Table of Contents

Executive Summary

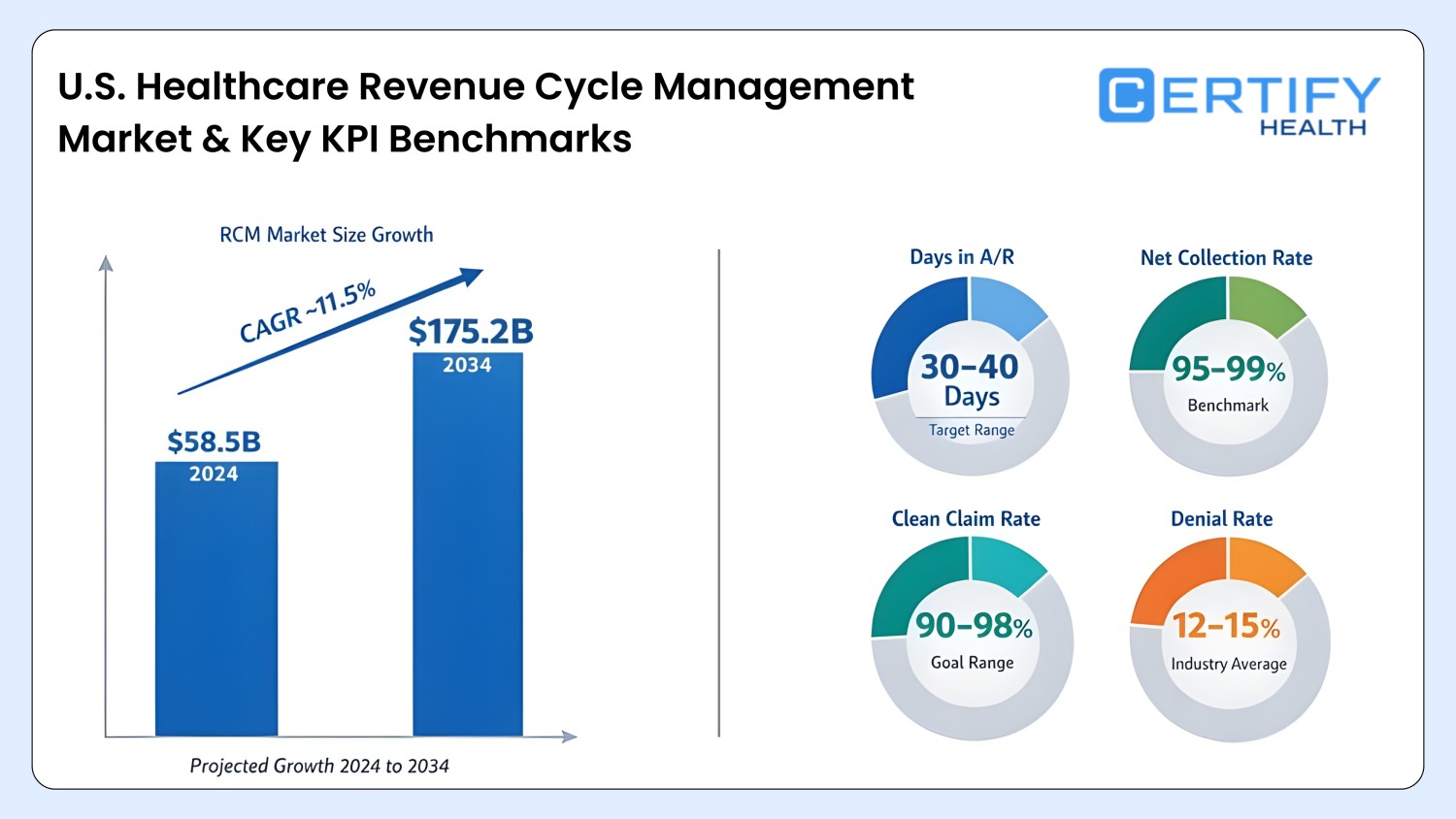

The modern healthcare financial ecosystem demands more than manual billing or fragmented processes. Revenue cycle management (RCM) now requires automation across patient payments, eligibility verification, claims processing, financial communication, and billing workflows. Without a unified approach, healthcare organizations face high claim denials, delayed collections, patient dissatisfaction, and administrative burden.

In a quantitative RCM study published in the International Journal of Accounting and Economics Studies, hospitals implementing RCM showed 45 days in A/R before vs. 25 days after implementation. That’s an 44% improvement in payment velocity.

Modern medical billing software powered by AI and automation streamlines every step of the revenue cycle. From real-time eligibility checks to digital patient payments, charge capture, and automated reconciliation, organizations can unlock revenue opportunities previously lost to inefficiencies.

