Table of Contents

Executive Overview

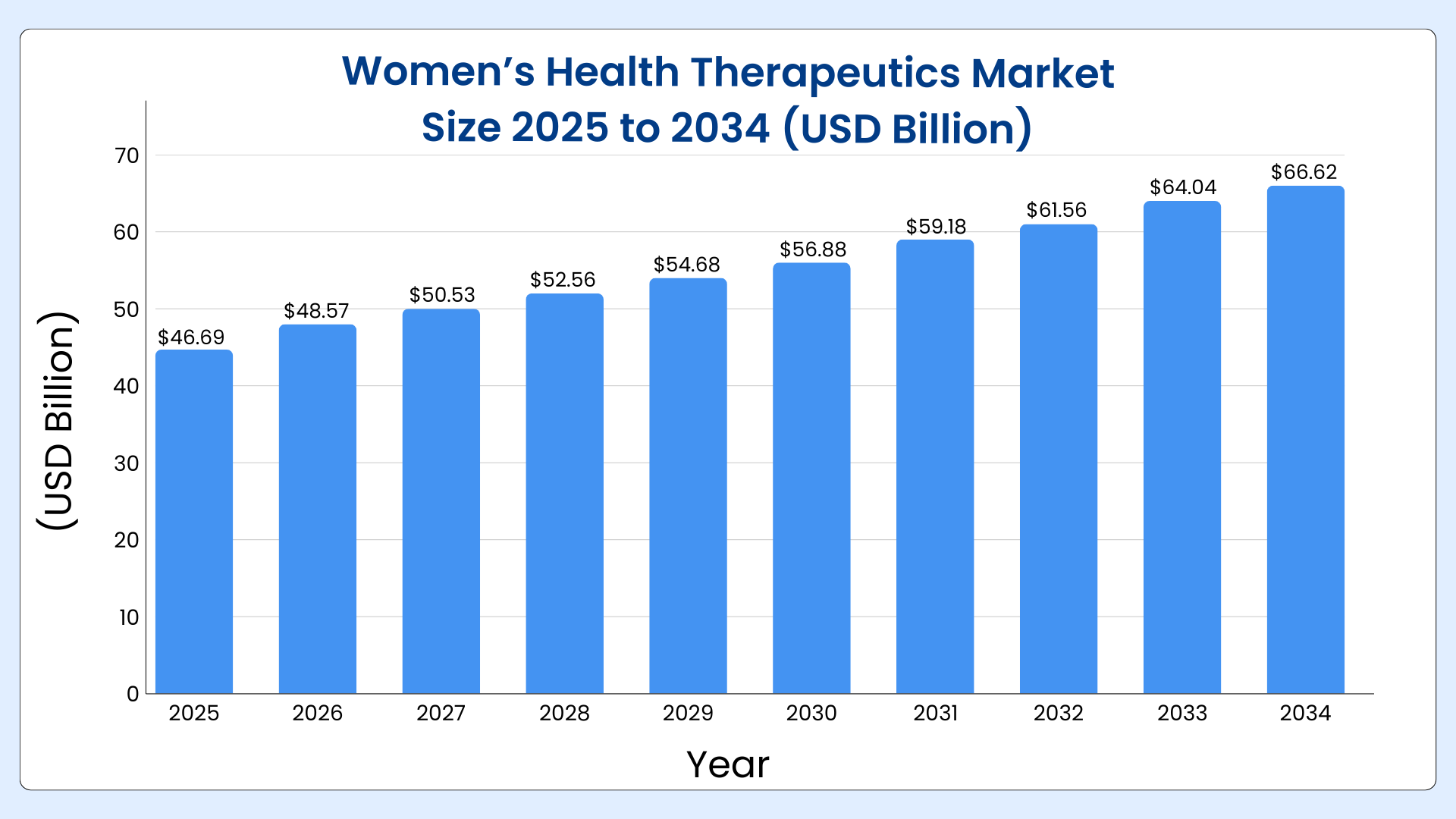

The U.S. women’s health therapeutics market reaches $46.69B in 2025, growing to $66.62B by 2034 (CAGR 4.03%), driven by demand for osteoporosis, endometriosis, and menopause treatments. Therapeutics span MFM, gynecologic oncology, fertility & reproductive care, urogynecology, family planning, minimally invasive surgery, endocrinology, breast care, mental health, and primary care.

