Table of Contents

Introduction

Ambulatory clinics are rapidly becoming the front door of healthcare, meeting rising demand for affordable, convenient, patient-centered care. With supportive policies and advancing technology fueling growth, they’re set to redefine how, where, and when patients receive care.

But with that growth comes a new layer of complexity. What used to be straightforward—see patient, bill insurance, get paid—is now a maze. Referrals, prior authorizations, eligibility checks, denials, and endless follow-ups clog the revenue cycle long before payment even lands.

If you’re still treating revenue cycle management (RCM) as a back-office afterthought, you’re already behind.

Success now demands a full rewire of how you handle revenue – from the front desk to final payment.

We’re witnessing a massive shift from high-volume, fee-for-service logic to value-driven, patient-centered systems that focus on outcomes rather than just transactions.

But here’s where it gets challenging for SMB ambulatory clinics. You’re dealing with limited resources, operational complexity that would make a Fortune 500 CFO sweat, and rising pressures around payer mix, patient responsibility, and compliance. You can’t afford to hire an army of billing specialists, yet you’re expected to perform like the big health systems.

Sound familiar? You’re not alone in this struggle.

Did You Know?

Operating margins remain tight for hospitals this year. Despite a 31% rise in outpatient revenue since 2021, skyrocketing drug (+15%) and non-labor costs (+10%) are eating into gains.

The result? Many health systems are growing in volume—but not in profitability.

What Sets Revenue Cycle Management Apart in Ambulatory Practices?

Unlike hospitals with large back-office teams, ambulatory practices manage clinical care and financial workflows under one roof. That makes RCM not just a support function, but the core system ensuring every patient encounter translates into timely, accurate revenue.

Picture this: It’s Monday morning at your ambulatory care practice. The front desk is buzzing—checking in patients, verifying insurance, and fielding nonstop calls. Medical assistants are splitting time between clinical care and billing tasks, while your administrator wrestles with denied claims and wonders why collections dipped by 15% last week. Unlike hospitals with dedicated departments, ambulatory practices often juggle it all under one roof.

That’s where Ambulatory Revenue Cycle Management (RCM) steps in. It’s not just about submitting claims—it’s the financial engine that keeps your practice running. From registration and benefits verification to charge capture, claims submission, and collections, every step needs to be precise. One slip can mean denials, delays, or cash flow headaches.

And the pressure is rising. Payer rules shift constantly. Documentation demands get stricter. Patients shoulder higher out-of-pocket costs and expect clear answers up front. Simply pushing more claims won’t cut it anymore. Accuracy and quality matter most.

Effective ambulatory RCM relies on robust performance tracking and technology.

Key metrics like days in accounts receivable (A/R), clean claims rate, denial ratios, and collection efficiency help practices pinpoint revenue leaks and optimize workflows. Advanced platforms incorporating automation and analytics streamline claim processing, predict denial trends, and enhance reimbursement outcomes, offering practices measurable ROI and sustainable financial stability.

Making Patient Experience a Priority in Ambulatory Revenue Cycle

Let me ask you something: When was the last time a patient thanked you for your billing process?

Exactly. Most patients see medical billing as a necessary evil—something confusing, frustrating, and expensive that happens after they get care.

But what if we flipped that script?

Healthcare cost transparency isn’t just a nice-to-have anymore—it’s becoming a competitive advantage. When patients know upfront what they’ll owe, something magical happens. They trust you more, they pay faster, and they’re less likely to avoid necessary care.

Here’s how ambulatory care practices can make this work:

Clear price estimates before services stop surprising patients with bills weeks later. With CERTIFY Health’s revenue cycle management software, practices can provide accurate cost estimates upfront, increasing point-of-service collections by up to 30%. The result? Stronger cash flow, fewer write-offs, reduced staff stress, and greater patient trust—turning what was once a billing pain point into a driver of loyalty and revenue.

Easy payment plans that actually work. Not everyone can pay $500 upfront, but most can handle $50 monthly. Support patients with flexible payment plans that match their financial reality.

