Table of Contents

Why Billing Experience Is the Critical Nexus of Patient Trust

Patient-friendly billing is now a core driver of patient retention, revenue growth, and trust in healthcare practices.

According to a 2023 Urology Times survey, 78% of patients strongly consider the billing process when choosing their provider, while price transparency ranked as their top decision factor.

That statistic underscores a new reality: patients are behaving like consumers. They want clarity, predictability, and fairness. Not surprising bills or opaque charges.

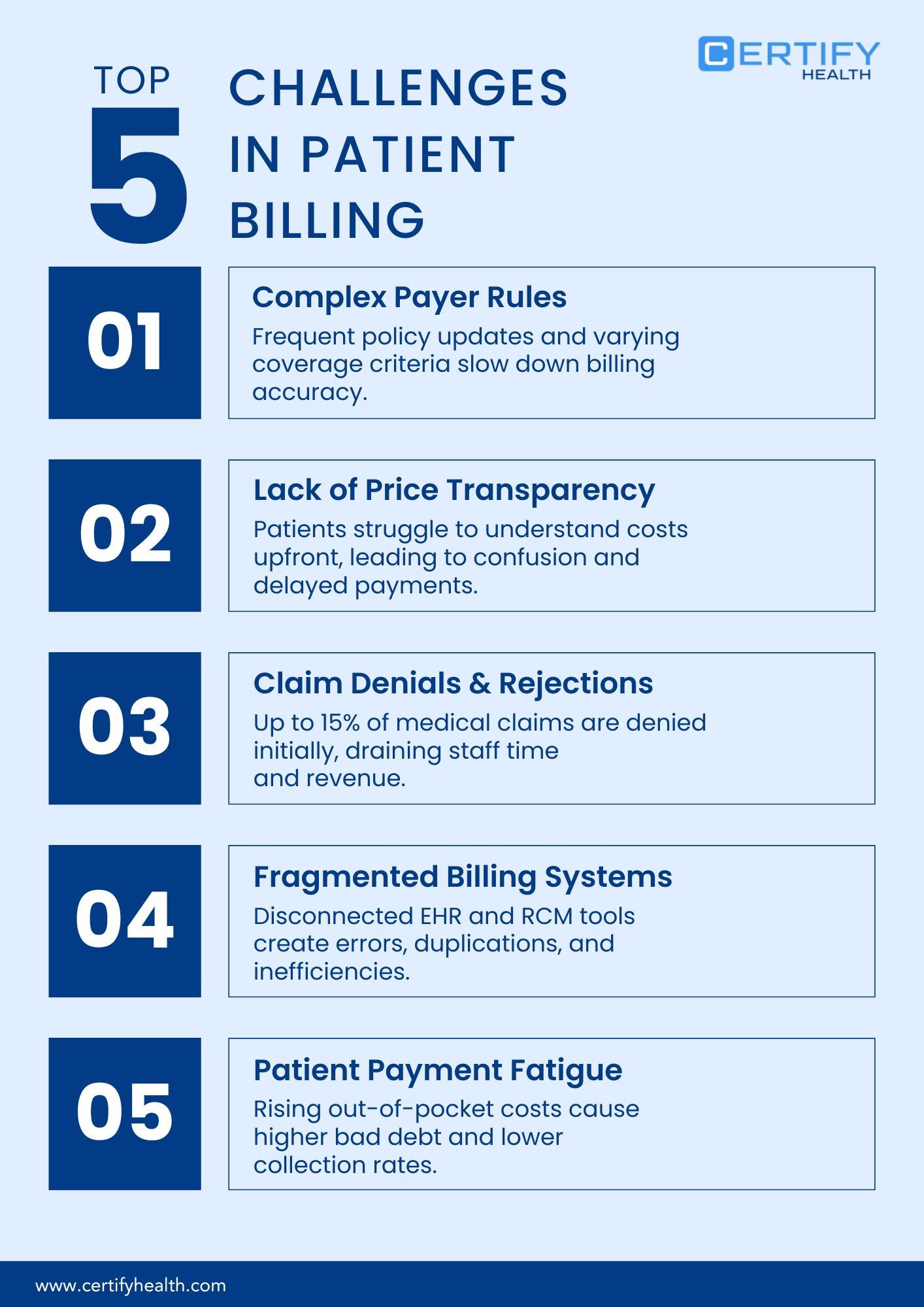

The Cost of Poor Medical Billing Experiences

Let’s get specific. When billing processes are confusing or inconsistent, healthcare organizations face a domino effect:

- Surprise bills → Erodes patient trust

- High self-pay A/R → Stretches cash flow

- Poor collections → Drives operational inefficiency

- Patient churn → Cuts into long-term revenue streams

In fact, another national survey of over 1,000 patients revealed that 56% would switch providers after a single bad billing experience. That’s more than half your patient base gone over an invoice.

So, what exactly is a patient churn?

In clinical and operational terms, patient churn is the rate at which patients switch providers or stop seeking care altogether.

Common drivers include:

- Poor overall patient experience

- Friction in intake or front-desk processes

- Communication breakdowns

- Billing-related dissatisfaction

Add to it the nuances like long resolution cycles, unclear communications, unpredictable out-of-pocket expenses, and you have a perfect storm for lost loyalty.

The Real-World Impact

When patients lose trust, revenue loss follows quickly. Frustrated patients not only leave; they talk. Word-of-mouth reputational damage can ripple through your local market faster than a billing cycle closes.

In short: patient-centric billing isn’t an operational checkbox; it’s a strategic imperative.

Make billing predictable. Communicate transparently. And measure satisfaction the same way you measure collections. Because in today’s healthcare economy, clarity converts.

Patient-Friendly Billing Strategies

1. Hospital Price Transparency: From Regulation to Revenue Trust

Transparency isn’t just a regulatory checkbox; it’s a signal of trust. And in modern healthcare, trust drives both retention and revenue.

Since January 1, 2021, the Centers for Medicare & Medicaid Services (CMS) has made the Hospital Price Transparency Final Rule effective. The rule mandates that hospitals publicly disclose their prices in two key formats:

1. A Machine-Readable File

Containing “standard charges,” including:

- Gross charge

- Discounted cash price

- Payer-specific negotiated rates

- Minimum and maximum negotiated rates

2. A Consumer-Friendly Display or Online Tool

Presenting at least 300 “shoppable services”, enabling patients to estimate their out-of-pocket costs with greater accuracy and confidence.

Compliance Momentum: The Numbers Behind the Policy

The results have been telling. After the rule’s implementation, CMS reported a major compliance surge:

- 2021: Only 27% of hospitals complied fully

- 2022: That figure jumped to 70%, reflecting significant progress across the U.S. healthcare system

And as of January 1, 2023, CMS expanded the rule: hospitals must now provide cost-sharing information for 500 shoppable items and services, making transparency a cornerstone of patient engagement.

Despite progress, smaller and mid-sized hospitals often lack full compliance. Limited resources, fragmented EHR systems, and lack of standardized pricing tools mean some institutions miss one or more components of the rule.

To close the gap, CMS has begun issuing new guidance and RFIs (Requests for Information) aimed at strengthening both hospital and insurer transparency frameworks.

Why Patients Value Cost Predictability

Let’s face it: patients hate unpredictability, especially when it comes to healthcare costs. When patients can estimate their financial responsibility, trust and payment timeliness improve dramatically.

In fact, transparent shoppable service pricing could save the U.S. healthcare system between $17.6 and $80.7 billion by 2025. That’s equivalent to a 6.9% reduction in spending for privately insured patients.

Turning Healthcare Transparency into Competitive Advantage

Forward-thinking hospitals aren’t treating transparency as a burden; they’re using it as a differentiator.

- Offer intuitive cost-estimation tools

- Train staff to explain shoppable service pricing clearly

- Embed transparency into the digital front door of care

Because when patients understand their costs upfront, they’re more likely to trust, return, and pay promptly.

2. Flexible Financing and Patient-Centric Payment Options

In today’s healthcare landscape, financial barriers often determine care decisions as much as clinical needs do. High deductibles, copays, and out-of-pocket obligations are creating a silent epidemic of medical debt.