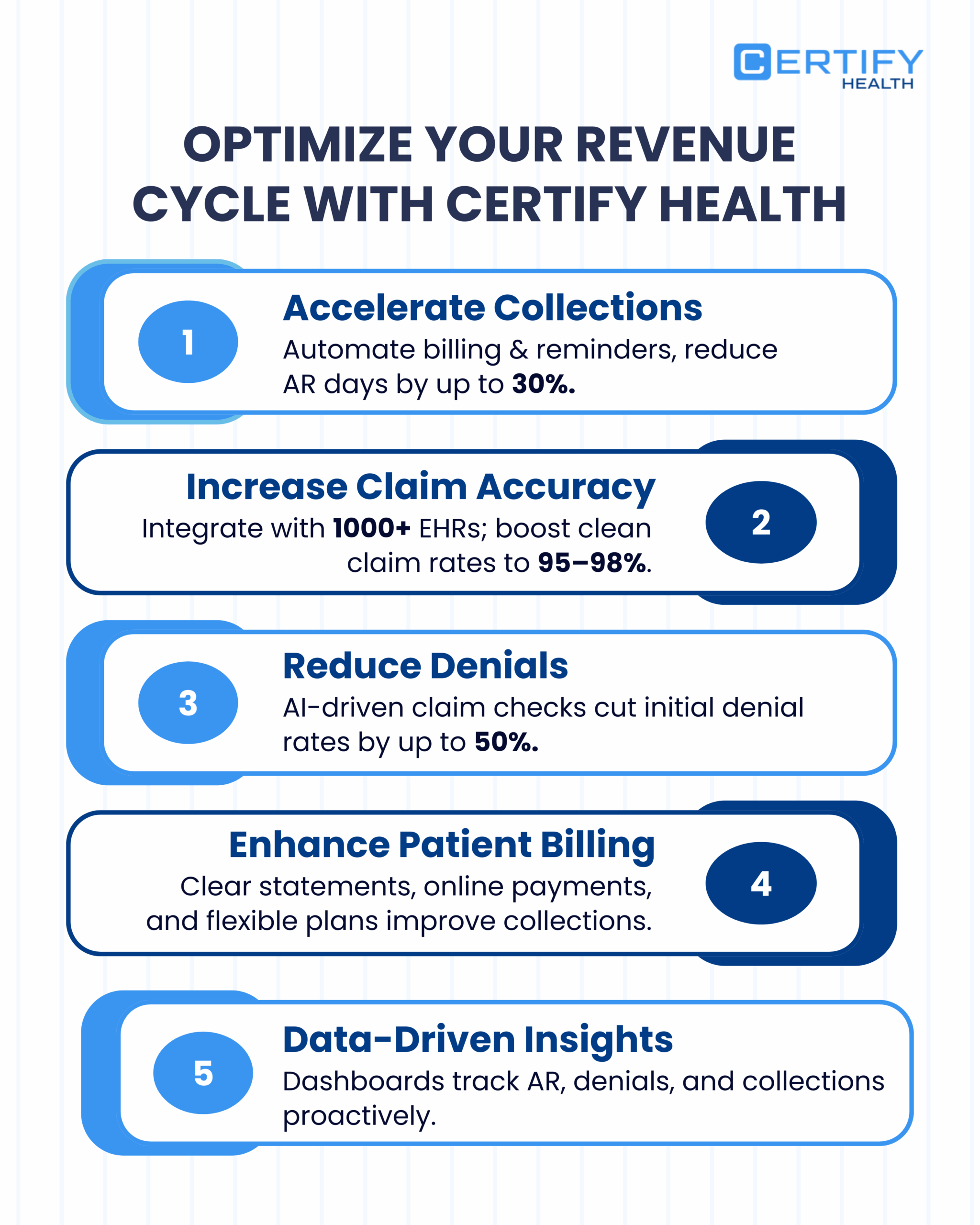

CERTIFY Health serves as a unified platform that connects every stage of the revenue cycle—from pre-visit financial prep to post-visit claim adjudication and payment collection. By integrating back-office workflows, patient payment tools, claims automation, analytics, and merchant infrastructure, healthcare organizations can:

- Reduce administrative burden and manual reconciliation

- Improve front-end revenue capture and patient satisfaction

- Minimize denials and accelerate collections

- Gain actionable insights through analytics and revenue dashboards

- Enable secure, compliant, and transparent financial processes

In short, modern RCM automation transforms healthcare revenue from a fragmented, error-prone process into a predictable, high-performing system that enhances both patient financial experience and organizational profitability.

Understanding Revenue Cycle Management in Healthcare

Revenue cycle management (RCM) is the financial backbone of modern healthcare. It encompasses every step from a patient’s first interaction to the final payment posting. Effective RCM ensures that healthcare organizations capture revenue accurately, reduce denials, and deliver a seamless patient financial experience.

Did you know?

Providers fail to collect 2%–5% of net patient revenue due to inefficient RCM or unchallenged underpayments.

What Is Revenue Cycle Management?

RCM is the end-to-end process that manages the financial interactions between patients, payers, and providers. Its key phases include:

| RCM Phase | Description | Key Objective |

|---|---|---|

| Pre-Visit | Eligibility verification, co-pay estimation, insurance discovery | Ensure accurate patient financial information and set payment expectations |

| During-Visit | Charge capture, coding, clinical documentation readiness | Record all billable services accurately |

| Post-Visit | Claim creation, claim scrubbing, submission, adjudication, appeals | Maximize collections and reduce denials |

| Payment & Reporting | Patient payments, reconciliation, analytics, dashboards | Ensure revenue is collected efficiently and transparently |

Modern RCM goes beyond manual processes. Organizations are shifting to automated, AI-driven revenue systems that provide real-time visibility, predictive analytics, and integrated workflows.

Benefits of modern RCM include:

- Reduced administrative burden

- Fewer claim denials

- Faster payment posting

- Improved patient satisfaction

- Comprehensive insights into revenue performance

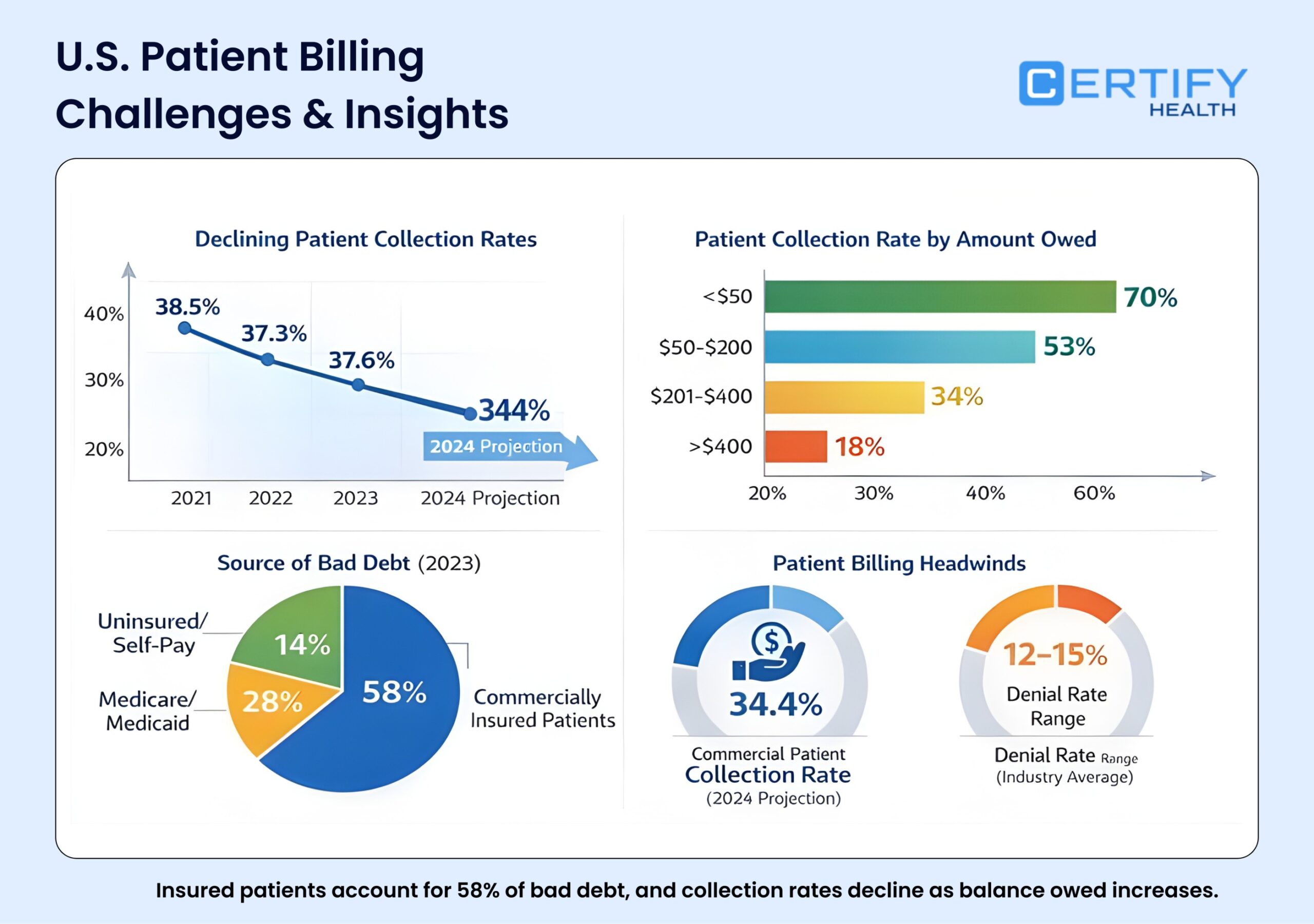

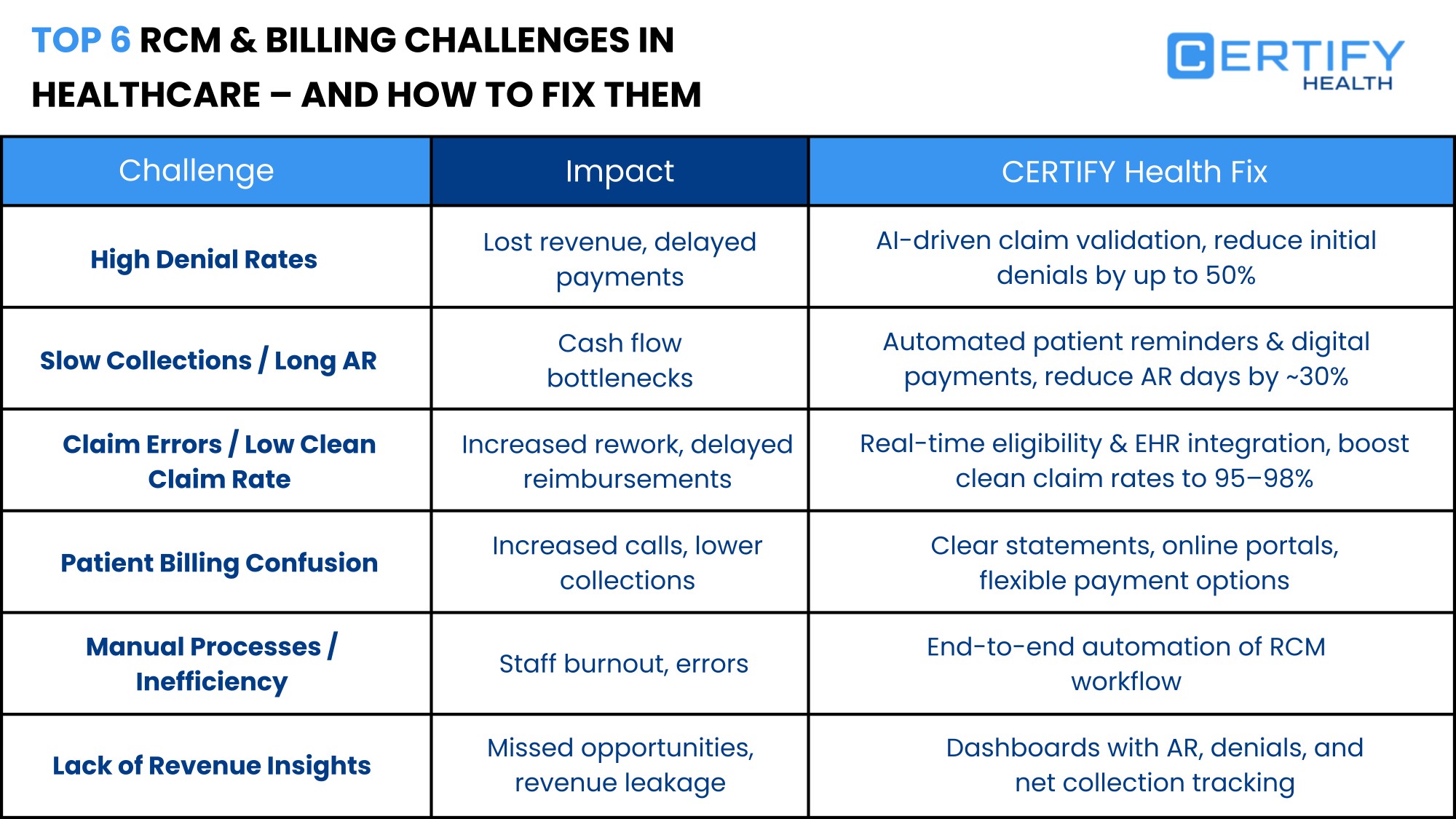

Why RCM is Broken in Most Healthcare Organizations

Despite its importance, RCM is often fragmented and inefficient. Common challenges include:

- High Claim Denials: Up to 20–30% of claims are denied due to coding errors, missing documentation, or eligibility issues.