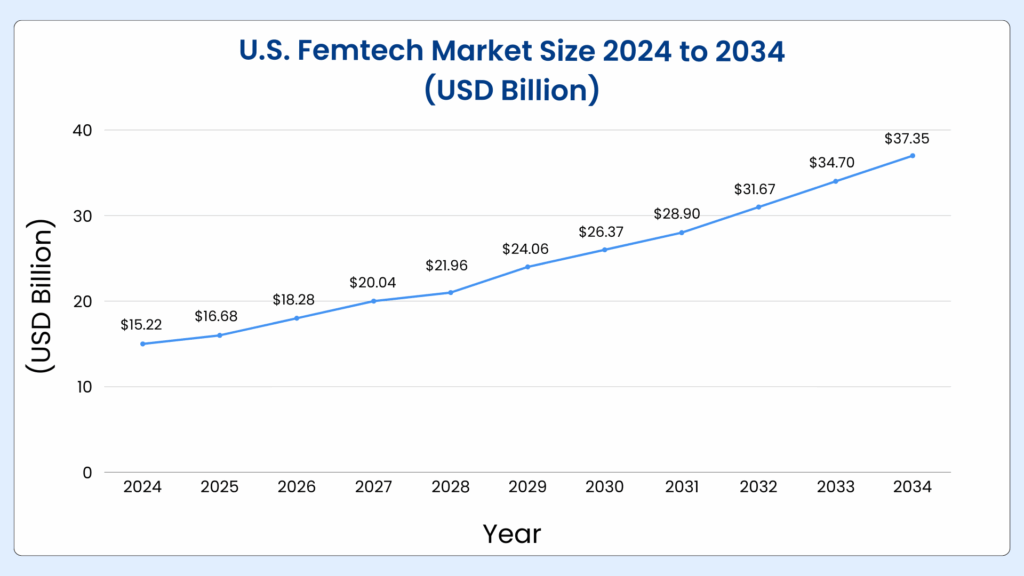

The femtech sector, valued at $16.68B in 2024, expands to $37.35B by 2034 (CAGR 9.39%), powering digital fertility, tele-OB, and menopause care.

What’s Changing

Demand surges from delayed childbirth, maternal risks, chronic overlaps, and menopause waves, shifting care across OBGYN, primary care, behavioral health, and cardiometabolic services. Digital tools like RPM and telehealth extend into homes and workplaces, with OBGYN services hitting $13.4B in 2025 (2.9% CAGR). Personalized care adoption rose 9.8% in 2025, fueled by telehealth and clinic visits.

The femtech sector, valued at $16.68B in 2024, expands to $37.35B by 2034 (CAGR 9.39%), powering digital fertility, tele-OB, and menopause care.

Why It Matters Now

Fragmented workflows create pain points: no-show rates at 20-24%, wait times of 30-40 minutes, OBGYN coverage at <93%, and ~30% burnout. RCM pressures include clean claims below 95% and prior-auth delays for 50% of insured patients. Digital/telehealth innovations captured 32% of new solutions in 2025, enabling preventive models amid consolidation and payer shifts.

The femtech sector, valued at $16.68B in 2024, expands to $37.35B by 2034 (CAGR 9.39%), powering digital fertility, tele-OB, and menopause care.

Who Wins and How

Winners use unified platforms like CERTIFY Health, integrating patient experience, practice, patient management, and revenue cycle workflows into one system, automating scheduling, intake, eligibility, payments, reminders, and RCM to cut denials, reduce no-shows, and enable fast, biometric, FHIR-connected check-ins.