The Scale of the Problem: Medical Debt in America

According to the Health System Tracker (Peterson Center on Healthcare & KFF), 20 million adults each owe over $250 in medical debt. That’s nearly 1 in 12 adults, adding up to a staggering $220 billion nationwide.

Breaking it down further:

- 14 million adults (6%) owe more than $1,000

- 3 million adults (1%) owe over $10,000

- 1 in 10 of these individuals live below the federal poverty line

These figures underline deep inequity in healthcare affordability, and why flexible financing programs are no longer optional.

How Financial Assistance Programs Boost Care Utilization

Research continues to show that when patients are financially supported, they stay in care longer and use healthcare services more appropriately.

A landmark study by Kaiser Permanente Northern California found that patients who received financial assistance showed:

- 59% increase in inpatient encounters

- 20% increase in ambulatory encounters

- 53% increase in emergency department visits

compared to similar patients who did not receive assistance.

Similarly, a peer-reviewed study published in Cancer found that among head and neck cancer patients, implementing dedicated financial counselors increased counseling engagement from 5.3% to 62.7%. Also, those patients reported significantly reduced financial stress after treatment.

Removing Financial Barriers Builds Patient Loyalty

Financial anxiety doesn’t just hurt wallets—it undermines health outcomes and patient loyalty. Patients burdened by billing worries often delay care, skip medications, or avoid follow-ups.

Conversely, financially supported patients experience less anxiety, feel more respected, and remain engaged with their care providers, boosting both clinical continuity and retention.

Operationalizing Flexible Payment Programs

To translate this evidence into daily operations, healthcare organizations can:

- Implement Dedicated Financial Counseling Staff

- Offer Financial Assistance Enrollment Before Service Completion

- Ensure Multiple Payment Pathways

- Communicate Program Benefits Clearly

- Track Patient Engagement and Outcomes

Flexible financing is all about access, trust, and long-term patient relationships. When patients feel supported financially, they stay, they pay, and they heal.

3. Simplicity in Statements & Empathetic Healthcare Communication

Confusing statements, unclear coverage explanations, and delayed communication drive dissatisfaction, payment delays, and avoidable disputes.

Nearly 40% of U.S. adults find medical bills hard to understand, according to national surveys. Most confusion arises around what’s covered by insurance versus what’s not; a gap that erodes patient confidence and increases administrative overhead.

This confusion comes at a cost. Providers often spend about 10–15% of a bill’s total value just collecting payments.

The Human Impact: When “Bill Shock” Hits Home

“Bill shock” isn’t just an emotional reaction; it has measurable financial consequences. A National study found that during the period between receiving care and receiving the bill, household expenses rose by 21.8%, only to drop by 10.9% after the bill arrived.

In other words, uncertainty about medical costs disrupts normal household budgeting. That stress directly affects how patients perceive their care experience.

Why It Matters: The Final Impression That Lasts

Billing is often the last interaction a patient has with your organization. A confusing or cold statement can undo months of positive clinical engagement. But a clear, compassionate billing process builds lasting loyalty and payment trust.

When healthcare providers communicate transparently and treat billing as part of the patient’s experience, they reinforce trust, reduce friction, and accelerate collections.

Designing Empathetic, Transparent Billing

- Use plain, non-technical language to explain coverage, insurance adjustments, and balances.

- Provide a side-by-side view of estimated vs. actual charges to demystify billing discrepancies.

- Offer multiple easy payment channels (mobile pay, online portal, auto-debit) with frictionless checkout.

- In addition to reminders, provide real human help like live chat, call-back options, or in-portal explanations.

A clear bill isn’t just a financial document; it’s a communication of care. When healthcare organizations lead with empathy and simplicity, they easily collect trust.