- Manual Reconciliation: Payment posting and account reconciliation consume significant staff hours and are prone to error.

- Patient Payment Delays: Patients often face confusing statements or unexpected bills, leading to delayed collections.

- Administrative Burden: Staff spend excessive time on repetitive tasks such as verifying coverage, entering charges, or following up on denied claims.

- Fragmented Systems: Multiple disconnected platforms for scheduling, billing, eligibility, and claims create data silos and reduce workflow efficiency.

Impact of Broken RCM:

- Missed revenue opportunities

- Increased operational costs

- Staff burnout

- Decreased patient trust and satisfaction

The Rise of Automation & AI in Healthcare Revenue Cycle

To overcome these challenges, organizations are adopting automation and AI across the revenue cycle. Key solutions include:

| Automation / AI Solution | Function | Benefit |

|---|---|---|

| Eligibility Automation | Real-time verification across payers | Reduces denials and upfront surprises for patients |

| Claims Scoring & Scrubbing | AI checks claims for errors before submission | Minimizes rejections and accelerates revenue capture |

| Digital Patient Payments | Text-to-pay, installment plans, AutoPay | Improves collection rates and patient experience |

| AI-Supported Documentation | Maps clinical notes to billing codes | Ensures accurate charge capture and reduces denials |

| Predictive Analytics | Forecast revenue, identify trends | Enables proactive interventions and financial planning |

Why Automation Matters:

- Accuracy: Eliminates human error in charge capture, coding, and claim submission.

- Efficiency: Reduces staff workload, freeing resources for patient-facing activities.

- Revenue Optimization: Maximizes clean claims and accelerates collections.

- Patient Experience: Transparent statements and flexible digital payment options reduce friction.

Example: A medium-sized clinic integrated eligibility automation and claims scoring. Denials dropped by 35%, front-end collections increased by 20%, and staff spent 50% less time on manual reconciliation.

Key Takeaways

Modern RCM is no longer just about billing; it’s a strategic operational function. Organizations that rely on manual, fragmented processes risk lost revenue, operational inefficiency, and poor patient experience. By embracing automation, AI, and integrated workflows, healthcare organizations can:

- Ensure clean claims from pre-visit to final payment

- Deliver a frictionless patient financial experience

- Reduce administrative burden and errors

- Gain actionable insights through analytics and reporting

- Transform revenue capture into a predictable, high-performing system

The Complete Revenue Cycle Framework

Understanding the revenue cycle framework is essential for healthcare organizations aiming to optimize financial performance. From pre-visit preparation to post-visit claim processing and patient payments, each stage plays a critical role in maximizing revenue capture and minimizing denials.

Pre-Visit Revenue: The Foundation of Clean Claims

The pre-visit phase sets the stage for accurate, efficient billing. Errors or gaps here propagate downstream, causing denials, delayed payments, and administrative burden.

Key Activities:

- Eligibility Verification: Confirm coverage in real time to prevent claim denials.

- Co-Pay & Deductible Estimation: Provide patients with upfront cost expectations.

- Insurance Discovery: Identify primary, secondary, and tertiary payers automatically.

- Payment Expectations: Communicate financial obligations clearly to patients via statements or digital notifications.

Benefits:

- Reduces surprise balances and improves patient financial experience.

- Minimizes claim rejections due to coverage errors.

- Enhances front-end revenue capture and operational efficienc

During-Visit Revenue Capture

During the patient encounter, accurate documentation and charge capture are essential. This ensures that services rendered are fully billable and compliant.

Key Activities:

- Charge Capture: Record all billable services in real time.

- Coding Completeness: Map clinical documentation to correct billing codes.

- Clinical Documentation Readiness: Ensure SOAP notes, progress notes, and discharge summaries are billing-ready.

Benefits:

- Maximizes revenue for each encounter.

- Reduces post-visit corrections and denied claims.

- Improves workflow efficiency by avoiding redundant documentation.

Post-Visit Revenue Processing

After the visit, claims must be prepared, validated, submitted, and followed up for payment. Automated processes accelerate collection while reducing administrative effort.

Key Activities:

- Claim Creation: Generate accurate claims based on captured charges.

- Claim Scrubbing: Automatically check for errors, coding mismatches, or missing data.

- Submission & Adjudication: Transmit claims to payers, track status, and manage denials.

- Appeals & Follow-Up: Identify denied claims, analyze denial reason codes, and resubmit with corrections.

Benefits:

- Accelerates revenue capture and reduces days in A/R.

- Improves clean claim rates and reduces rework.

- Enhances staff productivity and reduces administrative burden.

| Post-Visit Activity | Automation Tool | Impact on Revenue Cycle |

|---|---|---|

| Claim Scrubbing | AI-powered validation | Reduces claim denials by 20–30% |

| Submission Tracking | Real-time dashboards | Improves visibility into payment status |

| Denial Management | Automated workflows | Speeds appeal resolution and recovers lost revenue |

| Payment Posting | Auto-reconciliation | Reduces manual entry errors and delays |

Patient Financial Experience as a Revenue Lever

Patient-facing financial tools are critical for collections, satisfaction, and revenue optimization. Modern RCM platforms integrate text-to-pay, digital statements, and AutoPay options.

Key Strategies:

- Text-to-Pay: Send secure payment links via SMS for faster collections.

- Transparent Statements: Provide clear, understandable bills.

- Reducing Friction: Allow partial payments, installments, and AutoPay setups.

- Patient Communication: Send automated reminders for co-pays, deductibles, or outstanding balances.

Benefits:

- Increases patient payment rates and reduces aging A/R.

- Enhances trust and satisfaction by minimizing surprise bills.

- Strengthens overall financial performance while improving the patient financial experience.

Key Takeaways

- Pre-visit preparation ensures eligibility, co-pay accuracy, and upfront communication.

- During-visit capture maximizes charge completeness, coding accuracy, and billing-ready documentation.

- Post-visit processing leverages claim scrubbing, denial management, and automated posting to accelerate collections.

- Patient financial experience tools like text-to-pay and AutoPay are revenue levers that directly impact payment timeliness and satisfaction.

By implementing a full-cycle RCM framework, healthcare organizations can reduce manual reconciliation, minimize administrative burden, and ensure consistent revenue capture across the entire patient journey.

