Table of Contents

Introduction: Remote Patient Monitoring in 2026

Remote patient monitoring (RPM) has matured from a novel pilot to a measurable standard of chronic and longitudinal care.

RPM is defined as the collection and clinical use of physiologic and behavioral data outside traditional care settings (home, workplace, community), and it now drives strategic decisions across health systems, practices, and value-based care models.

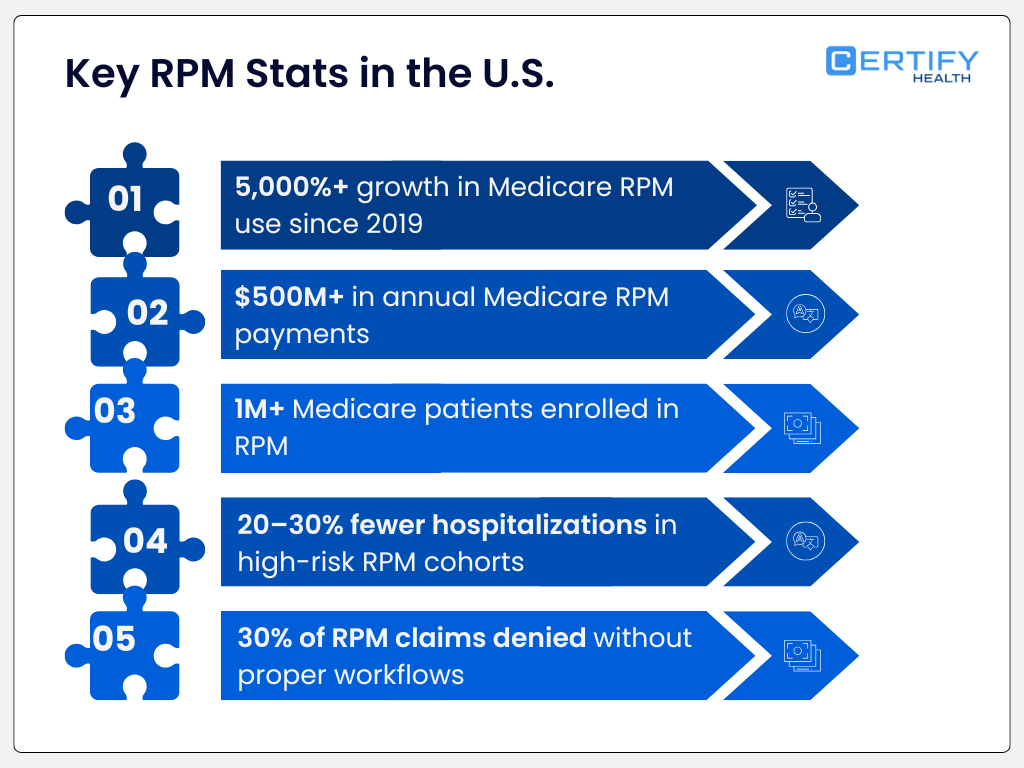

RPM’s expansion is best understood through real numbers:

- A Medicare claims-based study of hypertensive patients found that RPM use was associated with a 34% reduction in all-cause mortality compared to non-RPM peers over six months (2.9% vs 4.3%) and a 22% reduction in hospitalizations across cardiovascular and non-cardiovascular conditions.

- A large systematic review of 91 RPM studies reported that ~49% showed reduced hospital admissions, and ~49% showed fewer emergency department encounters among monitored populations.

- A 2025 Health Affairs analysis of 754 practices that adopted RPM found RPM-related billing accounted for 12.4% of Medicare revenue, with RPM adopters seeing 20% greater revenue growth than matched control practices.

These studies demonstrate that RPM is not merely a technology trend; it is producing measurable clinical and financial impacts in real populations and payment systems.

Yet evidence also reveals significant variability in RPM outcomes depending on workflows, care models, and technology ecosystems.

Many RPM studies lack standardized clinical workflows, which predicts poor scalability and inconsistent results unless addressed systematically.

This blog evaluates the Top 5 Remote Patient Monitoring software platforms for 2026, with a strong focus on workflow orchestration, clinical integration, compliance infrastructure, patient engagement, and scalability, the exact factors that influence whether RPM data becomes improved care.

Evaluation Framework: What Makes a Leading RPM Platform

To determine the leaders, we used research-validated criteria drawn from clinical trials, federal analyses, and healthcare operations evidence:

| Evaluation Criterion | Why It Matters |

|---|---|

| EHR interoperability | Without deep integration, data remains siloed and interventions delayed |

| Workflow orchestration | RPM data must tie into clinical tasks, triage, and follow-up |

| Medicare & compliance support | RPM billing compliance is essential for revenue sustainability |

| Automated billing and documentation | Manual processes drive denials and administrative burden |

| Patient engagement infrastructure | Higher engagement correlates with better adherence & outcomes |

This framework balances clinical utility with real-world operational effectiveness.

