Table of Contents

Picture this: your patients are walking into your dental practice focused on care – not with stack of insurance paperwork or anxiety about whether their dental claims will go through. Meanwhile, your front desk staff isn’t scrambling to call payers, deal with claim denials, or mop up the latest insurance verification emergency. Instead, the day runs smoothly, with improved cash flow, happy patients, and a stress-free experience for everyone.

Sound like wishful thinking? It’s not. With a powerful focus on dental insurance verification, paired with the right technology and expert workflows, your team can make this the new reality.

In this quick-start guide, we reveal actionable steps for your front desk team to reduce claim denial rates, deliver more accurate insurance quotes, and minimize extra work (and headaches).

You’ll see exactly how dental insurance verification software like CERTIFY Health can help your practice thrive by automatically handling real-time patient eligibility, spotting insurance exclusions, and more. Read on!

Why Insurance Verification Matters in Dental Practices?

TL;DR:

Rushed dental insurance checks = denials, delayed cash, staff burnout, and unhappy patients.

Smart practices verify insurance 2–3 days ahead to prevent errors and protect revenue.

Also, did you know? Nearly 75% of denials stem from fixable admin mistakes—automated verification stops them early.

Skipping or rushing dental insurance verification are expensive mistakes.

It’s the #1 cause of delayed payments, claim denials, and rework for your team. Each denied dental claim doesn’t just slow your revenue cycle and disrupt cash flow; it frustrates your patients and buries your staff in extra documentation.

When insurance eligibility isn’t verified in advance, your practice can face:

- Increased claim denials since patient coverage is out-of-date or inactive.

- Repeated claim submission cycles with delayed payments

- Staff burnout from chasing missing details and mopping up manual errors

- Surprised and dissatisfied patients who get unexpected bills

That’s why leading practices complete thorough dental insurance verification 2–3 days before every appointment. This proactive approach helps the front desk confirm patient eligibility, prevent non-verification errors, and flag potential coverage issues—creating a better experience and improving cash flow by reducing delayed payments.

You Might Also Like To Read: Step-by-Step Guide to Medical Insurance Verification with Digital Solutions

Essential Steps for Accurate Dental Insurance Verification

TL;DR:

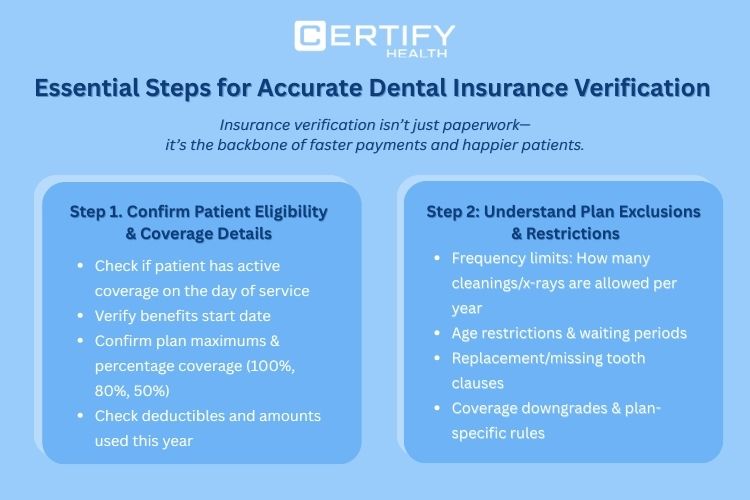

Insurance verification isn’t just paperwork, it’s the backbone of faster payments and happier patients. Here are few steps for accurate patient insurance eligibility verification.

Step 1: Confirm active coverage, benefits, deductibles, and usage.

Step 2: Review exclusions, clauses, and plan-specific rules.

Key Information to Review Before Patient Treatment

Step 1: Confirm Patient Eligibility and Coverage Details

The very first step should always be: Does this patient have active coverage, and is their dental benefit plan valid on the day of service?

Your front desk must check:

- Benefits start date to guarantee ongoing coverage

- Insurance plan maximums and percentage coverage by procedure (is it 100%, 80%, or 50%?)

- Deductibles, as well as the amounts utilized during the year

Failing to confirm eligibility means any claim can be denied before it’s even processed. This is where technology shines. Dental insurance verification software such as CERTIFY Health instantly pulls real-time insurance eligibility data giving your staff up-to-date, accurate coverage information with fewer manual errors. You get quicker confirmation, instant access to patient coverage, and faster dental claims processing.

Step 2: Understand Plan Exclusions and Restrictions

Insurance verification isn’t finished until you understand the fine print. Every insurance plan is a maze of exclusions, restrictions, and clauses. Miss one, and you’re headed straight for a claim denial.

The following must always be verified by your front desk:

- Frequency limits: e.g., how many cleanings or x-rays are allowed per year?

- Age limitations and waiting periods: Are there restrictions by age or how long the patient has been covered?