How CERTIFY Health Transforms Revenue Cycle Management

Healthcare revenue cycles are complex. High claim denials, fragmented systems, and manual reconciliation waste staff time and reduce collections. CERTIFY Health transforms RCM by delivering a unified, AI-driven platform that integrates every step—from pre-visit eligibility to post-visit payments—with real-time visibility and automation.

Patient-Side Revenue Tools

Patient-side tools reduce financial surprises and accelerate front-end revenue capture.

Key Features:

- Real-Time Eligibility Checks: Verify coverage across multiple payers instantly.

- Insurance Discovery: Identify primary and secondary payers automatically.

- Automated Co-Pay & Deductible Estimation: Provide patients with upfront cost expectations.

- Smart Reminders: Appointment-linked payment prompts reduce missed collections.

Benefits:

- Fewer patient billing surprises.

- Higher front-end collections.

- Improved patient satisfaction and trust.

Example Workflow Chart:

Impact: Clinics report 25–30% higher upfront collections and reduced patient queries about financial obligations.

Patient Payments

CERTIFY Health makes patient payments frictionless with mobile-first and digital-first experiences.

Capabilities:

- Text-to-Pay: Secure SMS payment links for instant payment.

- Installments & AutoPay: Flexible options reduce patient friction and improve cash flow.

- Unified Patient Financial Ledger: Consolidates balances, payments, and outstanding claims.

- Digital Statements: One-click payment from web or mobile devices.

Benefits:

- Accelerates collections.

- Reduces aging accounts receivable.

- Enhances patient financial experience.

Bullet Highlights:

- 50% reduction in late payments with Text-to-Pay.

- 20–25% increase in patient satisfaction scores.

- AutoPay minimizes missed or delayed collections.

Back-Office Workflows

Back-office staff benefit from automation and AI-driven reconciliation, reducing errors and workload.

Key Workflows:

- Automated Daily Reconciliation: Matches payments to charges and insurance remittances.

- Payment Posting Suggestions: AI recommends correct allocations.

- Configurable Dunning Cycles: Automate reminders and escalation rules.

- Auto-Escalation Rules: Flag overdue accounts for additional follow-up.

Impact Table:

| Workflow | Manual Process | CERTIFY Health Automation | Outcome |

|---|---|---|---|

| Reconciliation | 3–5 hours/day | 15 minutes/day | 80% reduction in staff time |

| Payment Posting | Manual review | AI-suggested allocations | Accuracy improved 99% |

| Dunning | Manual letters/calls | Automated reminders + escalation | Reduced overdue accounts by 40% |

Billing & Claims

CERTIFY Health streamlines end-to-end claims management, reducing rejections and increasing clean claim rates.

Features:

- End-to-End Claims Automation: From creation to submission.

- Built-In Scrubbing: AI checks for coding, documentation, and eligibility errors.

- Real-Time Rejection/Denial Reason Codes: Instant alerts for actionable fixes.

- Auto-Repair Workflows: Correct errors automatically before resubmission.

- Plug-and-Play Integrations: Compatible with PMs, clearinghouses, and payers.

Benefits:

- Clean claim rates increase 20–35%.

- Denials resolved faster.

- Staff focus shifts from manual correction to higher-value tasks.

Analytics & Reporting

Data-driven insights are critical for revenue optimization. CERTIFY Health provides:

- Revenue Dashboards: Monitor collections, A/R aging, and front-end revenue capture.

- Denial Trends: Identify recurring issues and payer-specific patterns.

- Missed Revenue Opportunities: Highlight unbilled services or incomplete documentation.

- Revenue Forecasting: Predict revenue trends using historical and real-time data.

- Productivity Analytics: Track staff performance in reconciliation, posting, and appeals.

Example Chart: Denial Trend Analysis

| Month | Total Claims | Denials | Denial % |

|---|---|---|---|

| Jan 2025 | 12,000 | 1,800 | 15% |

| Feb 2025 | 11,500 | 1,400 | 12% |

| Mar 2025 | 12,500 | 1,250 | 10% |

| Apr 2025 | 12,300 | 1,100 | 9% |

- Actionable dashboards allow managers to address the root causes of denials.

- Revenue forecasting enables proactive staffing and workflow adjustments.

Documentation for Billing

Billing-ready documentation ensures accurate charge capture and reduces denials.

Features:

- Automatic mapping of clinical notes to billing codes.

- Prior authorization alerts triggered by diagnosis or orders.

- Audit-ready logs for compliance and regulatory reporting.

- Integration with charge capture tools to avoid missed revenue.

Benefits:

- Faster claim submission.

- Reduced manual corrections.

- Compliance assurance.

Merchant Infrastructure

CERTIFY Health provides a secure, compliant payment stack for patient financial transactions.

Capabilities:

- Gateway & Transaction Logs: Track all payments and settlements.

- Chargeback Monitoring: Automated detection and resolution workflows.

- Payout Timelines: Clear schedules for transfers and reconciliation.

- Unified Reporting: Consolidated view of all payment activity.

- Financial-Grade Encryption: HIPAA-compliant security for patient payments.

Impact:

- Eliminates financial processing errors.

- Protects sensitive patient data.

- Streamlines reporting for audits and compliance.

Key Takeaways

CERTIFY Health transforms RCM by unifying patient-side revenue tools, payments, back-office workflows, claims management, analytics, documentation, and merchant infrastructure.

Benefits Across the Organization:

- Higher clean claim rates and revenue capture

- Reduced administrative burden and manual reconciliation

- Improved patient satisfaction and financial experience

- Predictable, data-driven revenue forecasting

- Secure, compliant, and transparent financial operations

Comparing Modern RCM Approaches in Healthcare

Healthcare organizations face critical decisions when choosing how to manage revenue cycles. Manual processes, legacy PM/EHR billing, and modern RCM platforms each deliver very different outcomes. Understanding the differences, benefits, and hidden costs is key to optimizing revenue capture, reducing denials, and improving patient financial experience.

Manual Billing vs. Automated Billing Systems

Manual billing relies on spreadsheets, paper forms, and human intervention for every step—eligibility checks, charge entry, claim submission, and reconciliation.