Good communication throughout the patient journey – clarifying financial responsibility, insurance status, and payment options—matters. Tools like CERTIFY Health’s patient communication platform can cut no-shows by 30% and reduce clinical staff effort by 50%.

The benefits? Happier patients who feel respected and informed. Fewer billing disputes that eat up your admin staff’s time. Smoother front desk work because everyone knows what to expect.

Here’s what happens next: Your team spends less time chasing payments and more time focused on what they do best – caring for patients.

Pro tip: When patients feel confident about the cost, the next step should feel effortless. CERTIFY Pay, an omnichannel payment gateway by CERTIFY Health enables simple, flexible ways to pay at the front desk or digitally, so financial conversations stay smooth and don’t detract from the care experience.

Accept patient or merchant payments easily with CERTIFY Pay:

- Support cards, ACH, HSA/FSA, and digital wallets

- Enable secure, PCI- DSS compliant collections that reduce A/R and billing follow-ups

Did You Know?

In 2025, denial rates are expected to surpass 10% in over half of all practices, according to a study. And 73% believe that things will only grow worse.

Reworking each denial can cost more than $25, which reduces earnings and delays service.

Nearly half of all denials start at the front desk—think eligibility and registration slip-ups.

Tracking and fixing root causes isn’t optional—it’s your fastest path to fewer denials and stronger cash flow.

How Each Role Can Help Drive ambulatory RCM Success

TL; DR:

Who plays what part in making ambulatory RCM a real success story?

Ambulatory RCM success takes a team effort.

- Practice Administrators: Streamline workflows, train staff, and invest in tech that delivers real ROI.

- Billing Managers: Shift from fixing denials to preventing them with smarter, data-driven systems.

- Physician Owners: Back RCM as a growth enabler—financial health fuels better patient care.

Practice Administrators: The Strategic Orchestrators

As a practice administrator, you’re the conductor of this complex orchestra. Your role in RCM success goes far beyond just “making sure bills get paid.”

You’re leading workflow improvements that can transform your entire operation. This means mapping out your current billing and collection workflow, identifying where delays and errors typically occur, and redesigning processes to eliminate bottlenecks.

Staff training becomes your secret weapon. Your billing and admin staff need ongoing education about coding changes, payer requirements, and new compliance standards. But here’s the twist—don’t just train them on what to do. Train them on why it matters and how their work impacts the practice’s financial health.

Not every shiny new RCM tool is worth your budget—and you know it. But doing nothing? That’s even more expensive. The key is balance: choose tech like CERTIFY Health’s ambulatory RCM tool that plays well with your current systems and actually moves the needle. The smartest practices don’t chase trends – they invest in tools that deliver real, measurable ROI without blowing the budget. Book a Demo to Optimize your RCM.

Billing Managers: The Quality Control Experts

Your billing manager role has evolved from “submit claims and follow up on denials” to becoming a data-driven problem solver.

Accurate coding and denial prevention? Still your bread and butter. But the game’s changed. It’s no longer just about fixing errors after they hit your desk—it’s about setting up smarter systems that stop them before they even happen. Strategic, proactive, and way less stressful.

Speeding up claim approvals means understanding each payer’s specific requirements and building workflows that address their common rejection reasons. Create standardized processes for pre-authorization, documentation requirements, and claim submission timing.

Data isn’t just for reporting—it’s your early warning system. Spot denial trends, catch issues early, and fix them fast. That shift from reactive to proactive? It’s how you stop revenue leaks before they drain your bottom line.

Physician Owners: The Vision and Resource Providers

As a physician owner, your relationship with RCM might feel like a necessary distraction from clinical work. But here’s the shift in thinking you need to make:

Supporting RCM priorities alongside clinical goals isn’t about choosing one over the other. It’s about recognizing that strong RCM enables better patient care by ensuring your practice remains financially viable and can invest in quality improvements.

Making decisions about technology and resources that impact both revenue and care requires understanding how RCM investments translate into better patient outcomes. When your billing processes run smoothly, your clinical staff can focus on patients instead of administrative tasks.