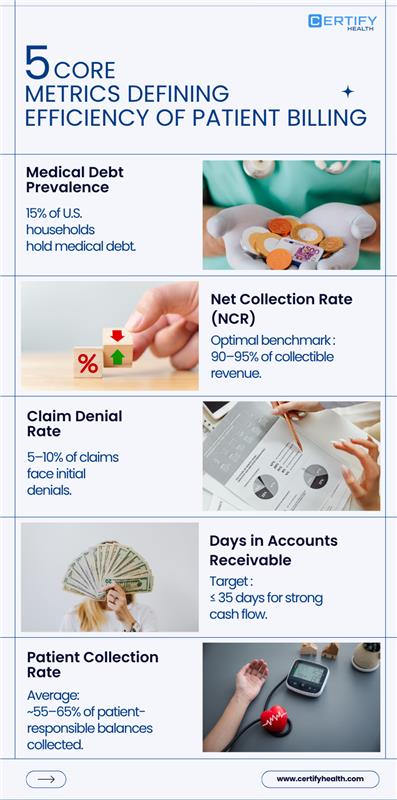

4. Data-Driven Revenue Cycle Management: Measure, Iterate, Show ROI

What you don’t measure, you can’t manage. In healthcare billing, data-driven performance tracking is the difference between hidden leakage and measurable growth.

Leading industry bodies like the Medical Group Management Association (MGMA) and the Healthcare Financial Management Association (HFMA) have established key performance benchmarks that help practices monitor both financial health and patient satisfaction.

Core Revenue Cycle Management Benchmarks to Track

- Point-of-Service (POS) Collection %

Measures all cash collected before, at, or within seven days of service.

FOS Payments ÷ Total Self-Pay Cash Collected.

- Self-Pay A/R Over 90 Days %

Should stay between 12%–15% of total receivables.

Anything higher signals potential revenue loss or patient collection fatigue.

- Days in Accounts Receivable (A/R)

A strong benchmark is under 40 days for efficient collection. - Net Promoter Score (NPS) for Billing Experience

Captures patient sentiment toward billing communication.

Paired with a net collection ratio of 96–97%, it reflects healthy operational and trust performance. - Bad Debt % of Gross Revenue

Indicates billing clarity and patient affordability. Lower bad debt ratios often mirror improved transparency and patient engagement.

Why Measurement Matters

Transparency and digital engagement can dramatically shift patient payment behavior, but only if those effects are measured.

Research from JAMA Network Open recommends tracking billing experience data and A/B testing communications to demonstrate quantifiable improvements in payment behavior and patient satisfaction.

Without structured tracking, improvements in retention, collections, or bad debt reduction cannot be validated or scaled.

What RCM Success Looks Like

Data-backed revenue cycle management produces visible gains:

- Faster collections

- Reduced outstanding A/R

- Higher net collection rates

- Improved billing satisfaction scores

These are not just financial KPIs; they’re signals of trust, process alignment, and operational maturity.

Building a Measurable RCM Framework

- Track Key Metrics:

- POS collection rate

- A/R >90 days %

- Bad debt % of revenue

- Patient billing satisfaction (NPS)

- Run Controlled A/B Tests:

Experiment with different billing formats, tone, and delivery methods (digital vs. print) to assess impact on payment lag and dispute rates.

- Benchmark Against MGMA/HFMA Standards:

Compare organizational performance against industry medians to identify revenue cycle gaps.

- Publish and Iterate:

Share results internally, track progress quarterly, and tie improvements directly to ROI.

Data is the backbone of modern revenue cycle management. By measuring, iterating, and benchmarking, healthcare leaders can turn billing from a backend task into a strategic performance engine.

Conclusion: Building Trust Through Digital, Patient-Friendly Billing

Billing is the final moment of truth in a patient’s care journey. It is basically a last opportunity for hospitals and clinics to make a lasting impression and build enduring trust.

All the strategies discussed—from price transparency to empathetic communication—can come together through a digital front door approach. This means creating connected workflows that unify every stage of the patient experience:

- Scheduling

- Pre-service collections

- Point-of-service engagement

- Post-visit billing and payments

When these steps are integrated digitally, patients experience care that feels seamless, transparent, and human.

