize for pediatric Medicaid verifications and X-ray regulations, auditing age-specific workflows. This phase uncovers hurdles early, setting up unified platform success.

II. Implementation Phase (Weeks 5-10)

Now roll out the unified platform’s core: digital intake, insurance verification, scheduling, payments, claims, and reporting. Stagger by size to minimize disruption, this is where tech adaptation shines against operational strains.

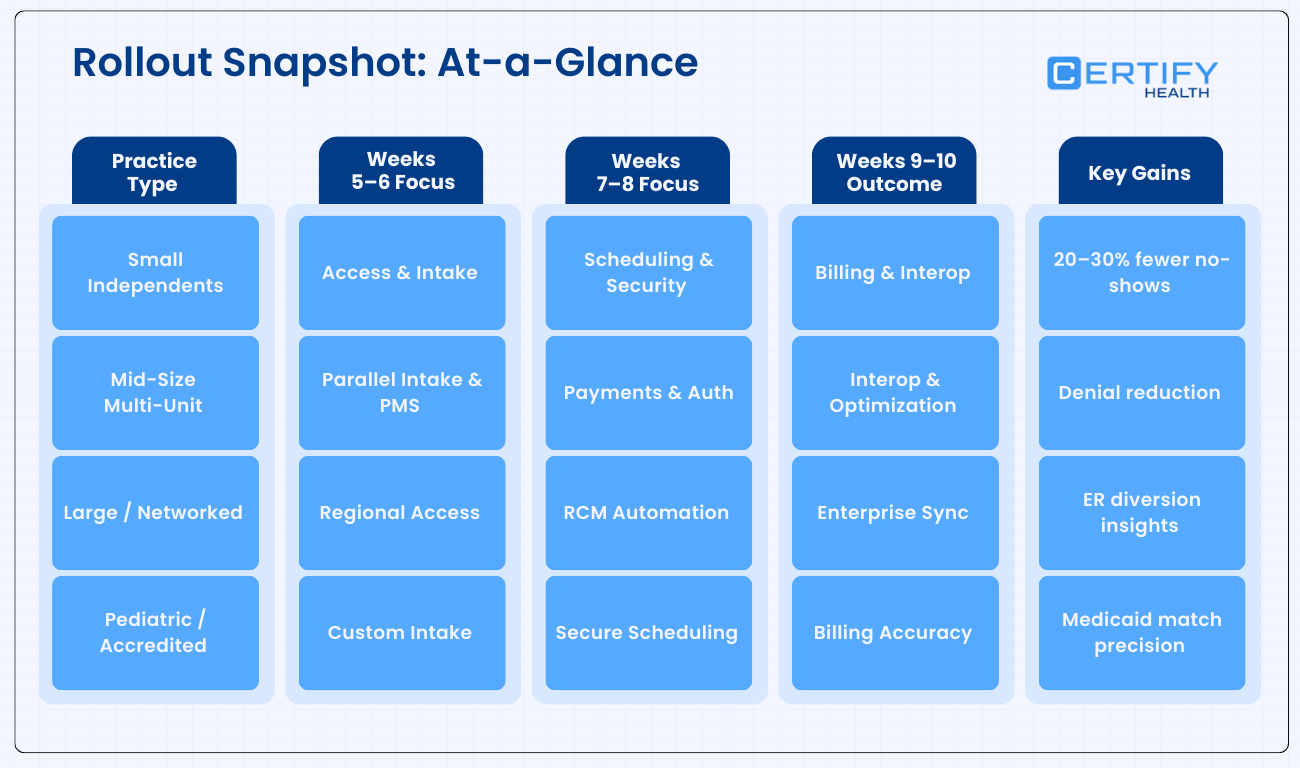

Small / Single-Unit Independents

(1–3 locations | No health system affiliation)

Goal: Minimize disruption while delivering immediate operational relief.

Approach: One rollout per week, focused on no-shows, front-desk load, and cash flow.

Phase Breakdown

Weeks 5–6 | Patient Access & Intake

- Digital intake with mobile + kiosk check-in

- Automated SMS reminders and live wait-time updates

Impact: 20–30% reduction in no-shows during staffing shortages

Weeks 7–8 | Core Operations

- Scheduling automation with waitlist

- Biometric/patient authentication

- OCR-based insurance capture + real-time eligibility

Impact: Faster check-ins, fewer eligibility delays, less manual juggling

Weeks 9–10 | Payments & Connectivity

- Text-to-pay and digital billing statements

- Lightweight EHR integration (e.g., eClinicalWorks) for Primary Care Provider (PCP) handoffs

Outcome: Self-service tools free up the front desk without complex IT overhead

Mid-Size Multi-Unit Groups

(4–20 locations | Private equity–backed or growth-stage)

Goal: Standardize operations across sites while protecting revenue.