Moving Toward Value-Based and Modernized RCM: Practical Steps for Ambulatory SMBs

TL; DR:

What steps move you from volume-based to value-based RCM?

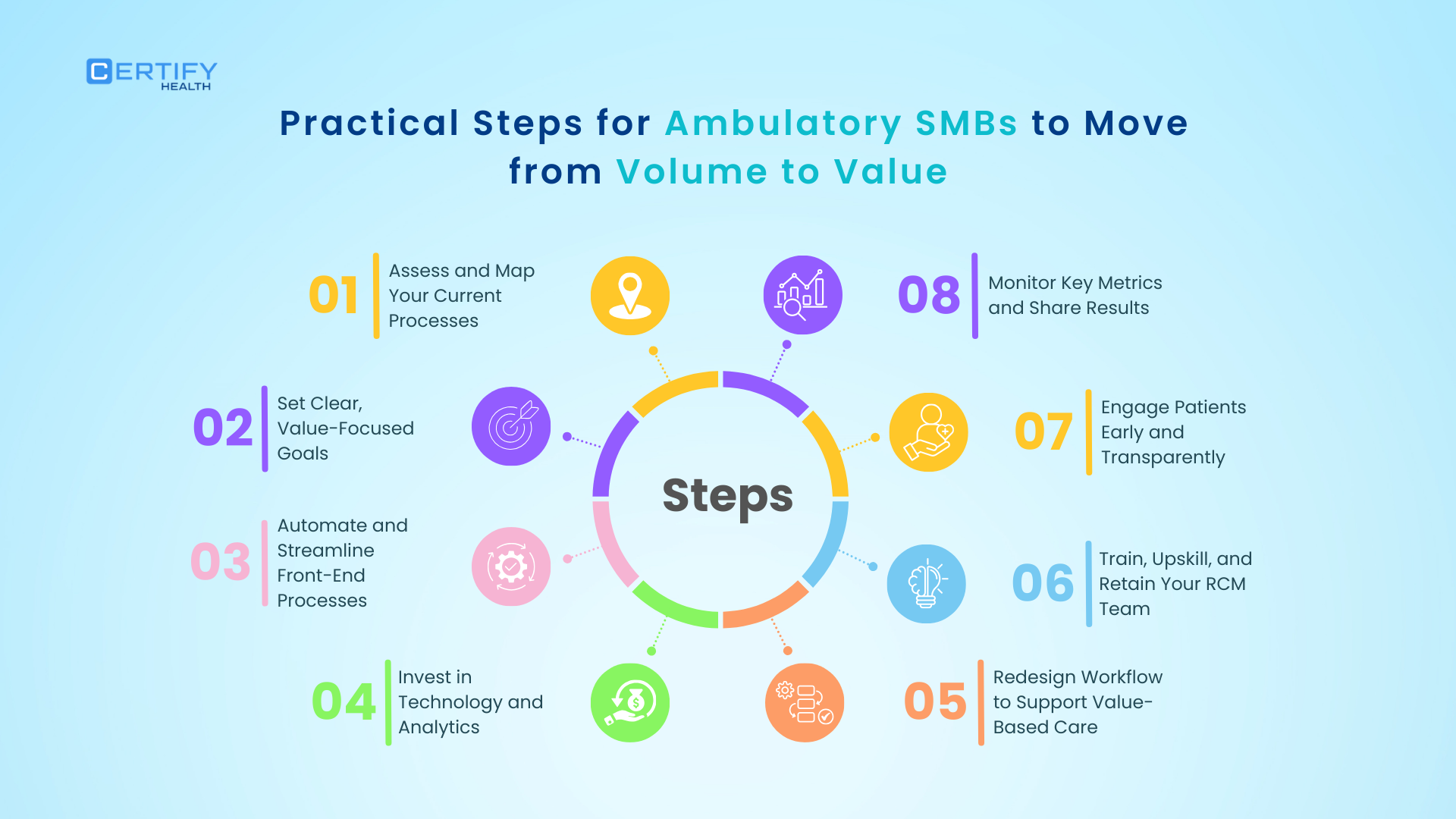

Here are some strategic steps you can take to move from volume to value based care:

- Assess & Map: Break down your entire workflow, spot bottlenecks, and fix what slows you down.