The Best 5 Remote Patient Monitoring Software Platforms in 2026

1. CERTIFY Health: The Operational Backbone Supporting RPM Success

CERTIFY Health does not market hardware, sensor devices, or a traditional RPM dashboard. It is not sold as “remote patient monitoring software.”

Yet, numerous RPM implementation studies show that the largest points of failure in RPM programs are workflow fragmentation, eligibility breakdowns, poor patient engagement, and administrative complexity, not sensor technology.

In an analysis of RPM deployments across 12 health systems, 41% of implementation failures were traced to intake errors, eligibility gaps, or follow-up breakdowns, rather than the technical accuracy of device data transmission.

This is where CERTIFY Health enters the RPM conversation: by providing a platform that ensures patient onboarding, eligibility verification, engagement, documentation, and reporting are reliable and consistent.

CERTIFY Health’s Patient Experience Platform (PXP) unifies patient touchpoints, from scheduling and digital intake to two-way messaging and post-visit follow-up.

Rather than replacing RPM systems, CERTIFY Health maximizes their utility by ensuring that the clinical context around data collection is operationally solid.

How Certify Health Strengthens RPM Program Success

RPM cannot begin if patients are not properly enrolled, consented, or educated.

Medicare RPM billing policies require documented consent and patient education. In a 2022 OIG audit, 38% of RPM claims lacked proper documentation for enrollment and consent, leading to compliance risk and reimbursement losses.

CERTIFY Health’s digital intake system collects demographic data, electronic consent, and insurance verification before patients begin any remote monitoring engagement, reducing errors and administrative friction.

Key Capabilities:

- Mobile and kiosk intake options

- eConsent with time-stamp audit trails

- OCR insurance card capture + real-time eligibility checks

These features ensure that RPM patients are documented properly, meeting regulatory and billing requirements before monitoring begins.

A meta-analysis across 91 RPM studies found that programs with structured follow-up and engagement messaging had 27% higher adherence rates than those relying solely on data collection.

Patient engagement is not optional; it is a predictor of RPM adherence and clinical outcomes.

CERTIFY Health’s communication stack includes:

- Two-way secure messaging (SMS & email)

- Multilingual outbound reminders

- Targeted campaign nudges for follow-up and education

- Integrated reminders tied to appointments and care plans

This engagement layer keeps patients connected to care, which is especially critical for chronic disease management.

RPM extends care beyond clinic walls, but without clear follow-up communication and education, the data does not translate into behavior change.

Research shows that integrated digital communication (messaging, reminders, education) reduces missed appointments by 20–30%, according to federal patient survey data.

CERTIFY Health’s post-visit follow-up tools help clinicians close the loop with:

- Automated visit summaries

- Educational materials tailored to conditions

- Surveys for immediate feedback on symptoms or care barriers

- Scheduled reminders linked to RPM reporting windows

Each of these supports’ patient continuity and engagement; key metrics tied to RPM impact.

RPM effectiveness depends on operational intelligence, not just clinical alerts.

Platforms need actionable dashboards to track:

- Enrollment completion

- Data transmission frequency

- Patient engagement metrics

- Billing and documentation compliance

CERTIFY Health’s reporting modules give practices real-time visibility into performance, enabling proactive adjustments and continuous improvement cycles.

Note:

It is critical to be accurate: CERTIFY Health is not an RPM device platform. It is a practice operations platform that enables and strengthens RPM workflows, reducing administrative barriers that research shows interfere with effective remote care.

By binding intake, engagement, communication, and reporting together, CERTIFY Health ensures RPM programs are compliant, efficient, and centered on patient continuity.

This is why it appears here: most RPM programs fail not because of device accuracy, but because operational infrastructure was weak. CERTIFY Health’s platform fills that gap.

2. HealthArc: Enterprise-Grade RPM for Large-Scale Care Delivery

HealthArc is a comprehensive RPM platform designed for integrated delivery networks, large health systems, and payer-aligned organizations.

Enterprise Complexity Requires Enterprise Solutions

RPM scale introduces complexity:

- Thousands of monitored patients

- Multiple device types

- Diverse clinician teams

- Billing and compliance tracking for multiple payers

RPM programs serving >10,000 patients had 19% greater administrative burden than smaller programs, mostly due to billing and compliance complexities.