Approach: Parallel rollouts across 4–5 locations at a time.

Phase Breakdown

Weeks 5–6 | Parallel Access & Scheduling

- Digital intake + SMS/email reminders across first site batch

- Automated scheduling and waitlists

- Denial and payer mix tracking via dashboards

Weeks 7–8 | Security & Payments

- Secure biometric logins across locations

- Text-to-pay, autopay, and multi-channel billing outreach

Impact: Lower collection costs and faster patient payments

Weeks 9–10 | Interoperability & Optimization

- EHR integrations (Epic, Cerner, etc.)

- Site-level and regional performance dashboards

Outcome: Reduced denials, aligned workflows, scalable growth model

Large / Networked Urgent Care Systems

(20+ locations | Hospital or health system–affiliated)

Goal: Enterprise-wide coordination amid ER competition and oversaturation.

Approach: Region-by-region deployment with API-driven integrations.

Phase Breakdown

Weeks 5–6 | Regional Patient Access

- Digital intake, SMS engagement, and staff tasking

- Real-time dashboards to monitor diversion and throughput

Weeks 7–8 | Security & Revenue Automation

- Enterprise MFA and biometric access controls

- Automated claims, digital billing, and autopay

Weeks 9–10 | Network-Wide Integration

- EHR-agnostic interoperability (Epic, Cerner, eCW)

- ER and primary care handoff APIs

Outcome: Unified analytics, compliant scaling, and system-level visibility

Pediatric-Focused or Level I–IV Accredited Urgent Care

Goal: Support age-specific workflows and Medicaid-heavy billing with precision.

Approach: Custom configurations aligned to pediatric care and diagnostic rules.

Phase Breakdown

Weeks 5–6 | Pediatric Access

- Child-friendly kiosks and parent-facing digital intake

- SMS updates tailored for caregivers

Weeks 7–8 | Scheduling & Security

- Appointment rules for sedation or age-restricted services

- Parent/guardian authentication controls

Weeks 9–10 | Billing & Compliance

- Pediatric-compliant digital billing and copay collection

- EHR connections for imaging and specialty referrals

Outcome: Faster slot fills, fewer Medicaid mismatches, compliant diagnostics

Rollout Snapshot: At-a-Glance

III. Post-Implementation Phase (Weeks 11-12+)

Optimization locks in gains. QA test all features, baseline KPIs (e.g., no-show rates, collection speed), provide ongoing support, and iterate.

- Small/Single-Unit Independents: Monthly KPI huddles; retrain on turnover hotspots.

- Mid-Size Multi-Unit: Quarterly lean audits pivot oversaturation strategies; denial dashboards ease financial pressures.

- Large/Networked: Annual tests with primaries/ERs; analytics scale affiliation revenue, tracking primary care coordination KPIs.

- Pediatric-Specialized or Level I-IV Accredited: Feedback loops refine clinical scope; track patient experience index (PXI) for pediatric satisfaction, ensuring regional compliance.

This post-implementation phase uses CFIR insights for sustained tech adaptation.

CERTIFY Health’s Unified Healthcare Platform for Urgent Care Guide | Tech Adaptation/Implementation

CERTIFY Health for Urgent Care: Overview

CERTIFY Health is an all-in-one platform built for the realities of urgent care. It replaces fragmented tools with unified platforms that handle everything, from the first appointment text to the final payment.

With automated check-ins, smart scheduling, real-time eligibility, biometric patient ID, faster collections, and seamless EHR handoffs, CERTIFY Health keeps chairs full, bills clean, and staff focused on care instead of chaos.

No bolt-ons. No workflow whiplash. Just one unified system that reduces no-shows, cuts denials, speeds payments, and eases staff burnout, so urgent care runs the way it should: fast, compliant, and financially sound.

Take a Walkthrough:

Phase 1: Pre-Implementation (Weeks 1–4)

Get Ready. Don’t Guess.

Goal: 90% readiness before go-live.