- Set Value Goals: Go beyond volume—reduce denials (<5%), speed up cash flow, and boost patient satisfaction.

- Automate Front-End: Eligibility checks, digital intake, and e-statements free staff from data entry and reduce costly errors.

- Invest in Tech: Start small—integrate your RCM with your EHR, use dashboards, and scale as you grow.

- Redesign for Value-Based Care: Build in pre-visit clearance, patient cost estimates, and population health reporting.

- Train Your Team: Upskill billing staff, cross-train, and fight burnout—your people are your greatest asset.

- Engage Patients: Be upfront about costs to avoid surprises, build trust, and improve collections.

- Track & Share Metrics: Transparency drives accountability and continuous improvement.

Ready to change your approach? Here’s your roadmap:

Assess and Map Your Current Processes

Work with your team to understand your current billing and collection workflow. Don’t assume you know where all the problems are. Map out every step from patient registration through final payment, and identify pain points such as delays, errors, and bottlenecks.

Pro tip: Your front desk and billing team see the cracks before anyone else—so start by listening to them. Then, give them the tools to fix it. A unified healthcare platform like CERTIFY Health streamlines the full care cycle – from patient experience to practice management, ambulatory revenue cycle to patient experience metrics, and beyond.

Set Clear, Value-Focused Goals

Define what success looks like beyond volume. Yes, you want to see more patients, but focus on reducing claim denials, improving cash flow, and enhancing patient satisfaction. Set specific, measurable targets for denial rates (aim for under 5%), days in accounts receivable, and patient payment collection rates.

Automate and Streamline Front-End Processes

Streamline your practice with CERTIFY Health’s integrated healthcare platform for ambulatory practices– complete with digital eligibility checks, online intake, and electronic statements. These front end process improvements reduce errors and free up staff time for higher-value activities. Your admin staff role shifts from data entry to patient engagement and problem-solving.

Invest in Technology and Analytics

Choose simple, affordable solutions that fit your clinic’s size and budget. Don’t try to implement everything at once. Start with basic RCM system integration with your EHR to enable real-time dashboards and smarter decision-making.

Redesign Workflow to Support Value-Based Care

Introduce pre-visit financial clearance processes, automated patient cost estimates, and population health reporting. This aligns your operations with payer expectations and prepares you for value based RCM models that reward quality over quantity.

Train, Upskill, and Retain Your RCM Team

Provide ongoing education and certification opportunities for billing and admin staff. Cross-train staff to build flexibility and consider partnering with experienced RCM vendors where needed. Staff burnout is expensive—invest in your people before you lose them.

Engage Patients Early and Transparently

Communicate about financial responsibility before visits to reduce surprises, improve collections, and build trust. This isn’t about being pushy—it’s about being transparent and helpful.

Monitor Key Metrics and Share Results

Track denial rates, days in accounts receivable, patient payment rates, and productivity. Share these insights regularly across teams to encourage accountability and continuous improvement. Your RCM success depends on everyone understanding how their work contributes to the practice’s financial health.

Conclusion

Seeing more patients? That’s not enough anymore. If your revenue cycle’s a mess, growth just means faster burnout and thinner margins.

Today’s top-performing practices don’t just chase volume—they optimize revenue. That means cleaner claims, faster payments, and smoother workflows—all without drowning your staff.

Your RCM isn’t back-office fluff. It’s a strategic power move. The smartest clinics treat it that way: investing in tech that fits their size, training staff to avoid burnout, and creating patient experiences that boost loyalty (and collections).

Here’s the move: Don’t overhaul everything. Start small. Fix your denials. Tighten financial clearance. Automate patient reminders. Then build from there.

Because sustainable growth doesn’t come from more patients—it comes from doing revenue right. Is your RCM built for that? If not, explore this list of handpicked RCM solutions.