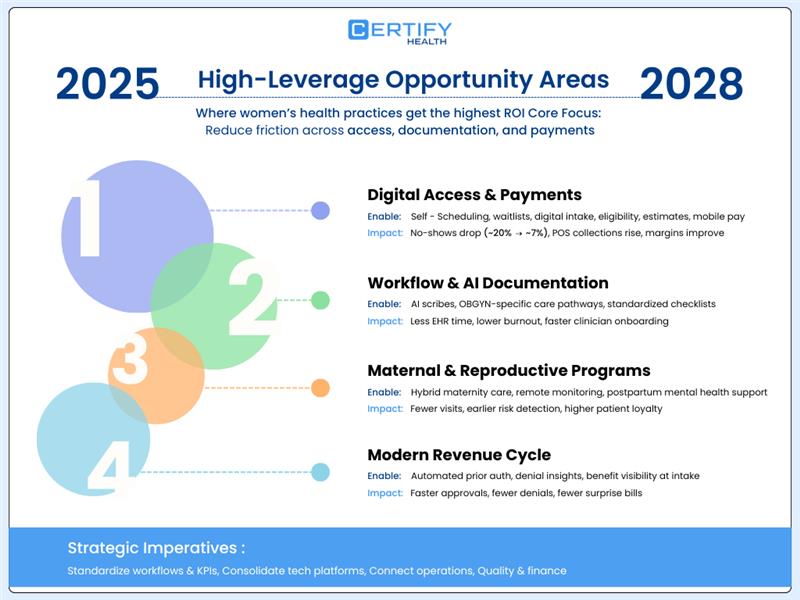

High-ROI areas include digital front doors, AI documentation, hybrid maternal programs, and prior-auth automation, improving margins, outcomes, and equity.

Market Landscape & 2025 Demand Drivers

The U.S. women’s health therapeutics market is valued at $46.69B in 2025 and is expected to reach $66.62B by 2034, growing at a 4.03% CAGR, led by rising demand for treatments in osteoporosis, endometriosis, and menopause.

The U.S. femtech market totals $16.68B in 2024 and is projected to grow to $37.35B by 2034, expanding at a 9.39% CAGR, driven by digital health tracking and fertility solutions.

Women’s health demand in 2025 is shaped by delayed childbirth, rising maternal risk, chronic disease overlap, and a strong midlife/menopause wave. Care is increasingly distributed across OBGYN, primary care, behavioral health, and cardiometabolic services, with digital tools extending into home and workplace settings.

Core care segments

- OBGYN & reproductive health: In 2025, the U.S. market for OB-GYN and fertility care is valued at approximately $13.4 billion, reflecting steady growth at a 2.9% compound annual rate over the past five years.

- Maternal & high‑risk pregnancy: Tele-OB programs, remote fetal and blood pressure monitoring, and hybrid prenatal schedules are already standard in many health systems, particularly for high-risk pregnancies.

- Adjacent specialties: cardiometabolic conditions, oncology, behavioral health, and pelvic floor/urology are increasingly embedded in integrated women’s health centers, often supported by RPM and virtual consultation pathways.

Women’s Healthcare Growth Drivers (2025)

The U.S. women’s healthcare market is growing steadily as care shifts from reactive treatment to personalized, preventive, and digital-first models.

What’s Driving Growth

- Rising awareness of reproductive, fertility, and preventive health

- Higher demand for personalized care, including hormonal therapy and screenings

- Strong adoption of telehealth, wellness apps, and digital consultations

- Increased healthcare spending and evolving patient expectations

In 2025, personalized women’s healthcare adoption grew by 9.8%, driven by telehealth usage and higher hospital and clinic visits.

Key Challenges

- High treatment and therapy costs

- Complex regulations and compliance requirements

- Limited affordability of advanced diagnostics and personalized medicine

These factors slow large-scale adoption, especially outside major urban centers.

Practice & Patient Convenience Adaptations

- Bi-directional communication and digital wellness platforms are scaling rapidly

- Growth of virtual consultations, remote monitoring, and app-based care

- Shift toward preventive and on-demand healthcare models

In 2025, digital and telehealth solutions accounted for 32% of new innovations in women’s healthcare.

U.S. Women’s Health Market: Key Takeaways

- Reproductive Health leads due to high demand for gynecological care and hormonal treatments

- Fertility & Contraceptives are growing fastest, fueled by delayed pregnancies and digital fertility tools

- Diagnostics dominate service usage, while telehealth is the fastest-growing service type

- Hospitals & Clinics continue to lead care delivery, while online platforms are growing at a fast pace.

Who Shapes Strategy and Investment in Women’s Health

Women’s health is now an ecosystem play: outcomes and margins depend on how well decision makers across clinical, operational, and financial roles collaborate.

Women’s Health Care Models

- Independent OBGYN groups: still anchor access in many markets but face rising costs, payer leverage challenges, and competition from hospital‑owned and PE‑backed platforms.

- Health‑system clinics & integrated delivery networks (IDNs): Under the direction of committed leadership and centralized governance, large organizations are combining OB-GYN, maternal-fetal medicine, NICU, behavioral health, and cardiometabolic care into cohesive women’s health programs.

- Fertility and specialty clinics: IVF and fertility clinics are scaling rapidly under employer benefits and cash‑pay models but are exposed to reimbursement and prior‑auth volatility.

