Table of Contents

Key Takeaways:

- ACA 2025 Raises the Bar on Verification: Self-attestation is out, only documented; IRS-verified income will qualify patients for ACA coverage and subsidies. Practices must adapt workflows to meet stricter CMS standards.

- Operational Accuracy = Financial Stability: Income verification errors now directly impact claim approvals, patient eligibility, and practice revenue. Integrating real-time verification tools prevents denials and payment delays.

- Compliance Is Continuous, Not One-Time: With evolving CMS rules and 90-day verification deadlines, practices must implement ongoing staff training, system updates, and patient education to stay compliant and maintain trust

Introduction

Your team sees a patient assuming their insurance is active, but after the visit, you learn they’ve lost Affordable Care eligibility due to an income verification problem, leaving your staff to chase payments and manage unexpected denials.

For practices, it’s not just a patient issue, it’s a direct hit to your revenue. The ACA’s income verification standards are no longer a side note in eligibility checks. In 2025, they’re the rulebook.

Recent ACA policy shifts have set a stricter tone for how practices, payers, and patients interact with the Marketplace and Medicaid eligibility systems. From the ground up, income verification is now the linchpin holding together accurate ACA eligibility, subsidy integrity, and your practice’s compliance standing.

Why So Critical in 2025?

The 2025 Marketplace Integrity and Affordability Final Rule fundamentally alters what constitutes “verified” income in the eyes of the Centers for Medicare and Medicaid Services (CMS). With over 11.8 million Americans potentially impacted, according to data from the American Medical Association, there has never been a more important time to get income verification right.

Overview of 2025 ACA Income Verification Changes

Stronger Verification Standards

CMS now requires all marketplaces to verify consumer income directly against IRS and other highly trusted data sources.

No More Self-Attestation Loopholes

If IRS data isn’t available, practices can no longer simply take the patient’s word for projected income; documentary evidence is required to confirm ACA eligibility.

60-Day Extension Eliminated

That “grace period” for unresolved income inconsistencies? It’s officially gone. Applicants now have only 90 days to resolve all discrepancies.

Marketplace Integrity at Stake

These changes are all about marketplace integrity, cracking down on waste, fraud, and improper subsidy payments.

11.8 Million People Affected

According to the latest AMA analysis, at least 11.8 million individuals will be subject to these new rules, making it crucial for practices to update their workflows.

Practices failing to stay current – risk delayed claims, denials, patient frustration, and potential compliance penalties.