- Replacement and missing tooth clauses: Will the plan pay for a new bridge, or are they subject to the missing tooth clause?

- Coverage downgrades and plan-specific rules

“Non-verification” of these items leads directly to claim denials and a tsunami of extra work for your team.

Did you know?

In a study, it was found insurers processed 425 million claims, and nearly 1 in 5 in-network claims (19%) were denied.

Out-of-network claims faced an even higher 37% denial rate, highlighting the financial risk of non-verification or incorrect verifications.

CERTIFY Health’s automated verification system flags these insurance exclusions and sends alerts to your staff to check plan-specific issues before treatment. That means fewer surprise denials and more accurate insurance quotes from the start.

Pro Tips: Outstanding Accuracy and Patient Communication

Here’s where your team goes from “good” to “outstanding.” Even with the same dental plan, family members can have different coverage rules, frequency limits, or waiting periods. Always confirm patient insurance for every appointment.

Before presenting cost estimates, confirm:

- i. Outstanding claims and prior usage to ensure correct calculations

ii. Insurance eligibility for the specific date of service, including any changes in patient insurance

Once insurance is verified, practices can turn accurate estimates into immediate collections. With CERTIFY Health’s CERTIFY Pay, an omnichannel payment gateway, dental teams collect copays and balances via POS, QR codes, kiosks, or SMS/email pay links, supporting cards, ACH, HSA/FSA, and wallets while reducing A/R and follow-ups.

Behind the scenes, every transaction runs through healthcare-grade HIPAA & enterprise grade PCI DSS security controls designed to meet regulatory requirements and protect patient financial data end to end.

Dental insurance verification software like CERTIFY Health tracks all these moving parts automatically, making sure your front desk stays organized and minimizes extra manual errors. This transparency reduces surprises for both patients and staff, improves patient satisfaction, and ensures your dental claims are ready for approval.

How CERTIFY Health Empowers Your Front Desk Team

TL; DR:

Manual insurance checks drain time and cause errors. CERTIFY Health’s smart dental verification software automates eligibility, flags red-flag clauses, and tracks coverage in real time.

- Fewer denials & delays

- Faster claims & cash flow

- Accurate cost estimates for happier patients trust.

Automation = efficiency, accuracy, and stronger patient trust.

Let’s talk about the power of automation and what’s possible with smart dental insurance verification software. With CERTIFY Health’s insurance verification software for dental practices, your front desk can process insurance checks in seconds and focus on real patient connections.

Key Features At a Glance

- Real-time insurance eligibility verification so your front desk never wastes time on calls or outdated portals

- Automated alerts for insurance exclusions, age limitations, frequency limits, downgrades, missing tooth clause, and other red flags

- All deductibles, annual maximums, and coverage details tracked per patient—no more hunting through paper files

- Clear, accessible benefit summaries on demand for accurate cost estimates and effective patient education

These features dramatically reduce manual entry and errors, significantly improving dental claim submission accuracy. They empower your team to provide precise insurance quotes, lower claim denial rates, and maintain a faster dental claims workflow, leading to improved cash flow for your practice.

Don’t Let This Opportunity to Streamline Dental Insurance Verification Slip Away – Act Now!

Read Our Guide On: How to Verify Patient Insurance Verification Using CERTIFY Health Solutions

Why These Features Matters for Your Practice

When your staff uses real-time insurance eligibility checking, claim denials drop, and the number of delayed payments shrinks. Automated tracking of patient eligibility, insurance coverage, and exclusions ensures smoother operations, with fewer instances of non-verification disrupting your schedule.

Plus, every accurate quote and clear cost estimate helps your patients feel informed and valued translating to higher satisfaction and loyalty.

Conclusion

If you want faster dental claims, fewer denials, and a stress-free experience for both your practice and your patients, the answer is here.

Book a CERTIFY Health demo and see how easy dental insurance verification can be.

Technology can help your front desk team reduce manual errors, enhance patient satisfaction, and boost your practice’s cash flow.

Say goodbye to delayed payments, claim denial headaches, and extra work!

Frequently Asked Questions

What are the top reasons dental claims get denied?

- Missing or inaccurate patient insurance information

- Policies that have expired or carry hidden restrictions (such as unmet prior authorizations)

- Incorrect procedure coding or mismatched coverage details

- Coordination of benefits not updated with the payer

How can dental front desk teams minimize denials?

- Confirm eligibility and benefits in real time before every appointment

- Leverage automated verification tools that highlight outdated or missing data

- Double-check patient details at each visit instead of relying on prior records

What’s the most frequent oversight during patient check-in?

- Depending on the patient’s recollection instead of verifying their plan details

- Overlooking coordination of benefits updates or missing prior authorization steps

How does technology speed up the insurance process?

- Platforms like CERTIFY Health provide instant eligibility checks and flag issues upfront

- Real-time validation helps practices avoid denials, shorten reimbursement delays, and eliminate hours of manual rework