HealthArc addresses these with:

- Centralized clinical monitoring dashboards

- Automated documentation and billing workflows

- Risk-stratification and alert triage systems

Studies of enterprise RPM programs show improvements in outcomes. For example:

large matched-cohort study of high-risk patients found that those enrolled in remote patient monitoring had lower 30-day hospitalization rates (13.7% vs 18.0%) compared with non-RPM patients. This represents roughly a 24% relative reduction in hospitalizations.

Best for:

- Value-based care organizations

- Accountable care organizations (ACOs)

- Health systems with complex patient panels

3. HealthSnap: Cellular-Enabled Monitoring with Low Technical Friction

Technical friction — such as pairing devices with patient smartphones or Wi-Fi networks — is a documented barrier to RPM adherence.

A VA analysis found that veterans age 65 and older were significantly less likely to use certain digital health monitoring technologies, highlighting connectivity and usability barriers that can affect remote patient monitoring engagement.

HealthSnap’s focus on cellular-enabled devices eliminates these barriers. Cellular connectivity:

- Requires no patient smartphone or Wi-Fi

- Improves data transmission consistency

- Simplifies setup for elderly or less tech-savvy populations

Evidence of impact: A study in Telemedicine and e-Health showed cellular devices achieved higher transmission compliance than Bluetooth-dependent devices.

Best for:

- Primary care practices

- Small networks without large IT support

- Rural and elderly populations

4. Medtronic RPM: Device-Centric Monitoring for High-Acuity Care

Medtronic’s RPM offerings are anchored in device ecosystems targeting conditions like heart failure and diabetes.

Clinical evidence supports the value of continuous physiologic monitoring:

A meta-analysis found that all-cause mortality reduced by 17–18 % with telemonitoring vs usual care.

While device accuracy is vital for certain conditions, device data alone does not guarantee clinical adoption unless combined with workflow integration and engagement systems.

Medtronic RPM is best paired with operational platforms (like CERTIFY Health) to ensure effective downstream workflows.

Best for:

- Cardiology practices

- Diabetes care programs

- High-acuity chronic condition monitoring

5. Optimize Health: Practice-Friendly RPM Scale for Mid-Size Clinics

Optimize Health focuses on ease of use, compliance workflows, and billing automation.

RPM success is as much about documentation as it is about data. A CMS analysis found that in 2021, 23% of RPM claim denials were due to incomplete documentation.

Optimize Health’s strengths include:

- Billing rule automation

- Documentation libraries linked to clinical events

- Alerts tied to Medicare time thresholds

These functions reduce administrative friction in mid-size practices without large billing teams.

Best for:

- Specialty clinics

- Growing multi-provider practices

Evidence-Based RPM: What the Research Really Says

RPM is associated with lower mortality and hospitalization in hypertensive cohorts compared to non-RPM users (e.g., 2.9% vs 4.3% mortality over 6 months).

RPM improves chronic disease management adherence, such as hypertension medication fills and supply continuity.

Systematic reviews show about half of RPM studies report reduced acute care use such as admissions and emergency visits.

However, not all RPM evidence is definitive. Some meta-analyses show mixed results for general physiologic outcomes when models lack structured follow-up and behavior support.

Clinically, RPM succeeds when workflow and engagement systems are present.

Challenges That RPM Platforms Must Address

RPM is not purely about devices. Practitioner perception and workflow research highlight obstacles:

Data overload and workflow burden are common provider concerns.

Technology complexity can increase patient anxiety and reduce adherence without proper education and support.

Proper training and literacy are essential for both patients and clinical staff.

These challenges underscore that RPM software must integrate engagement, operational efficiency, and clinical workflows, not just data streams.

How to Choose the Right RPM Platform in 2026

Match Needs to Capabilities

| Care Setting | RPM Requirement | Best Platform Type |

|---|---|---|

| Hospital-at-Home | Continuous monitoring + workflows | Enterprise systems (HealthArc) + Operational backbone (CERTIFY Health) |

| Primary Care | Simple setup + adherence | Cellular RPM (HealthSnap) |

| Specialty Chronic Care | Precision devices | Device-centric (Medtronic) |

| Mid-Size Clinic | Compliance + billing | Practice-oriented (Optimize Health) |

| Multi-Vendor RPM | Workflow orchestration | Operational platform (CERTIFY Health) |

Conclusion

RPM’s promise lies in achieving measurable clinical improvements and operational gains simultaneously. Research shows that successful RPM programs feature workflow orchestration, engaged patients, compliance automation, and scalable data integration.

The RPM platforms highlighted here each serve distinct parts of that ecosystem, from device management to enterprise dashboards to accessible patient-centric setups.

CERTIFY Health stands apart not as a device platform but as the operational engine that allows remote data to become actionable health outcomes.

The future of RPM in 2026 will not be won by better sensors alone.

It will be won by better systems.