Challenges of Manual Billing:

- High administrative burden and repetitive tasks

- Increased errors and claim denials

- Delayed payments and extended days in A/R

- Poor visibility into revenue trends and productivity

- Limited patient payment options and friction-prone processes

Benefits of Automated Billing Systems:

- AI-assisted claim scrubbing and denial detection

- Real-time eligibility checks and coverage verification

- Automated patient reminders, text-to-pay, and AutoPay

- Centralized dashboards for revenue, denials, and productivity

Impact Table: Manual vs. Automated Billing

| Metric | Manual Billing | Automated Billing | Improvement |

|---|---|---|---|

| Claim Denials | 20–30% | 8–12% | 60–70% reduction |

| Days in A/R | 45–60 days | 20–25 days | 50% faster collections |

| Staff Hours per Day | 4–6 hours | 1–2 hours | 60–70% reduction |

| Patient Payment Compliance | 65–70% | 90–95% | 25% improvement |

Legacy PM/EHR Billing vs. Dedicated RCM Platforms

Many organizations rely on legacy PM/EHR billing modules, which are often fragmented and lack advanced automation.

Limitations of Legacy Systems:

- Poor integration across patient scheduling, documentation, and billing

- No AI-driven claim scrubbing or denial reason insights

- Limited support for patient payment options or flexible workflows

- Fragmented reporting and limited analytics

Advantages of Dedicated RCM Platforms:

- End-to-end automation from pre-visit to post-payment

- Real-time dashboards for revenue forecasting, denial trends, and productivity

- Integration with digital payment solutions (text-to-pay, AutoPay, installment plans)

- AI-assisted clinical documentation mapping for accurate charge capture

Comparison Chart: Legacy vs. Dedicated RCM

Legacy PM / EHR Billing

- Limited automation

- Fragmented workflows

- Delayed visibility

- Manual reconciliation

Dedicated RCM Platform

- Automated eligibility & claims

- Integrated workflows

- Real-time dashboards

- Faster reconciliation & collections

Why Clean Claims Start Before the Visit

Upfront eligibility verification, co-pay estimation, and insurance discovery are critical. Organizations that ignore pre-visit prep face:

- High rejection rates due to coverage issues

- Delayed collections and patient dissatisfaction

- Increased administrative workload for corrections and follow-ups

Bullet Highlights for Clean Claims:

- Verify eligibility in real time across multiple payers

- Estimate patient responsibility before the visit

- Communicate payment expectations clearly

- Automate pre-authorization alerts if needed

Impact: Clinics implementing pre-visit automation see 20–30% reduction in denials and faster A/R turnover.

Why Interoperability Is the Hidden RCM Accelerator

Many RCM inefficiencies stem from fragmented systems. Integrating scheduling, documentation, billing, and payment systems unlocks efficiency:

- Real-Time Data Flow: No delays in charge capture, claim submission, or payment posting.

- Unified Patient Records: Ensures clinical documentation maps correctly to billing codes.

- Automated Alerts: Detects missing documentation, coding errors, and denied claims instantly.

- Revenue Insights: Consolidated dashboards enable forecasting, productivity tracking, and identification of missed revenue opportunities.

Example Table: Impact of Interoperability on Key Metrics

| Metric | Fragmented System | Interoperable RCM | Improvement |

|---|---|---|---|

| Claim Denials | 25% | 10% | 60% reduction |

| A/R Days | 50 | 23 | 54% faster |

| Manual Reconciliation Time | 4–6 hrs/day | 1–2 hrs/day | 60–70% reduction |

| Patient Satisfaction (Financial Experience) | 70% | 92% | 22% improvement |

Key Takeaways

- Manual billing creates inefficiency, errors, and delayed revenue.

- Legacy PM/EHR billing modules provide limited automation and fragmented workflows.

- Dedicated RCM platforms deliver end-to-end automation, AI-powered documentation, and patient-friendly payment options.

- Pre-visit preparation (eligibility, co-pay estimation, insurance discovery) is crucial for clean claims.

- Interoperability across scheduling, documentation, billing, and payments accelerates collections and reduces administrative burden.

Conclusion: Modern RCM requires automation, AI, and interoperability at every stage. Organizations adopting these approaches unlock predictable revenue, reduce denials, and improve patient satisfaction.

Use Cases & Real-World Impact

Modern revenue cycle management platforms like CERTIFY Health are transforming financial operations across hospitals, clinics, specialty practices, and back-office teams. By integrating automation, AI, and patient-centric payment solutions, organizations unlock efficiencies, reduce denials, and improve collections.