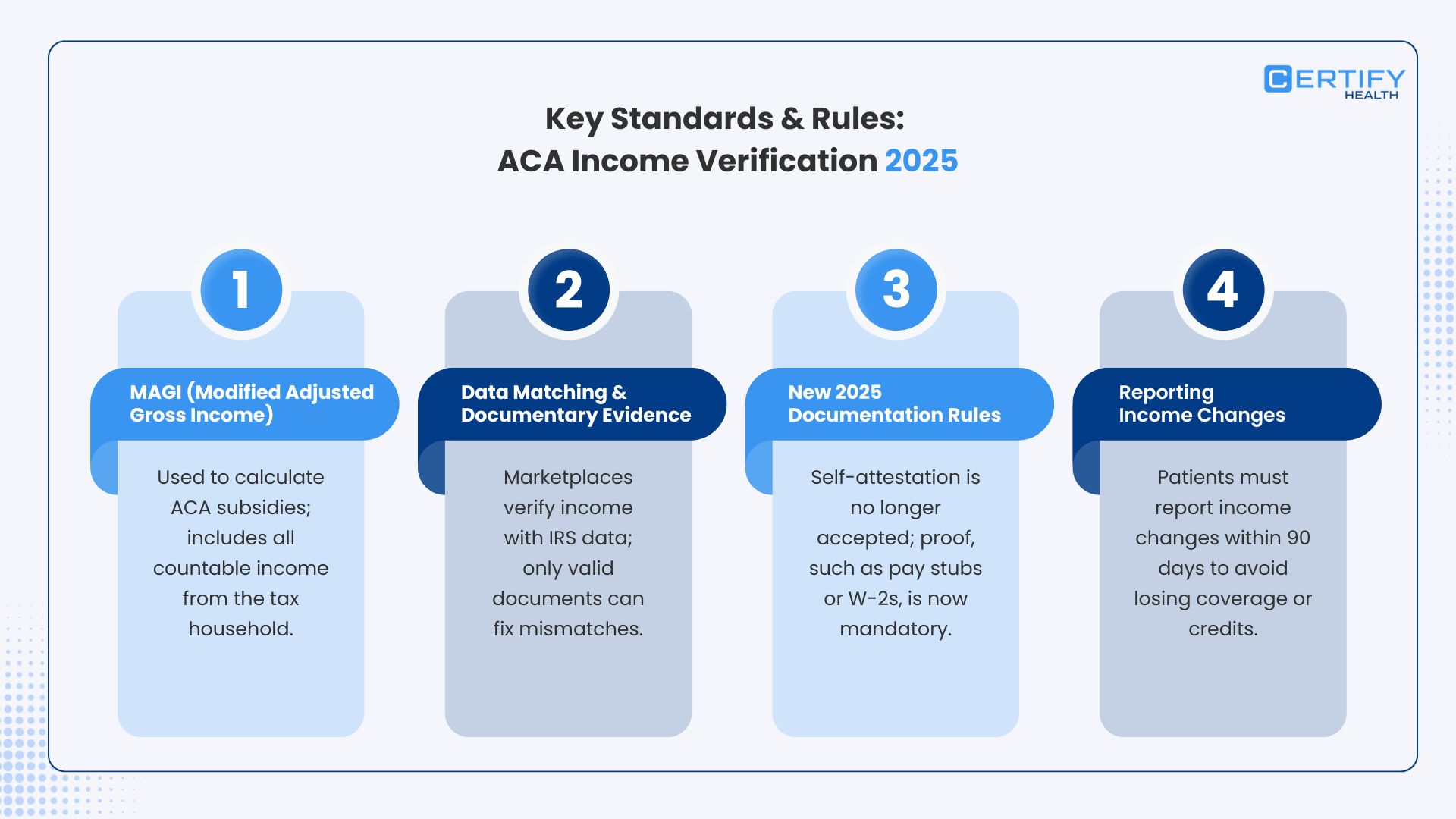

Key Standards and Rules

What do these new income verification standards actually look like in daily practice? Let’s break down the essentials:

1. MAGI (Modified Adjusted Gross Income)

- Why MAGI Matters: The ACA uses MAGI to determine eligibility and calculate advanced premium tax credits and cost-sharing reductions. Practices must ensure all “countable income” from everyone included on a patient’s federal tax return is factored in.

- Countable Income Examples: Wages, salary, tips, business income, unemployment, social security (taxable), and taxable interest. Certain non-taxable income is excluded, but practices must check the latest guidelines.

2. Data Matching and Documentary Evidence

- IRS Data Is Gold: Income verification begins with data matching, marketplaces compare applicant claims with IRS and federal tax return data.

- Documentation is Mandatory: If there’s a mismatch or no IRS data, self-attestation is out; only documentary evidence, such as pay stubs, W-2s, or a signed employer letter, counts for resolving inconsistencies.

- Importance of Documentary Evidence: Practices must communicate to patients exactly what constitutes valid evidence, and secure those documents upfront.

3. New 2025 Documentation Rules

- No Self-Attestation Without IRS: as already discussed, if IRS can’t confirm income, applicants must provide documentary evidence; CMS will no longer accept “I promise” as proof.

- Electronic Filing Deadlines: Ensure all required ACA and IRS forms are submitted on time to avoid lapses in coverage and compliance issues.

4. Reporting Income Changes

- Notify Fast: If a patient’s income changes, think job loss or gain, your team must guide them to report it within 90 days to the Marketplace. Missing this window can mean losing credits or tax reconciliation headaches.

Impact of Verification on ACA Eligibility and Subsidies

Getting income verification right isn’t just regulatory box-checking; it shapes your patients’ entire experience with ACA plans.

- Advanced Premium Tax Credits (APTC): Accurate income verification determines if a patient qualifies for APTCs, which can lower plan premiums by hundreds per month.

- Cost Sharing Reductions (CSR): Eligibility for CSRs, reducing out-of-pocket expenses, is also tied directly to verified income.

- Failure to Verify? Big Consequences: If practices or patients don’t resolve verification by the deadline, those advanced credits can disappear, and after one year without reconciliation, new credits may be withheld for another year. Patients automatically reenrolled without verification may owe a fallback $5 monthly premium (per CMS rules).

