Table of Contents

U.S. providers lose billions each year to revenue cycle inefficiencies, RCM and administrative waste alone cost hospitals over $160 billion annually.

Top revenue cycle management software isn’t just billing tools; it’s the engine turning your first patient appointment into guaranteed final payments through automated RCM.

The CAQH Index shows industry can save $16.3 billion by automating healthcare admin work, on top of $122 billion already avoided through streamlining. Read this blog till the end to discover the top healthcare revenue cycle management software tailored for outpatient care, including CERTIFY Health, Waystar, Athenahealth, and more, helping organizations save billions annually.

Why RCM Matters for Outpatient Care in 2026

Revenue cycle management software forms the backbone of healthcare operations, spanning end-to-end RCM from eligibility checks to collections and payments. Over half of RCM leaders report operations failing without urgent changes, driven by denial rates climbing above 5% and cost-to-collect eating 30% of gross revenue.

Why is revenue cycle management important? It slashes automated denial management issues, boosts cash flow, and frees front-desk staff, why is revenue cycle management important in the healthcare industry becomes crystal clear when top revenue cycle management software cuts AR days by 50%.

Also, Read: From Volume to Value: Rethinking RCM for Ambulatory Care Practice Expansion

Isn’t RCM just billing?

No, medical revenue cycle management software unifies the patient to payment journey, preventing leaks at every step.