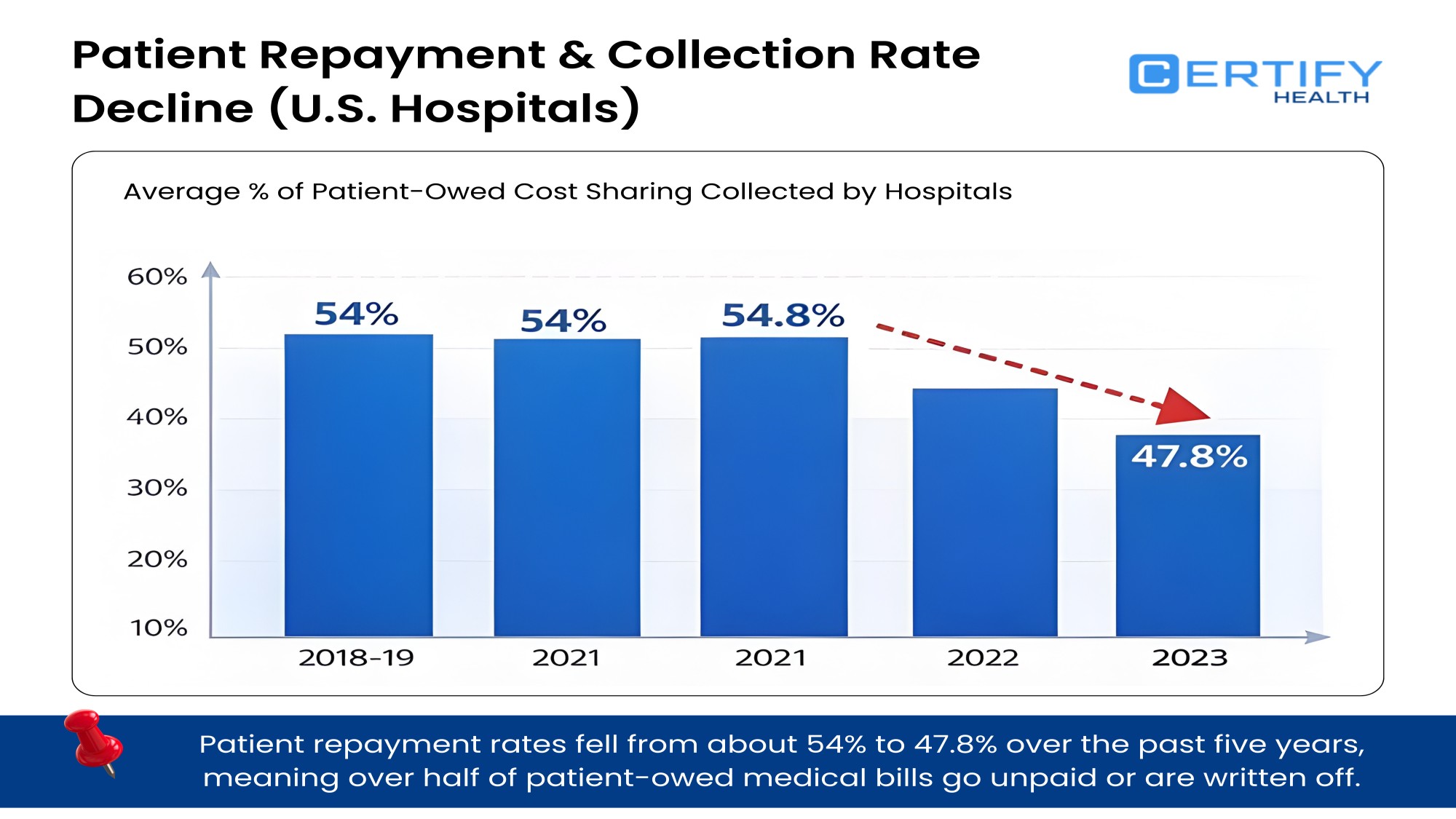

For Hospitals

Hospitals face high patient volume, complex billing, and staffing shortages. Manual processes increase denials, slow collections, and strain staff. CERTIFY Health helps hospitals:

- Automate eligibility verification and co-pay estimation for thousands of patients daily

- Reduce claim denials with AI-assisted claim scrubbing and real-time rejection alerts

- Accelerate collections through integrated patient payment tools like Text-to-Pay and AutoPay

- Consolidate dashboards for revenue forecasting, productivity tracking, and denial trends

Impact: Hospitals see up to 30% faster collections, reduced A/R, and improved staff efficiency, allowing clinicians to focus more on patient care.

For Clinics & MSOs

Clinics and multi-site organizations (MSOs) often struggle with scalable workflows and profitability. Fragmented systems and manual reconciliation create bottlenecks. CERTIFY Health provides:

- Pre-visit insurance discovery and automated eligibility checks to prevent claim denials

- Seamless charge capture and clinical documentation mapping to ensure accurate billing

- Digital patient payments with installment plans for enhanced financial engagement

- Real-time dashboards for revenue performance and operational visibility

Impact: Clinics report 25–35% improvement in clean claims and consistent revenue capture across multiple locations, with reduced administrative overhead.

For Specialty Practices

Specialty practices face coding complexity, high-value claims, and frequent prior authorizations. Errors or delays can lead to significant lost revenue. CERTIFY Health helps specialty practices:

- Auto-generate charge-ready documentation based on clinical notes

- Trigger prior authorization alerts to prevent delayed approvals

- Use AI-assisted claim scrubbing to catch coding or documentation gaps

- Streamline patient financial experience with upfront co-pay estimation and digital payments

Impact: Specialty practices experience fewer denials, faster revenue realization, and improved patient satisfaction, particularly in high-value service lines.

For Back-Office Teams

Back-office teams handle payment posting, reconciliation, denials management, and reporting. Manual processes are time-consuming and error-prone. CERTIFY Health enables:

- Automated daily reconciliation of payments and remittances

- AI-suggested posting for faster and more accurate payment allocation

- Configurable dunning cycles and auto-escalation for overdue accounts

- Centralized analytics to identify missed revenue opportunities and productivity trends

Impact: Back-office teams spend less time on repetitive tasks, reduce errors, and have clear visibility into the full revenue cycle, enabling proactive revenue recovery.

How CERTIFY Health Delivers Complete Revenue Transformation

Healthcare organizations need more than isolated billing or payment tools—they require a complete, unified RCM platform that integrates every revenue touchpoint. CERTIFY Health provides this by combining automation, AI, analytics, and secure infrastructure into a single platform, delivering predictable financial outcomes and a superior patient financial experience.

Unified Platform from Pre-Claim to Final Payment

CERTIFY Health covers the entire revenue cycle from pre-visit eligibility checks to final payment posting, ensuring no revenue is left uncollected.

Key Capabilities:

- Pre-visit insurance discovery and eligibility verification

- Automated co-pay and deductible estimation

- Charge capture, clinical documentation mapping, and claim creation

- Digital patient payments, installment plans, and AutoPay options

- Automated claim scrubbing, submission, and denial management

- Payment posting, reconciliation, and reporting

Impact: Healthcare organizations experience clean claims, faster collections, and reduced administrative burden.

AI-Enhanced Billing Workflows

AI drives accuracy, efficiency, and revenue optimization. CERTIFY Health’s AI tools include:

- Claims Scrubbing & Scoring: Detect errors before submission, reducing denials

- Charge Mapping: Converts clinical documentation into accurate billable codes

- Prior Authorization Alerts: Ensures approvals are obtained proactively

- Predictive Denial Analytics: Highlights claims at risk of rejection

AI Workflow Impact

| Workflow | Manual Approach | AI-Enhanced | Result |

|---|---|---|---|

| Claim Scrubbing | Staff reviews manually | AI detects errors pre-submission | 60–70% fewer denials |

| Charge Capture | Manual mapping | Auto-generated from documentation | 95%+ accuracy |

| Prior Auth Alerts | Reactive follow-up | Automated real-time alerts | 80% faster approvals |

Integrated Payments + Merchant Infrastructure

CERTIFY Health provides a secure, compliant, and flexible payment infrastructure.