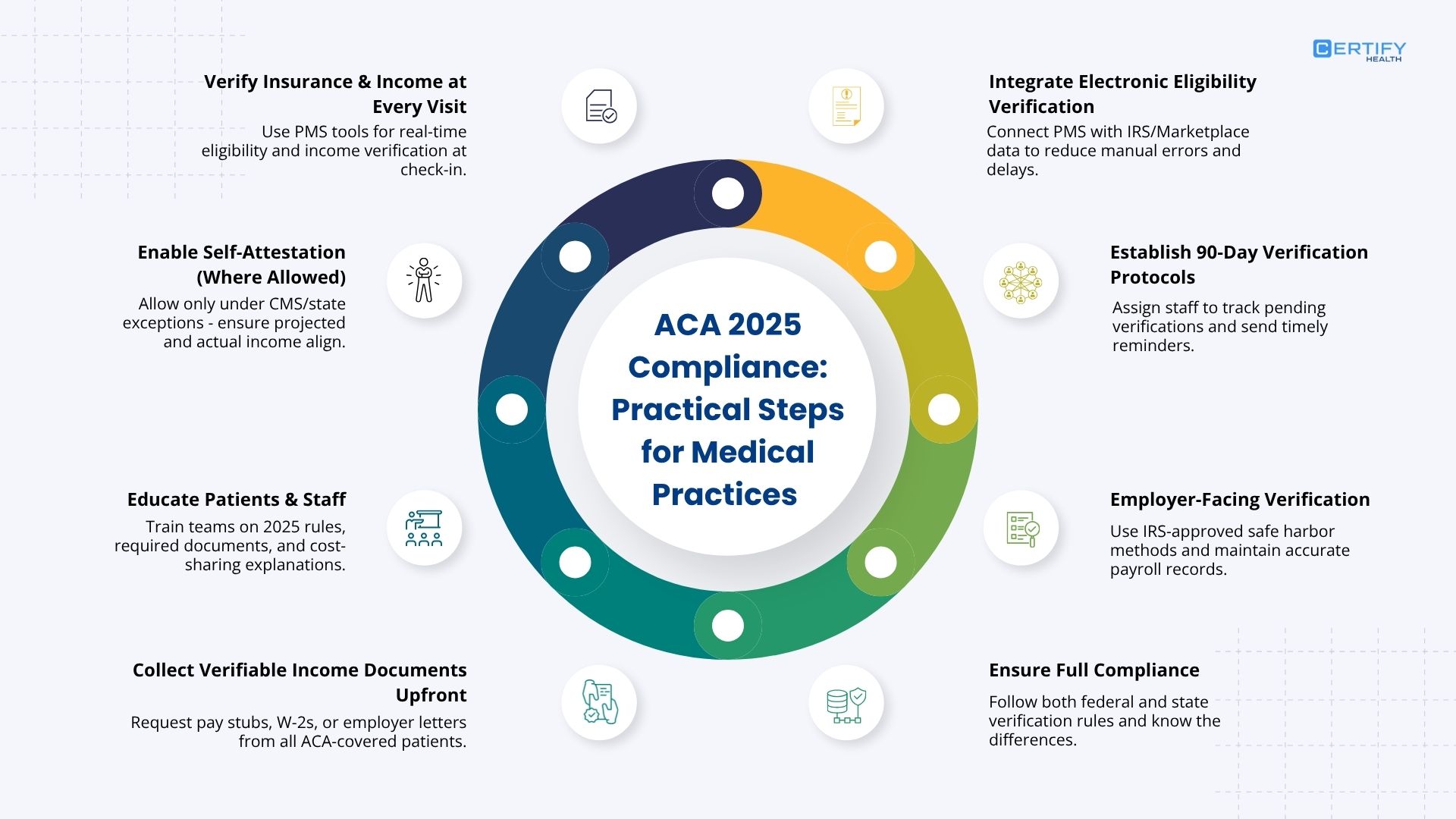

Practical Steps Medical Practices Should Take

What actions should your practice take to meet ACA 2025 income verification standards?

1. Verify Insurance and Income at Every Visit

- Leverage Integrated Technology: Use your practice management system to capture eligibility, verify insurance, and document income at the point of care.

- Instant Checks: Where possible, link eligibility verification directly with real-time IRS and Marketplace systems.

2. Enable (and Educate On) Self-Attestation, Where Allowed

- For cases where self-attestation is permitted (under special state waivers or specific CMS exceptions), make sure patients and staff understand the rules. Projected income must match actuals, and all information must be accurate.

3. Educate Patients and Staff

- Train Your Team: Regularly update staff on 2025 ACA income verification rules, required documentation, and the workflow for resolving inconsistencies.

- Patient Guidance: Empower front desk and clinical teams to clearly explain cost-sharing requirements, what documentation patients need, and how to avoid subsidy loss.

- Connect to Navigators: When in doubt, refer patients to certified Navigators who can help them with the application process.

4. Collect Verifiable Income Documents Upfront

- Require all new and returning ACA patients to submit at least one form of documentary evidence (pay stub, W-2, or employer letter) as part of intake.

5. Integrate Electronic Eligibility Verification

- Link your system with IRS and Marketplace data feeds to minimize manual entry and speed up verifications.

- Ensure that electronic filing deadlines for all CMS-required forms are mapped into your workflow management tools.

6. Establish Protocols for 90-Day Verification

- Designate a staff member or team to monitor unresolved verification cases.

- Set up reminders and escalation steps for missing documentation, especially with the end of the 60-day extension.