Evaluating Best RCM Software

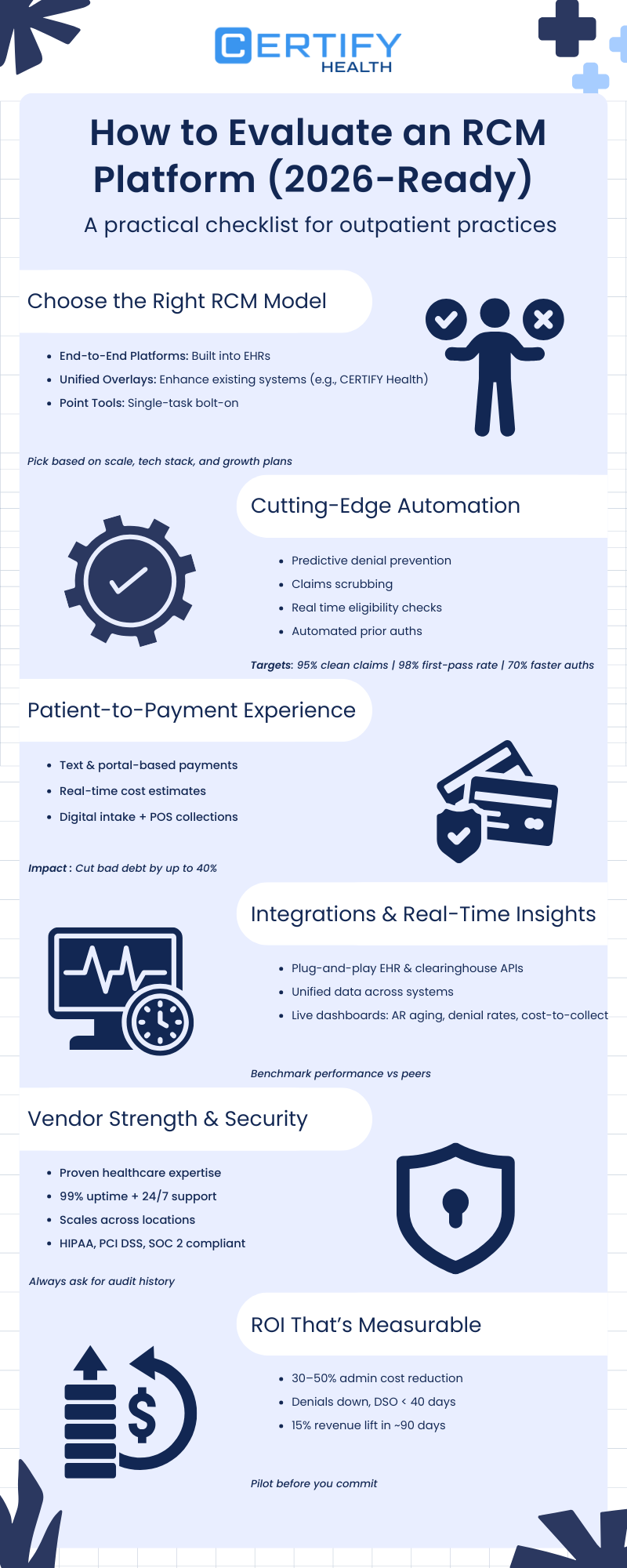

1. Match the RCM Model to Your Practice Needs

Not all RCM software fits every outpatient setup. Start by assessing your current tech stack, provider count, and expansion goals.

- EHR-Integrated End-to-End Systems: Ideal for practices locked into one vendor ecosystem. They handle everything from scheduling to billing but can trap you in rigid upgrades.

- Unified Overlays (e.g., CERTIFY Health): Layer onto your existing EHR without rip-and-replace. These consolidate eligibility, claims, and payments into one intelligent hub, perfect for multi-location growth.

- Point Solutions: Cheap add-ons for scrubbing or denials, but they create data silos and integration headaches.

Pro Tip: For mid-sized outpatient care (1-10 providers), prioritize overlays that enhance, not replace, your systems. They scale effortlessly as you add locations.

2. Demand Cutting-Edge Automation

Manual processes kill profitability. Top RCM platforms in 2026 leverage automation to preempt errors and accelerate revenue.

Key features to probe:

- Predictive denial prevention using payer rules and historical claim logic.

- Real-time eligibility verification and streamlined prior authorization workflows.

- Advanced coding guidance and claims scrubbing to achieve up to 98% first-pass acceptance.

Targets to Hit:

- 95%+ clean claims rate.

- 70% faster authorizations turnaround.

- 50% reduction in manual coding time.

Test demos rigorously: Upload sample claims and watch for error flags in seconds.

3. Optimize the Full Patient-to-Payment Journey

RCM isn’t just back-office, it’s patient-facing. Evaluate how the software streamlines collections from intake to final payment.

Must-haves:

- Patient portals and SMS for easy, real-time payments.

- Transparent cost estimators to set expectations upfront.

- Digital forms and point-of-service (POS) collections during visits.

Real Impact: These tools can slash bad debt by 40% and boost patient satisfaction scores. Ask vendors for case studies from similar outpatient specialties.

4. Ensure Seamless Integrations and Actionable Analytics

Data trapped in silos? No thanks. Insist on plug-and-play connectivity with your EHR, practice management system, and clearinghouses.

Look for:

- Bi-directional APIs for instant data sync.

- Unified dashboards tracking A/R aging, denial trends, and cost-to-collect metrics.

- Peer benchmarking to spot underperformance early.

2026 Edge: Platforms with embedded analytics let you drill into specialty-specific insights, like dermatology claim denials from coding mismatches.

5. Vet Vendor Reliability and Compliance

A shiny demo means little without rock-solid operations. Grill vendors on their track record.

Checklist:

- Deep healthcare domain expertise (years serving outpatient care).

- 99.9% uptime, 24/7 U.S.-based support, and sub-30-day onboarding.

- Multi-location scalability without performance dips.

- Ironclad security: HIPAA, PCI DSS, SOC 2 Type II, plus recent audit reports.

Red Flag: Vague answers on compliance? Walk away. Request references from practices like yours.

6. Calculate Tangible ROI Before Signing

Don’t buy promises, demand numbers. Project ROI using vendor-provided calculators, then validate with independents.

Expected Wins:

- 30-50% drop in administrative costs.

- Denials reduced by 25-40%, DSO under 40 days.

- 10-15% revenue uplift within 90 days.

How to Measure: Track baselines now (e.g., current clean claim rate via Excel), then compare post-implementation. Unified platforms like CERTIFY Health shine here, delivering quick wins across RCM stages.