Features:

- Mobile-first Text-to-Pay, digital statements, and AutoPay

- Unified ledger for patient balances, payments, and adjustments

- Transaction logs and reporting for reconciliation

- Chargeback monitoring and payout schedules

- Financial-grade encryption compliant with HIPAA standards

Benefits:

- Faster patient collections

- Reduced errors in reconciliation

- Transparent, audit-ready financial reporting

Predictive Revenue Intelligence (Analytics + Forecasting)

CERTIFY Health provides real-time dashboards and forecasting tools for actionable insights.

Analytics Features:

- Revenue dashboards tracking collections, A/R, and denials

- Trend analysis for payer performance and denial reasons

- Missed revenue detection and revenue capture optimization

- Predictive forecasting for cash flow planning and staffing

Impact Example: A multi-location clinic used CERTIFY Health analytics to identify $150K in missed revenue from unbilled procedures, recovered within one month.

Security, Compliance & Healthcare-Grade Infrastructure

CERTIFY Health ensures regulatory compliance and robust security across the revenue cycle.

- Role-based access and audit trails for every transaction

- HIPAA-compliant storage and encrypted communications

- Interoperability with HL7 and FHIR standards for secure data exchange

- Compliance-ready reporting for audits and regulatory reviews

Key Takeaways:

- Unified workflows ensure no revenue leaks from pre-visit to final payment

- AI-enhanced documentation and claim workflows minimize denials

- Integrated payments improve patient financial experience and collection rates

- Analytics provide visibility for strategic decision-making and revenue forecasting

- Secure infrastructure ensures regulatory compliance and audit readiness

Why CERTIFY Health?

- Provides end-to-end RCM automation without switching systems

- Delivers predictable, scalable revenue performance

- Enhances patient satisfaction through transparent billing and flexible payments

- Reduces administrative workload, freeing staff for higher-value tasks

- Offers actionable insights to drive continuous improvement

Healthcare organizations that adopt CERTIFY Health achieve clean claims, faster collections, and operational efficiency across all revenue cycle functions.

Implementation Framework

Successfully deploying a modern revenue cycle management (RCM) platform requires careful planning, structured onboarding, and measurable success metrics. CERTIFY Health follows a proven implementation framework that ensures rapid adoption, minimal disruption, and immediate ROI.

1. Timeline & Onboarding

A typical implementation follows a structured phase-based timeline:

Phase 1: Discovery & Requirements Gathering (Weeks 1–2)

- Assess current workflows, pain points, and system gaps

- Identify critical revenue bottlenecks and integration requirements

Phase 2: Workflow Mapping & Configuration (Weeks 3–6)

- Configure eligibility verification, patient payment tools, claims automation

- Map clinical documentation to billing codes for seamless charge capture

Phase 3: Data Migration & System Integration (Weeks 7–9)

- Migrate patient records, payment history, and transaction logs

- Integrate with PM/EHR systems, clearinghouses, and payer portals

Phase 4: Training & Adoption (Weeks 10–12)

- Role-based training for front-office, clinical, and back-office teams

- Hands-on sessions for patient-side tools, claim management, and dashboards

Phase 5: Go-Live & Optimization (Week 13+)

- Monitor performance metrics, fine-tune workflows, and resolve adoption issues

- Continuous support and updates for long-term optimization

2. Role-Based Training

CERTIFY Health emphasizes training by role to ensure all users maximize platform value:

- Front Desk Staff: Appointment-linked eligibility checks, co-pay collection, text-to-pay reminders

- Clinical Staff: Charge capture, clinical documentation mapping, prior authorization alerts

- Back-Office Teams: Automated reconciliation, claim scrubbing, denial management, reporting

- Managers & Executives: Revenue dashboards, productivity metrics, forecasting insights

3. Immediate ROI Points

Organizations typically see fast, measurable improvements after implementation:

- Reduced claim denials by 20–35%

- Faster collections with integrated patient payments

- 50–70% reduction in manual reconciliation and administrative burden

- Enhanced patient financial satisfaction and transparency

- Actionable insights from real-time dashboards for proactive revenue management

Key Takeaways:

A structured implementation framework, combined with role-based training and system integration, ensures healthcare organizations quickly realize the benefits of CERTIFY Health. From clean claims and faster collections to predictive revenue insights, the platform transforms revenue cycle management into a scalable, high-performing process.

Conclusion & CTA: Transform Your Revenue Cycle Today

Modern revenue cycle management (RCM) is no longer optional—it’s a strategic imperative for healthcare organizations. Fragmented systems, manual reconciliation, claim denials, and delayed patient payments not only reduce revenue but also erode patient trust and staff productivity.

CERTIFY Health delivers a unified, AI-powered RCM platform that covers the entire revenue cycle, from pre-visit eligibility to final payment posting. Organizations using CERTIFY Health experience:

- Fewer claim denials and faster claim resolution

- Accelerated patient collections with Text-to-Pay, AutoPay, and digital statements

- Reduced administrative burden through automated reconciliation and workflow management

- Actionable insights from dashboards, predictive analytics, and denial trend monitoring

- Enhanced patient financial experience and satisfaction

Why act now?

The longer revenue cycle inefficiencies persist, the more revenue is lost, and staff frustration increases. CERTIFY Health provides a proven, scalable solution that not only recovers lost revenue but also transforms your operational efficiency.

Next Steps – Take Control of Your Revenue Cycle:

- Request a Live Demo: See the platform in action and understand how it integrates with your workflows

- Get Pricing: Explore flexible options tailored to your organization size and specialty

- Download the RCM Buyer’s Guide: Learn the essential features and evaluation criteria for modern revenue cycle platforms

- Talk to a Revenue Cycle Expert: Get personalized recommendations for workflow optimization and revenue maximization

“Streamline billing. Reduce denials. Accelerate collections. Deliver a seamless patient financial experience.”

By taking action today, your organization can eliminate workflow friction, optimize revenue capture, and enhance patient satisfaction—all with a single, intelligent platform.