7. Employer-Facing Verification

- For those handling group plans: use IRS-approved safe harbor methods for affordability. Maintain accurate payroll and income data, leveraging HR tech that includes ACA-compliance checks.

8. Ensure Compliance on All Front

- Adhere to both federal and varying state-level income verification requirements, and ensure your team understands the difference.

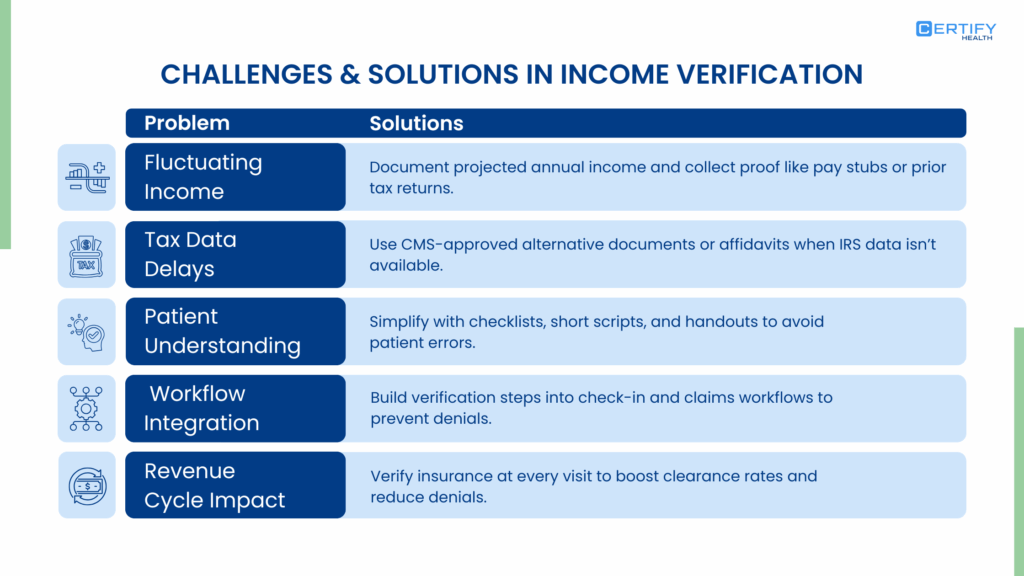

Challenges and Solutions in Income Verification

Here’s what practices will encounter, and practical solutions that protect both revenue and patient coverage:

- Fluctuating Income: Many patients, especially gig workers, see income change month-to-month. Teach staff to document projected annual income based on best estimates and collect supporting evidence (past returns, current pay stubs).

- Tax Data Delays: Not all IRS data is instantly available. Use alternative sources or affidavits with CMS approval and document these steps in your eligibility workflow.

- Patient Understanding: Complexity leads to mistakes. Use checklists, concise intake scripts, and patient-facing handouts to demystify the process.

- Workflow Integration: Embed all income verification steps directly in your patient flow, from check-in to claims submission, to reduce denial risk.

- Revenue Cycle Impact: Consistent insurance verifications at the point of care are directly linked to lower claim denials and higher financial clearance rates.

- But when coverage or subsidy eligibility shifts, even slightly, it increases the likelihood of underpayments, delayed collections, or unexpected patient balances.

This is where strong payment infrastructure becomes essential.

With CERTIFY Health’s CERTIFY Pay, practices can maintain financial stability even as ACA Marketplace rules shift.

CERTIFY Pay enables clinics to collect patient responsibility more reliably by supporting online, in-person, mobile, and recurring payment options, backed by PCI-DSS–compliant, secure processing with built-in fraud protection and fast settlement.

Its smart routing and automated reconciliation help practices stay ahead of patient payment fluctuations and reduce the downstream impact of eligibility errors or subsidy adjustments.

Future Outlook and Compliance Considerations

The reality of the ACA for medical practices? Change is the only constant. Here’s what’s on the horizon after 2025:

- Temporary Policies: Many of the new income verification standards are set to expire at the end of 2026, requiring ongoing vigilance for new updates from CMS and HHS.

- Ongoing Training and Tech Updates: Make staff training and eligibility system upgrades a recurring event to keep up with regulatory shifts.

- Practice Revenue and Risk: Staying ahead of verification requirements protects both your financial bottom line and mitigates compliance risk while ensuring patients get and keep the affordable coverage they count on.

- Patient Experience: Transparent communication and seamless verification not only reduce denials but also build trust and improve patient satisfaction.

Conclusion

The post-2025 ACA landscape leaves no room for complacency on income verification standards. For every medical practice aiming to maintain compliant, friction-free insurance workflows, this isn’t “just another hoop”; it’s the key to keeping your doors open and your patients protected.

Invest in staff training, integrate robust verification technology, and communicate the right documentary evidence requirements starting now. Your bottom line and your patients will thank you.