Small / Single-Unit Independents (1–3 locations)

| Week | Focus | What Happens |

|---|---|---|

| 1–2 | Readiness & POCs | Kickoff call, readiness checklist (kiosks, Wi-Fi, state regs) |

| 3 | Identity & Insurance Test | Pilot Facecheck on one tablet; OCR scan of sample insurance cards |

| 4 | Eligibility & Training | Live eligibility demo; POC trains 2–3 staff on Patient Experience Platform Check-in |

Mid-Size Multi-Unit (4–20 locations)

| Week | Focus | What Happens |

|---|---|---|

| 1–2 | Multi-Site Alignment | Hardware standardization, compliance map, POC per cluster |

| 3 | Pilot at Busy Sites | OCR + Facecheck at highest-volume clinics; Medicaid payer validation |

| 4 | Scheduling Preview | Practice Management System demo; test reminder texts for no-show reduction |

Large / Networked (20+ locations)

| Week | Focus | What Happens |

|---|---|---|

| 1–3 | Enterprise Audit | EHR API review (Epic/Cerner), bandwidth, stakeholder mapping |

| 4 | Interop Testing | Sandbox interoperability tests; regional Facecheck rollout plan |

Pediatric / Level I–IV

| Week | Focus | What Happens |

|---|---|---|

| 1–2 | Pediatric Readiness | Child-friendly kiosks; pediatric Medicaid & consent rules |

| 3 | Family Identity Setup | OCR for family insurance cards; Facecheck for guardians |

| 4 | Scheduling & Compliance | ASAP list demo for pediatric slots; compliance alerts test |

Phase 2: Implementation (Weeks 5–10)

Roll Out Fast. Watch Wins Stack.

Weekly or batch go-lives with real-time dashboards.

Small / Single-Unit Independents

| Week | Focus | Outcome |

|---|---|---|

| 5 | PXP Digital Intake | Faster check-ins, less front-desk typing |

| 6 | Eligibility Automation | No surprise coverage issues |

| 7 | PMS + ASAP Lists | Open slots filled automatically |

| 8 | CERTIFY Pay | Faster collections via text-to-pay |

| 9 | RCM Automation | Denials reduced without staff rework |

| 10 | Light Interop | Basic EHR connectivity live |

Mid-Size Multi-Unit

| Week | Focus | Outcome |

|---|---|---|

| 5 | PXP + PMS Parallel | Phone volume drops across sites |

| 6 | Patient Mgmt | Consistent eligibility across payers |

| 7 | CERTIFY Pay | Autopay proves ROI to investors |

| 8 | RCM Dashboards | Denials visible and fixable |

| 9 | Interoperability | Cleaner PCP referrals |

| 10 | Optimization | Site-level tuning |

Large / Networked

| Week | Focus | Outcome |

|---|---|---|

| 5 | Region 1 PXP/PMS | Intake + scheduling standardized |

| 6 | Facecheck + OCR | Hospital record alignment |

| 7 | Enterprise Payments | Affiliate collections automated |

| 8 | RCM + Interop | Audit-ready workflows |

| 9 | Staff Auto-Tasks | Less guessing, fewer errors |

| 10 | Network Dashboards | Enterprise visibility |

Pediatric / Level I–IV

| Week | Focus | Outcome |

|---|---|---|

| 5 | Child PXP | Faster guardian check-ins |

| 6 | Pediatric Identity | Correct Medicaid & consent handling |

| 7 | PMS Pediatric Slots | Smarter scheduling rules |

| 8 | Family Payments | Simplified copay collection |

| 9 | Pediatric RCM | Service-limit & X-ray alerts |

| 10 | Follow-Up Interop | Continuity of care |

Phase 3: Post-Implementation (Weeks 11–12+)

Lock In Gains. Keep Improving.

Goal: Sustained no-show reduction, faster collections, happier patients.

Small / Single-Unit Independents

| Timing | Focus |

|---|---|

| Week 11 | PXI surveys; Facecheck retraining |

| Week 12+ | Local workflow tweaks |

Mid-Size Multi-Unit

| Timing | Focus |

|---|---|

| Week 11 | Denial dashboards & staff task review |

| Week 12+ | Site comparisons, loyalty campaigns |

Large / Networked

| Timing | Focus |

|---|---|

| Week 11 | Network PXI + interoperability checks |

| Week 12+ | Revenue and diversion analytics at scale |

Pediatric / Level I–IV

| Timing | Focus |

|---|---|

| Week 11 | Pediatric experience metrics + compliance QA |

| Week 12+ | Specialty optimization sign-off |

Full Flow Wins: Intake cleans data (no denials), visits/pay fill calendars (cash in 15 days), post-visit improves returns (85% loyalty). Easy setup, EHR-agnostic, PCI-secure, your urgent care thrives without silos.

This roadmap empowers your buying decision with data-backed, size-specific tech adaptation. Dive in, adapt smart, and watch your urgent care center thrive.