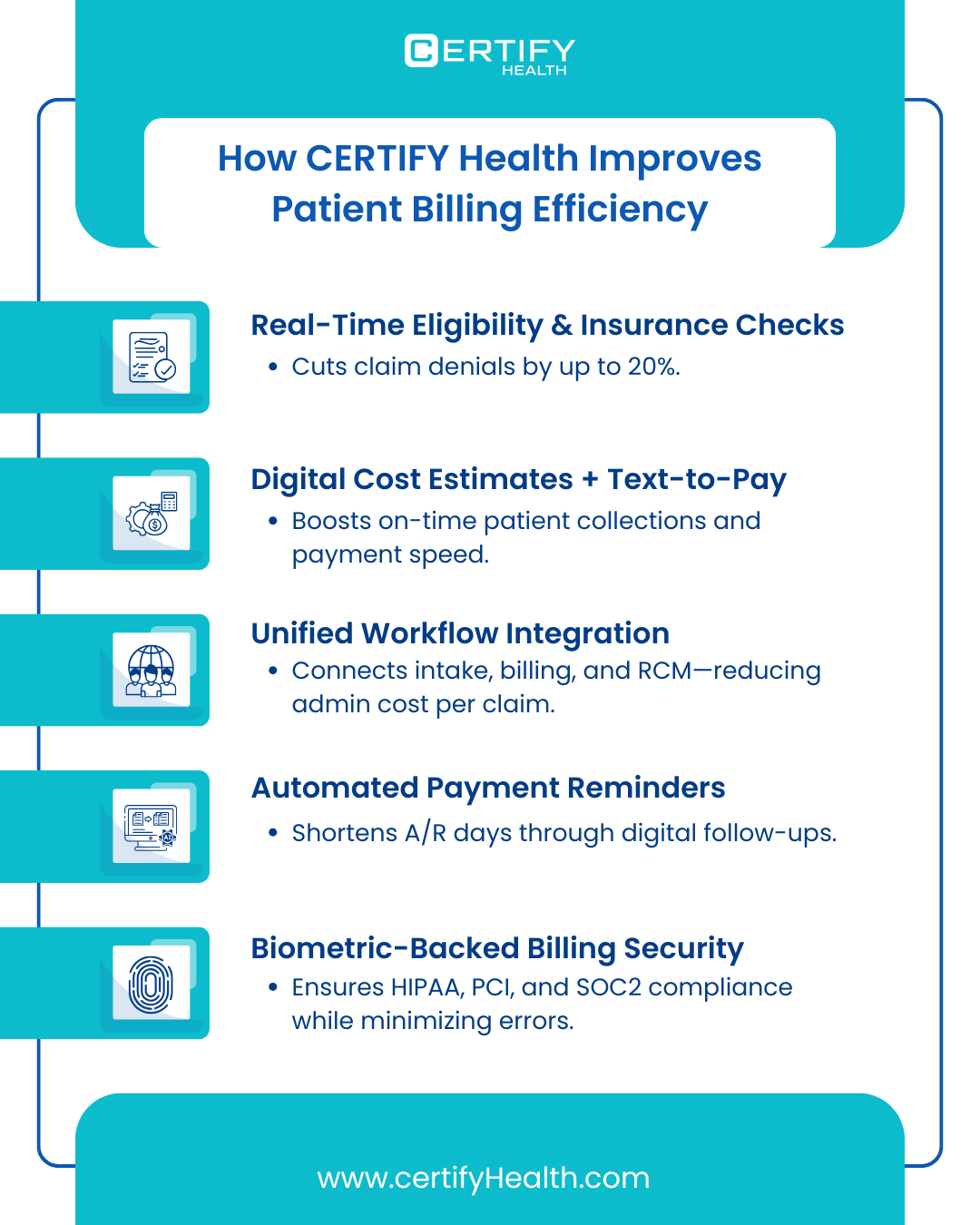

The Digital Advantage: Patient-Centric Revenue Management

By leveraging tools such as CERTIFY Health, healthcare organizations can streamline revenue cycle management (RCM) while elevating the patient experience.

CERTIFY Health results:

- 25% fewer claim denials with real-time eligibility checks

- 40% faster patient collections via automated digital payment tools

- 50% reduction in front-desk workload through smart automation

- Millions recovered in lost revenue for multi-location practices and DSOs

Why It Matters

The earlier and more often a patient engages digitally, the better informed they are, the less likely they’ll experience bill shock, and the more likely they are to pay promptly and stay loyal.

In short:

When billing becomes simple, transparent, and patient-friendly, it transforms from a transaction into a trust-building experience.

Digital engagement isn’t just the future of billing; it’s the foundation of sustainable patient relationships. Schedule a demo to learn more.