- Digital‑first and hybrid femtech: companies offering virtual fertility support, menopause care, perinatal mental health, and cycle‑tracking are increasingly partnering with payers and employers but must prove clinical and financial ROI.

Who Makes Buying Decisions in Women’s Health

- Practice managers & operations directors: own scheduling, staffing, throughput, and experience; have high influence over digital front door, intake, and communication technology.

- Medical directors & lead OBGYNs: They have significant influence over documentation and triage decisions, as well as clinical procedures, quality standards, and care model redesigns such team-based care and hybrid prenatal scheduling.

- Revenue cycle leaders: own payer enrollment, coding, denials, patient collections, and increasingly, automation choices around eligibility and prior auth.

- System executives (Women’s Health VPs, CIO/CMIOs): decide on platform‑level investments, EHR optimization, unified engagement platforms, RPM programs, and AI governance.

- Payers and employers: shape benefit design (maternity bundles, fertility coverage, menopause support) and increasingly require data on outcomes and utilization to sustain contracts.

Key Patient Segments in Women’s Health

- Reproductive‑age women: prioritize fertility, pregnancy, contraception, and pelvic health, and are the heaviest users of digital health apps and remote support tools.

- Midlife & menopausal patients: Drive growing demand for menopause support programs, hormone therapies, bone density care, and management of cardiovascular and metabolic health, often linked to workplace wellness initiatives.

- High‑risk & underserved populations: Despite efforts to expand access to telemedicine and specialty care, rural, low-income, and racially marginalized patients still experience greater rates of maternal morbidity and mortality.

Systemic Pain Points & 2025 Benchmarks

The central challenge is not a lack of tools, but fragmented workflows that force leaders into daily trade‑offs between access, clinician well‑being, and revenue integrity.

Benchmarks below give a 2025 “line in the sand” for financial, operational, and experience performance.

Workforce Shortages

| Metric | Current/Projected | Impact |

|---|---|---|

| OBGYN Demand Coverage | 82% by 2037, compared to under 93% in 2025 | Rural/low-income areas hardest hit; nonmetropolitan severe shortfalls by 2035. |

| Burnout Rate | Nearly 30% of OB-GYNs, according to Medscape’s 2025 report. | Leads to higher turnover, with many clinicians valuing work–life balance over higher pay. |

Operational Friction

| Metric | Typical Rate | Best Practice Target |

|---|---|---|

| No-Show Rates | 20-24% (women's clinics); up to 64% high-risk OB | Targeting 5–7%, compared to under 20% for CDC prenatal benchmarks. |

| Wait Times | 30-40 min median | Reduced to 11–15 minutes with optimized scheduling. |

RCM & Admin Pressures

| Metric | Typical | Best-in-Class |

|---|---|---|

| Clean Claims | Many are below benchmark | Clean-claim rates above 95%, with minimal AR over 120 days. |

| Prior Auth Impact | Around 50% of insured patients experience delays or claim denials. | Not tracked; about half of patients report care delays |

Equity & Outcomes

| Disparity | Rate Ratio (Black vs White) |

|---|---|

| Maternal Mortality | 3.5x (2023); 50.3 vs 14.5 per 100k |

2025 Reality of Technology Adoption in Women’s Healthcare

Most women’s health organizations now run a patchwork of EHR modules, patient portals, telehealth platforms, and point solutions rather than a unified operating system. The result is partial digitization with limited impact on staff workload or financials.

What’s There

- Digital front doors: online scheduling, portals, and basic messaging are common, but are often poorly integrated with eligibility, cost estimates, or RCM workflows.

- Tele‑OB and RPM: remote blood pressure, weight, and in some cases fetal monitoring are increasingly embedded into prenatal and postpartum care, with studies showing reduced stress and better satisfaction.

- Femtech point solutions: fertility tracking apps, virtual menopause consults, pelvic floor therapy apps, and perinatal mental health platforms are proliferating, but typically sit outside the EHR and billing flows.

What’s Not In Place

- Unified platforms: few organizations have a single system spanning scheduling, intake, documentation, triage, RCM, and analytics across all sites and service lines.

- Scaled AI: early pilots of AI scribes and triage tools exist, but broad deployment is constrained by cost, governance, and integration challenges.

- Learning analytics: robust, near‑real‑time analytics tying access, staffing, outcomes, and revenue (e.g., how no‑shows affect postpartum follow‑up and downstream complications) remain rare.