Also, Read: 13 Steps to Mastering Revenue Cycle Management in Healthcare

Top 10 Leading RCM Vendors in 2026 for Outpatient Care

Top revenue cycle management software? CERTIFY Health tops lists for U.S. outpatient practices seeking RCM automation without ditching their EHR/PMS. This revenue cycle management healthcare software layers on for end-to-end RCM, connecting digital intake, real-time eligibility, clean claims, and text-to-pay collections.

Front-end wins include insurance discovery, co-pay capture, and reminders slashing no-shows; back-end handles claim scrubbing, denial prevention, and analytics.

Practices see 25-35% cleaner claims, 60% faster collections, and 50% less front-desk time; multi-location dental group can see cash flow in 60 days. Best revenue cycle management software for those switching to unified flows.

CERTIFY Health’s CERTIFY Pay:

CERTIFY Pay delivers secure, PCI-compliant payment solutions designed specifically for healthcare providers, enabling seamless and compliant patient transactions.

The platform supports multiple payment options from contactless, in-clinic payments to online and mobile modes, across key touchpoints in the patient care journey.

By simplifying collections and strengthening payment security, CERTIFY Pay helps outpatient practices improve cash flow while maintaining smooth, efficient operations.

Key Features List:

- End-to-End Revenue Automation: Manages the full revenue journey from eligibility to final payment.

- Real-Time Insurance Verification: Confirms coverage before visits to prevent avoidable denials.

- Upfront Payment Capture: Collects co-pays and balances at check-in or checkout.

- Automated Payment & Visit Reminders: Sends SMS and email nudges to reduce no-shows and late payments.

- Secure Payment Infrastructure: Supports cards, ACH, and digital wallets with full compliance.

- Text-to-Pay & Patient Billing Tools: allows for quick, easy payments through portals and text reminders.

- Centralized Billing Dashboard: Provides a single view of transactions, balances, and status.

- Claims Automation & Denial Prevention: Submits clean claims with built-in error checks.

- Back-Office Revenue Workflows: Streamlines reconciliation, dunning, and accounting tasks.

- Revenue Analytics & Reporting: Tracks AR aging, payer trends, and financial performance.

- Seamless EHR & PMS Integrations: Connects with major systems without replacing existing tech.

- Enterprise-Grade Security & Compliance: Meets HIPAA, PCI DSS, SOC 2, and GDPR standards.

Pros:

- Unified patient-to-payment workflows without replacing EHR/PMS

- Scales well for multi-location outpatient and dental groups

- Centralized dashboards with real-time revenue visibility

- Strong upfront collections (eligibility, co-pays, reminders)

Cons:

- Works best when front-desk and billing workflows are aligned

Curious to See it in Action? Book a Free Demo!

Does CERTIFY Health integrate easily?

Yes, API-first design works atop any EHR for instant EHR interoperability.

Revenue cycle management software companies shine differently, here’s your 2026 guide to top revenue cycle management software beyond #1 CERTIFY Health.

Waystar is a cloud powerhouse for large practices that excels in claims scrubbing, AI denial prevention (3x faster appeals), patient payments. Ideal for end-to-end without EHR swaps, but pricier for small ops.

Key Fatures:

- Financial Clearance: Real-time eligibility, benefits, prior auth

- Patient Financial Care: Digital payments, cost estimates

- Revenue Capture: Finds missing charges, underpayments

- Claims Management: Automated submission, tracking, remittances

- Denial Management: Early detection and faster appeals

- Analytics: Dashboards for claims, denials, AR

- AI Automation: Denial prediction, task prioritization

- EHR Integrations: Seamless EHR and PM connectivity

Pros:

- Strong claims scrubbing and revenue capture for high-volume practices

- Scales well for large, multi-location groups

- Broad EHR and practice management system integrations

Cons:

- Heavy reliance on AI-driven workflows may require additional validation and oversight

Athenahealth is a comprehensive EHR and RCM platform for ambulatory and multi-specialty practices, it combines automation, intelligent rules, patient-centric billing, and integrations to reduce denials, improve payments, and financial performance.

However, its benefits from a large user network come with a revenue-share pricing model and require moderate staff training to use effectively.

Key Features:

- EHR interoperability: Syncs RCM with EHRs to eliminate duplicate data entry

- Billing rules engine: Flags errors pre-submission to reduce denials

- Claims management: Simplifies claim creation and speeds reimbursement

- Denials management: Identifies and resolves denials faster

- Patient payments: Supports digital self-pay billing and online payments

- Integrated clearinghouse: Streamlines claims processing and reduces errors

Pros:

- Strong billing rules engine that flags errors before claim submission

- Integrated clearinghouse simplifies claims processing and reimbursement

Cons:

- Revenue-share pricing model can impact margins as collections grow

- Workflow flexibility may be limited compared to modular RCM solutions

NextGen RCM for Ambulatory Care is designed to maximize revenue for small- to mid-sized practices. It is a best revenue cycle management software tailored to the unique needs of practices for claims management, medical billing, payment management, and e-statements. The platform is fully integrated but requires a technology stack transition.

Key Features:

- Claims management: Processes and submits payer claims accurately.

- Accounts receivable recovery: Tracks and collects outstanding payments.

- Eligibility verification: Confirms patient insurance coverage quickly.

- Analytics & consultative services: Offers professional advice along with data insights.

- Payment posting: Records payments into the financial system.

- Credentialing services: Manages provider enrollment with payers.

- Coding services: Applies correct medical codes for billing.

- Call center services: Handles patient financial and billing inquiries.

- Patient statement services: Generates and delivers billing statements.

Pros:

- Well-suited for small to mid-sized ambulatory practices

- Added value through credentialing, coding, and consultative services

Cons:

- Implementation timelines may be longer due to system migration

- Requires transitioning to the NextGen technology stack to realize full benefits

ModMed RCM is designed for specialty practices, such as dermatology and ophthalmology, and comes with embedded revenue cycle management features including ICD-10 coding suggestions and MIPS reporting. This best revenue cycle management software is ideal for practices where coding accuracy is critical, but less suited for generalist or multi-specialty settings.

Key Features:

- Medical claims processing: Reviews and prepares claims for submission.

- Eligibility verification: Checks patient insurance before visits.

- Denial & resubmission management: Identifies & resubmits denied claims.

- Reporting: Produces regular revenue cycle reports.

- Practice management integration: Connects RCM with scheduling and billing systems.

Pros:

- Strong fit for specialty practices like dermatology and ophthalmology

- Simplifies denial identification and resubmission workflows

Cons:

- Less flexible for multi-specialty or highly customized workflows

- Best value when used within the ModMed ecosystem

DrChrono is a mobile-first EHR and RCM platform designed for startups and smaller practices. This top revenue cycle management software offers AI-assisted coding, denial management within 24 hours, and patient payment processing.

While it provides an affordable entry point, it may lack the depth and advanced features required for larger, enterprise-level organizations.

Key Features:

- Eligibility verification: checks patient insurance coverage before service.

- RCM task manager: dashboard to monitor outstanding billing tasks.

- Medical coding services: certified coders review and assign ICD‑10/CPT codes.

- Denial analysis: tracks and analyzes denial trends.

- Claims submission: electronically submits claims through the clearinghouse.

- Billing statements & outreach: handles statement generation and patient follow-up.

Pros:

- Affordable entry point compared to enterprise RCM solutions

- Patient statements and follow-up tools included

- Built-in RCM task management for day-to-day billing visibility

Cons:

- AI-assisted coding and automation may require manual review for accuracy

- Feature depth may be limited for high-volume or multi-location practices

CareCloud’s revenue cycle management healthcare software addresses billing challenges to maximize revenue opportunities. It’s an all-in-one, cloud-based software that includes denial management, prior-authorization management, EHR integrations, and more.

This provides a solid middle-ground solution, though it doesn’t offer the most advanced automation capabilities.

Key Features:

- Insurance eligibility verification: checks patient coverage before care begins

- Prior authorization management: automates payer authorization requests

- Denial detection and management: identifies and works denials proactively

- Appeals automation: streamlines appeal filing and follow‑up

- Seamless EHR integration: synchronizes clinical and billing data

- Contract/payer negotiation support: analysis and optimization of payer terms

Pros:

- All-in-one, cloud-based RCM solution covering core billing workflows

- Useful contract and payer analysis to support reimbursement optimization

Cons:

- Advanced customization options may be limited for complex workflows

- Best suited for small to mid-sized practices rather than large health systems

FinThrive is a comprehensive healthcare Revenue Cycle Management (RCM) platform that supports patient access through revenue recovery with AI, automation, analytics, and a unified data backbone.

Key Features:

- Predictive prior-authorization management: anticipates auth needs before claim submission

- Real-time insurance discovery and eligibility: Confirms active coverage instantly

- Missed insurance coverage detection: Identifies overlooked payer coverage

- Denial, underpayment, and AR analytics: Flags revenue leakage and delays

- Automated billing and claims processing: Submits clean claims automatically

- Charge integrity and revenue consistency checks: Ensures accurate, complete charge capture

- Contract and payer pricing management: ensures reimbursement rates align with contracts.

Pros:

- Strong insurance discovery and real-time eligibility capabilities

- Robust denial, AR, and contract analytics for financial visibility

- Well-suited for organizations managing complex payer relationships

Cons:

- Heavy reliance on AI-driven workflows require additional validation.

- Best value realized in larger or more complex organizations

Optum provides a comprehensive, end-to-end revenue cycle management platform combining technology, automation, clinical and payer insights to optimize revenue cycle performance.

Key Features:

- Authorization management: Manages prior auth requirements early

- Insurance verification: Confirms patient coverage and benefits instantly

- Charge reconciliation: Matches services to billable charges

- Denial management: Analyzes and resolves payer denials

- Underpayment detection: Flags payer reimbursement shortfalls

- Patient billing: Manages statements and balances

Pros:

- Scales well for large, complex, multi-location organizations

- Robust authorization and insurance verification capabilities

Cons:

- Implementation and optimization can take time due to system scale

- Less flexible for practices seeking lightweight or modular RCM solutions

Aptarro’s RevCycle Engine is an AI-powered revenue cycle rules engine that proactively reviews and corrects billing and coding issues before claims are submitted, helping reduce denials, automate error detection, and improve clean-claim accuracy.

Key Features:

- Rule-based error detection: Applies built-in and custom rules to all charges

- Automated charge corrections: Fixes common billing and coding errors

- Integrated readiness: Works with EMRs and PM systems

- Denial prevention: Catches issues before claims go out

- Coding review optimization: Limits manual review to complex cases

- Charge review management: Gives visibility into corrections workflow

- Payment support: Improves claim accuracy for faster collections

Pros:

- Improves clean-claim accuracy and reduces downstream rework

- Helps accelerate collections by preventing avoidable denials

Cons:

- Heavy reliance on AI- and rules-driven logic may require regular validation

- Focused on pre-claim optimization rather than full end-to-end RCM

Point tools vs. full platforms?

Bolt-ons fix one gap; Healthcare revenue cycle management software like CERTIFY Health deliver end-to-end RCM ROI.

Best RCM for Your Practice

Multi-location outpatient wanting patient to payment unity atop existing EHR? CERTIFY Health, no disruptions, instant wins.

Hospitals chasing deep denials/claims? Waystar, R1, Change.

EHR-loyalists? athenahealth, NextGen, ModMed.

Ask vendors:

- Integration timeline with our EHR?

- Your average denial rate reduction?

- Time-to-value post-implementation?

- 24/7 support for multi-locations?

- HIPAA/PCI audit proofs?

Download our Complete List of Questionaries to Ask Revenue Cycle Management Vendors.

Ready to end manual chaos?

Request your free revenue workflow audit, map your intake-to-payment gaps to CERTIFY Health’s unified model, complete with projected KPIs like 40% denial cuts in 90 days.