2025 Limitations or Current Barriers

- Data privacy and state regulation: post‑Dobbs reproductive data concerns and divergent state policies complicate data sharing and increase legal risk for cross‑state tele‑OB and abortion‑related services.

- Post‑PHE telehealth policy: while many payers have maintained some telehealth flexibility, reimbursement rules, licensure requirements, and audio‑only coverage remain heterogeneous.

- AI governance: health systems are under pressure to ensure explainability, bias mitigation, and clear human oversight for AI tools in clinical documentation and risk scoring.

Key Growth Opportunities for Women’s Healthcare (2025–2028)

Given these constraints, the highest‑ROI moves are those that reduce friction at the intersection of access, documentation, and payment. For women’s health, four clusters stand out.

1) Digital Access & Payment Experience

- High‑impact capabilities: self‑scheduling based on acuity, automated wait‑lists, digital intake, real‑time eligibility, cost estimates, and mobile payments integrated with RCM.

- Financial impact: lowering no‑shows from ~20% to 7% and improving POS collections can shift a group’s operating margin by several points while improving experience.

2) Workflow Automation & Intelligent AI Documentation

- AI scribes: Ambient documentation tools can materially reduce after‑hours EHR time and burnout when tightly integrated into the clinical workflow and governed well.

- OBGYN‑specific pathways: standardized prenatal, postpartum, and gynecologic pathways with embedded order sets and checklists reduce variation and speed onboarding of new clinicians.

3) Unified Maternal and Reproductive Care Programs

- Hybrid maternity models: combining in‑person visits with scheduled telehealth, remote monitoring, and asynchronous education reduces unnecessary visits while improving risk detection.

- Postpartum & mental health: Telehealth “fourth trimester” programs including proactive follow-up, depression screening, lactation support, and contraception counseling are becoming key drivers of improved outcomes and patient loyalty.

4) Advanced RCM for Women’s Health

- Prior auth and denial management: automated prior‑auth submission, status tracking, and AI‑assisted denial pattern analysis are becoming table stakes for fertility and complex maternity care.

- Benefit design alignment: surfacing employer fertility and maternity benefits inside scheduling and intake flows helps avoid surprise bills and supports adherence.

From a strategic perspective, this leads to three key priorities:

- Harmonize workflows and performance metrics across all locations

- Merge redundant point solutions into a streamlined set of platforms

- Create continuous feedback loops linking staffing, operations, quality, and financial management

A Day in the Life: Women’s Health Leaders (2025)

The Importance of Adopting Smarter Technology

A) Practice manager at a multi‑site OBGYN group

- 7:30 a.m.: Reviews dashboard showing today’s clinics across four sites: no‑show risk scores flag afternoon high‑risk OB slots; staffing gaps at one suburban site due to MA sick calls.

- 9:00 a.m.: Front‑desk escalates that average check‑in time is creeping back toward 25 minutes because staff are re‑entering data from patient forms that do not flow cleanly into the EHR.

- 11:00 a.m.: Works with IT to tweak self‑scheduling rules after noticing that long‑visit new OB appointments are over‑concentrated on Mondays, causing 45‑minute waits.

- 2:00 p.m.: Meets with the RCM manager about a spike in denials tied to a payer’s new policy for ultrasounds; Realizes that insurance details and benefit verification aren’t being consistently captured at check-in.

- 4:30 p.m.: Receives complaints about phone hold times; considers shifting more communication into secure messaging and automating routine outreach (appointment reminders, lab follow‑up) through a unified digital front door.

What Better Tech Fixes

- Anticipates missed appointments and auto-fills open slots

- Seamless digital check-in that syncs instantly with systems

- Intelligent scheduling that evenly distributes provider workload

- Insurance eligibility confirmed ahead of visits

- Secure messaging replaces time-consuming phone calls

B) Lead OBGYN / medical director in an integrated women’s health service line

- 8:00 a.m.: Starts clinic with 24 patients on the schedule; triage dashboard identifies two high‑risk patients with elevated home blood pressures overnight, prompting same‑day visit adjustments.

- 10:30 a.m.: Juggles MFM consults, complex gynecologic cases, and inbox messages; spends every brief break dictating notes to keep documentation from spilling into the evening.

- 1:00 p.m.: Participates in a quality meeting reviewing postpartum follow‑up adherence and racial disparities in hypertension control; realizes there is no systematic trigger to flag missed visits and outreach.

- 3:30 p.m.: Fields questions from residents about new postpartum care guidelines emphasizing continuous, rather than single‑visit, follow‑up and struggles to align this with current scheduling templates and reimbursement rules.

- 7:00 p.m.: Completes notes and messages from home; considers piloting an AI scribe but worries about accuracy, legal exposure, and patient perceptions.

What Better Tech Fixes

- Alerts for high-risk patients in real time

- AI‑assisted documentation

- Clear triage protocols

- Automated follow-up reminders for patients

- Integrated analytics show how care model changes (e.g., more virtual postpartum touchpoints) improve both outcomes and RVUs.

C) Revenue cycle manager for a regional women’s health and fertility network

- 7:45 a.m.: Opens RCM dashboard showing clean‑claim rate at 92%, below the 95% target with a spike in denials for fertility services from a national payer.

- 9:15 a.m.: Meets with front‑office leads to reinforce eligibility checks and documentation for employer fertility benefits, after identifying that incomplete benefit capture is leading to unexpected patient balances.

- 12:00 p.m.: Reviews AR aging; notices an uptick in AR >120 days tied to prior‑auth delays and incomplete documentation, impacting cash flow and physician distributions.

- 2:30 p.m.: Works with IT to test automation for prior‑auth submission and status checks, aiming to free staff from phone and fax loops and reduce cancellations of high‑value procedures.

- 5:00 p.m.: Drafts a proposal to leadership linking investment in a unified intake and cost‑estimate platform to projected improvements in POS collections and denial reduction.

What Better Tech Fixes

- End‑to‑end visibility from scheduling to payment

- Automated prior auth and denial prediction

- Patient‑friendly financial journeys that stabilize cash flow.

Take a look at our Financial Pressure Index 2025 and see how unified payment solutions like CERTIFY Pay empower you to overcome eligibility and collection challenges while exceeding modern patient expectations in today’s competitive payment landscape.

Key KPIs That Signal Maturity (Financial, Operational, Experience)

Women’s health leaders in 2025 increasingly align on a focused KPI set to track operational maturity and readiness for more advanced, value‑based models.

| KPI category | 2025 reality (typical) | 2025–2028 target benchmark |

|---|---|---|

| No‑show rate | 15–24% in many women’s health clinics. | 5–7% with digital scheduling and outreach. |

| Wait time | 25–40 minutes average at busy sites. | Under 15 minutes through template redesign. |

| Provider burnout | ~30% of OBGYNs report burnout | Downward trend with AI documentation and staffing |

| Clean‑claim rate | Often below 95% in complex service lines. | ≥95% across payers with automation. |

| AR >120 days | Rising share for maternity and fertility. | Minimal, tightly monitored. |

| POS collections | Highly variable; leakage in high‑deductible plans. | Majority of patient responsibility captured upfront |

| Postpartum follow‑up | Missed visits common, especially by race/geography. | Timely follow‑up within 12 weeks for most patients. |

| Equity metrics | Persistent gaps in maternal outcomes by race. | Narrowing disparities with targeted programs |

These metrics form the backbone of a “learning practice” scorecard, enabling leaders to quantify returns on tech and workflow investments.

Outlook For 2026 And Bridge to Tech Adaptation

By 2026, women’s health will likely see continued volume growth, further consolidation of OBGYN groups, and more structured maternity and reproductive benefit designs from payers and employers.

Practices that succeed will be those that treat operational efficiency as a health outcome and unify data across clinical, operational, and financial domains.

- Financially: margin pressure will persist as staffing costs and technology spend rise, but organizations with mature RCM automation and digital front doors will capture more revenue per visit and reduce leakage.

- Operationally: hybrids of in‑person and virtual care, especially maternity, menopause, and mental health will become default, with AI‑enabled tools helping right‑size visit type, length, and team composition.

- Patient experience: women will increasingly choose providers and systems that offer coordinated, transparent, and tech‑enabled journeys from fertility through menopause, and that demonstrate equity commitments in outcomes data.

Closing the Gap

Standardize KPIs, consolidate solutions, and integrate unified platforms to link access, operations, and revenue. Smart practices lead in 2026 as they adopt unified healthcare platforms like CERTIFY Health, achieving 40% higher operational efficiency, a 66% increase in revenue inflow, and 90% patient loyalty, all while meeting evolving compliance requirements.

Schedule a CERTIFY Health demo To unify your women’s health workflows and capture 2026 growth.

Download Our Tech Adaptation Guide on Women’s Health

Also, Explore Our Trending Articles on:

CERTIFY Health’s Insight Doc on:

References: