Table of Contents

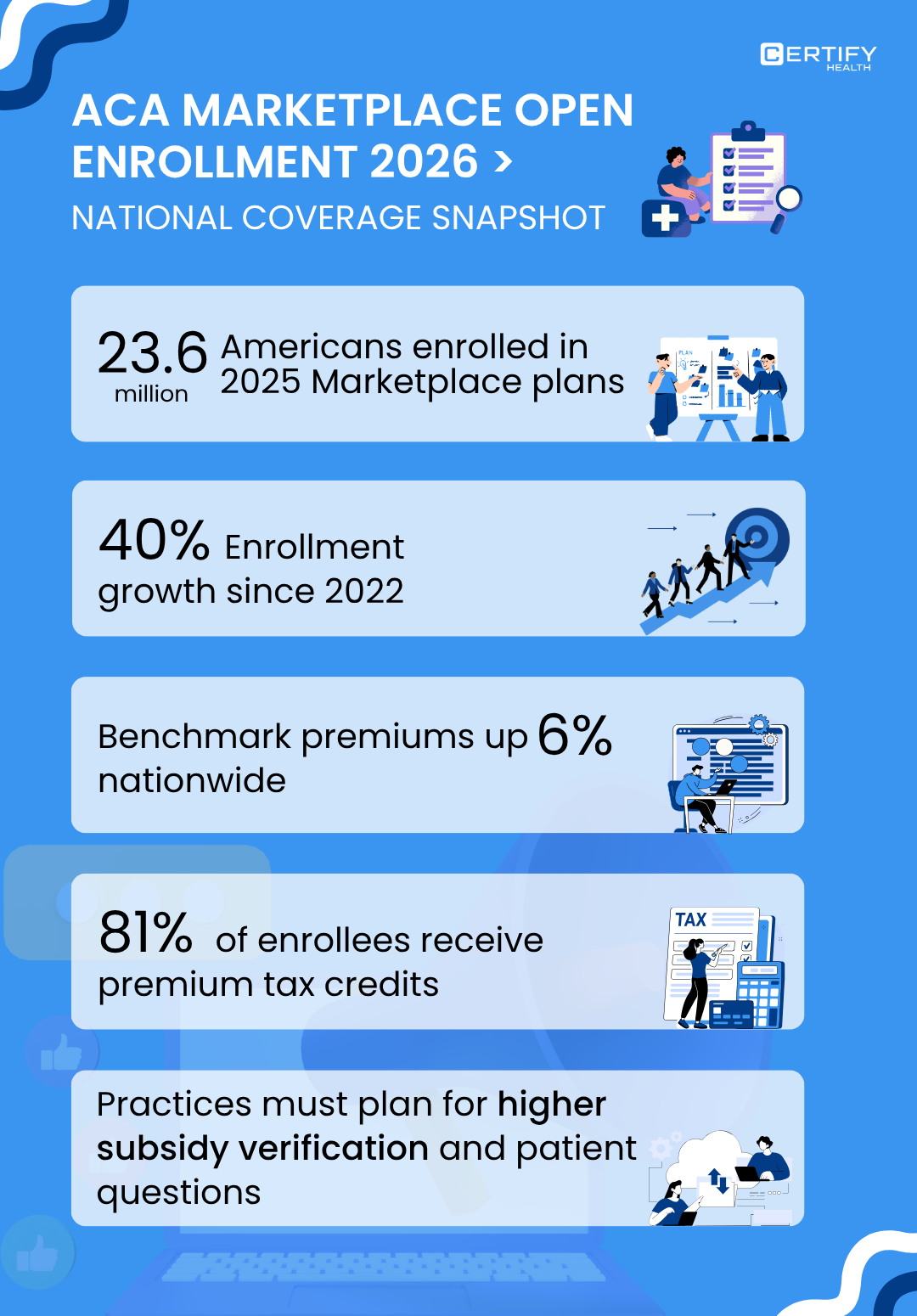

Introduction: ACA Marketplace Open Enrollment (OE) 2025 - 2026

The ACA Marketplace Open Enrollment (OE) isn’t just another administrative season; it’s a financial and operational checkpoint for practice leaders.

From November 1, 2025, to January 15, 2026, is the period for millions of Americans to re-enroll or join Marketplace plans.

Miss that window, and coverage cannot be claimed unless there’s a qualifying life event like a job change or pregnancy. Here’s the headline: 23.6 million Americans selected Marketplace plans for 2025. That’s a 63% jump from 2022, and double the 11.6 million in 2021.

That’s strong growth.

But underneath the good news are the looming affordability cliffs, new tax penalties, reduced enrollment flexibility, that could lead practices to face:

- Drop-offs in insured patients

- Increased uncompensated care

- Revenue instability during 2026

What is The ACA Marketplace?

Marketplaces are a part of the Affordable Care Act. These marketplaces let individuals compare standardized health plans and access federal subsidies.

Two key policy levers every practice leader should track:

1. Premium Tax Credits (PTCs):

Designed to lower premium costs for low- and middle-income enrollees.

Over 90% of Marketplace users currently rely on these credits.

2. Preventive Care Mandate:

Requires plans to cover all USPSTF (U.S. Preventive Services Task Force): “A/B” preventive services (screenings and immunizations) with zero cost-sharing.

ACA open Enrollment Marketplace 2026: 3 Critical Policy Shifts

1. The Affordability Cliff

The biggest threat is the expiration of Enhanced Premium Tax Credits (EPTCs).

What are EPTCs?

EPTCs are temporary subsidies that kept coverage that capped Marketplace premiums at a maximum of 8.5% of household income for a standard Silver plan.

For many lower-income enrollees, coverage was effectively free.

Impact: This policy helped nearly 23 million Americans gain subsidized coverage.

What’s changing: The enhanced credits expire on December 31, 2025.

That means in 2026:

- Subsidized premiums could jump by as much as 114% for affected enrollees.

- Millions risk losing affordable coverage.

- Practices will see more uninsured patients translating to higher bad debt and uncompensated care.

2. Marketplace Integrity & New Tax Penalties

New federal rules increase financial liability for patients who inaccurately report their income.

Full Repayment of APTC: The law eliminating caps on repaying excess Advance Premium Tax Credits (APTCs) takes effect.

What is Advance Premium Tax Credit (APTC):

Think of the APTC as an advance loan from the federal government to help you pay your health insurance premiums every month under the ACA Marketplace.

It’s a tax credit paid in advance based on your estimated annual income.

Starting in 2026, all taxpayers must repay the full amount of any excess APTC received, regardless of income. This significantly raises the risk for patients with fluctuating income.

The Old Rule: The Repayment Cap (Before 2026)

Under the current system (up to 2025), if your income ended up being higher than estimated, the IRS limited how much of your excess APTC you had to repay.

- The maximum repayment cap was $1,575 of FPL (for most middle-income households).

- This cap protected many lower- and middle-income families from large surprise tax bills.

Example:

You estimated your income as $35,000 and received $500 per month in subsidies ($6,000 total for the year).

But you actually earned more (say, $50,000) which means you qualified for a smaller subsidy. Instead of repaying all $6,000, you only had to repay up to $1,575 under the old rule.

Here’s the critical APTC policy change:

Beginning in tax year 2026, the repayment cap is eliminated.

That means:

- If you underestimate your income and receive too much subsidy,

- You’ll have to repay the full excess amount, no matter how large it is.

Using the same example:

- $500/month subsidy = $6,000 per year

- Under new rules, you must repay the entire $6,000 if you earned more than your estimated income.

There’s no upper limit; the government will reconcile every dollar of excess APTC at tax time.

Who’s Most at Risk?

Full Repayment of APTC rule mainly affects:

- Gig workers

- Freelancers

- Self-employed individuals

- Anyone with fluctuating income

If your earnings change mid-year and you don’t promptly update your income on the Marketplace, you could face a hefty repayment bill come tax season.

For healthcare practices, this change matters because coverage volatility increases:

- More patients may lose coverage mid-year due to repayment shocks.

- Practices may see rising self-pay balances and bad debt risk.

3. Reduced Enrollment Flexibility

The ACA Marketplace Open Enrollment (OE) is the main window for individuals to get or modify health insurance coverage for the upcoming year.

For 2026 coverage, that window runs from November 1, 2025, to January 15, 2026.

Individuals who miss it will not be eligible to get insurance.

Unless, of course, you qualify for an exception.

The Exception: Special Enrollment Periods (SEP)

Special Enrollment Periods (SEPs) act as “emergency windows” allowing people to enroll outside the standard OE period.

You can benefit from SEP if you experience a Qualifying Life Event. (QLE)

What is a Qualifying Life Event (QLE)?

Some examples include the following:

- Losing employer or Marketplace coverage

- Getting married or divorced

- Having or adopting a child

- Moving to a new state

- Major household income change

These events allow a short period (typically 60 days) to adjust or obtain coverage.

The Policy Change: Loss of the Low-Income SEP

Here’s where 2026 brings a significant shift.

Under prior rules, low-income individuals (earning up to 150% of the Federal Poverty Level) had year-round SEP access.

That meant flexible enrollment for those whose income fluctuated, a lifeline especially for gig workers and hourly earners. Starting in 2026, this flexibility is gone.

The new rule:

- Eliminates the year-round SEP for low-income individuals.

- Restricts Marketplace enrollment strictly to the standard OE window unless a formal QLE occurs.

Why It Matters

This policy change reduces insurance flexibility for millions:

- Low-income workers who rely on unstable or seasonal jobs lose on-demand coverage.

- Missed updates could mean months without insurance, leading to delayed care and higher uncompensated treatment rates for providers.

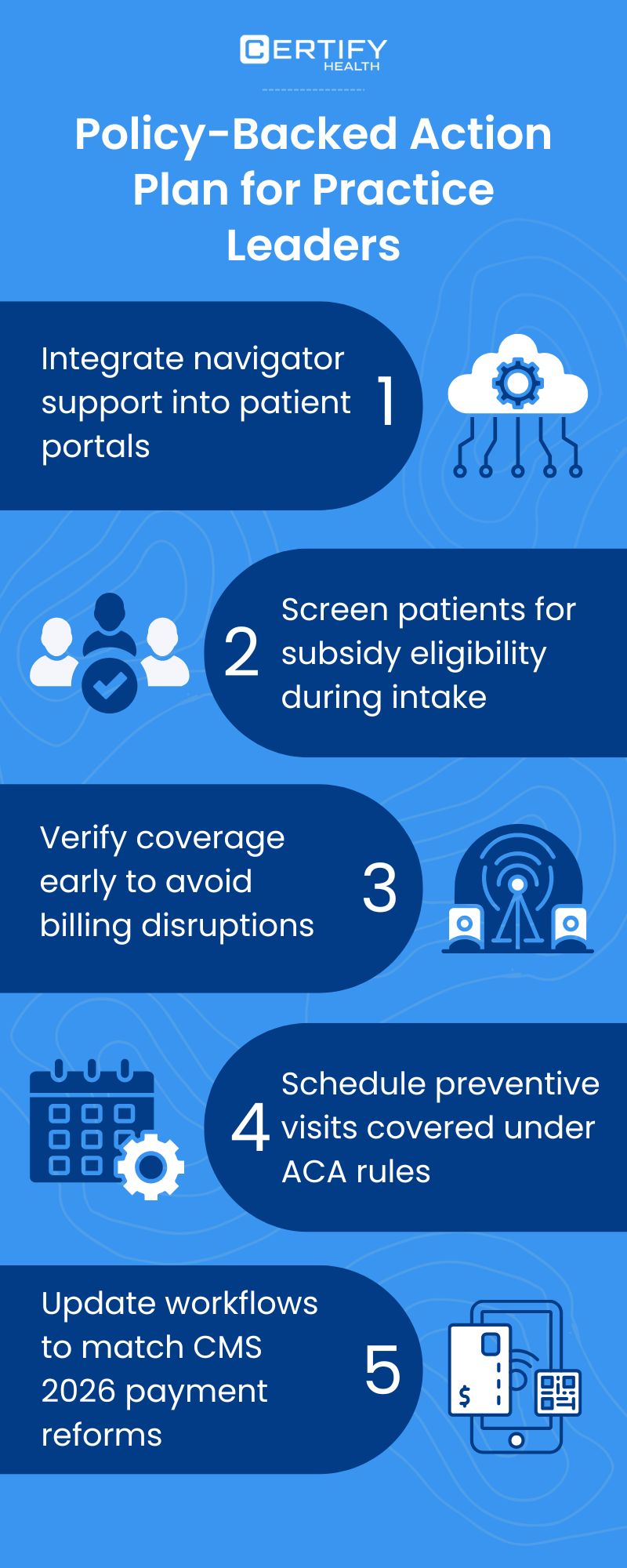

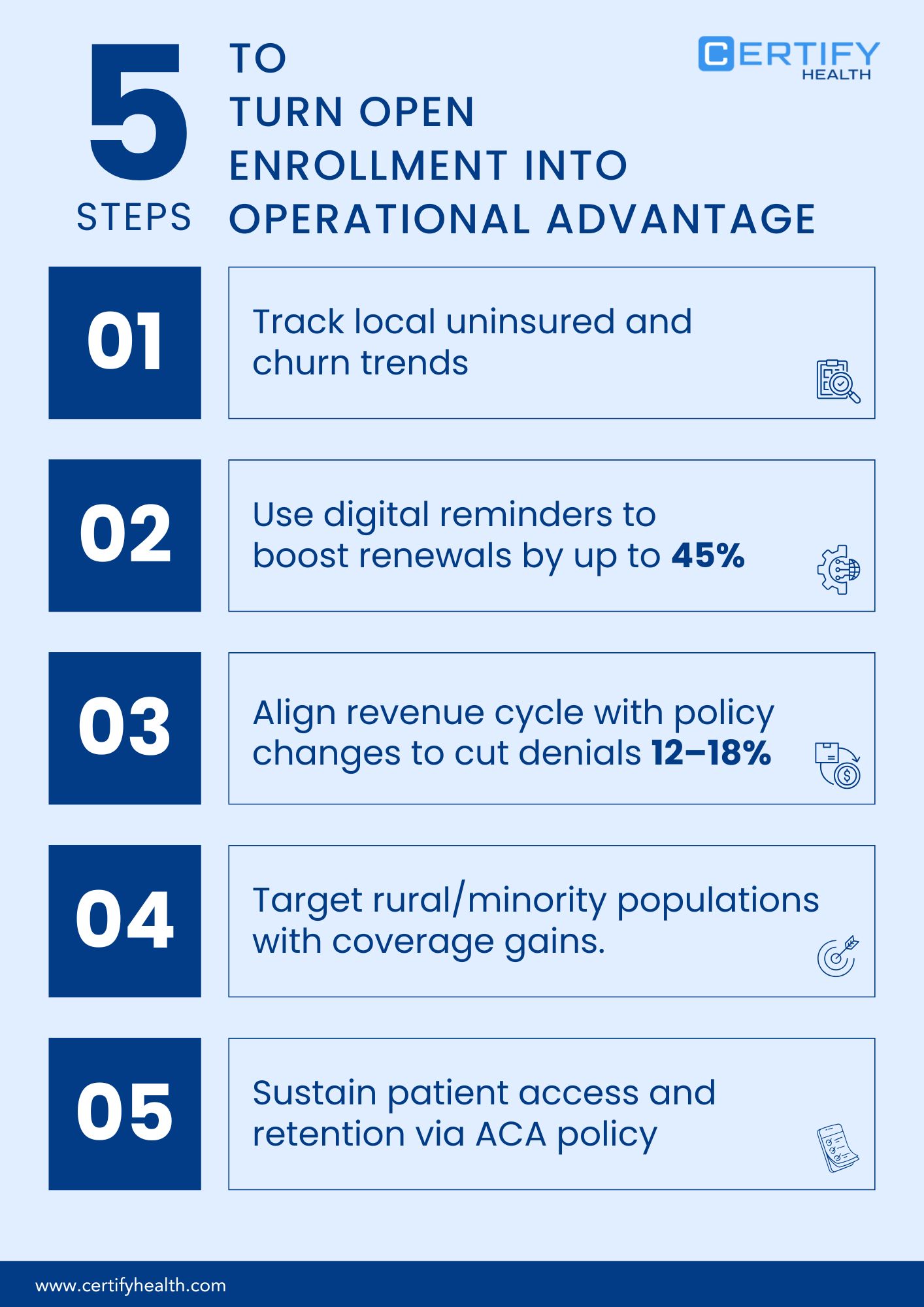

ACA 2026 Readiness Playbook: Unified Action Plan for Practice Leaders

Three converging policy shifts are reshaping the ACA landscape for 2026:

The Affordability Cliff, Marketplace Integrity Rules & New Tax Penalties, and Reduced Enrollment Flexibility.

Together, they threaten patient coverage stability, practice revenue, and care continuity.

The below playbook merges all three into a research-backed, action-oriented plan that practice leaders can deploy immediately.

| Priority Area | Key Actions | Outcomes |

|---|---|---|

| Audit and Forecast Financial Risk | • Review 2025 billing data to identify % of Marketplace-covered patients. • Simulate subsidy-loss impact on cash flow. • Track payer-mix shifts quarterly. |

Establishes your uncompensated care baseline and helps forecast subsidy-dependent revenue exposure. Kaiser Family Foundation reports that enrollment in the Marketplaces grew by 113% from 2020 to 2025, indicating a vastly larger volume of subsidy-dependent lives. |

| Strengthen Navigator Partnerships | • Integrate certified Marketplace Navigators or brokers. • One part-time navigator can handle 100-200 patients. • Link navigators directly in your patient portal. |

Practices with strong navigator support improve enrollment completion and renewals. For instance, Centers for Medicare & Medicaid Services reports ~3.9 million new consumers selected a Marketplace plan for 2025. (CMS) |

| Proactive Patient Education | • Run SMS/email campaigns explaining: EPTC expiration - new APTC repayment rules - enrollment deadlines. • Add Medicaid/state assistance info for alternatives. |

Fewer surprises = lower coverage churn. Marketplace enrollment reached ~24.2 million for 2025, indicating large scale of subsidized lives where education matters. |

| Deploy Real-Time Eligibility Verification | • Check Marketplace and Medicaid eligibility prior to treatment. • Flag patients with pending subsidy or coverage loss. • Re-verify during income changes or mid-year job shifts. |

Prevents downstream billing errors and reduces uncompensated visits. Research shows typical claim denial rates are around 5-10%, which can improve after automating workflows. |

| Collect Payments Upfront | • Offer pre-checkout and installment options. • Use transparent pricing tools. • Train front-desk to identify high-risk patients. • With CERTIFY Health’s CERTIFY Pay , an omnichannel payment gateway platform, streamline collections with better payment options. |

Practices adopting upfront collection with CERTIFY Pay enable the collection of pre-payments, installments, and reduced bad debt. CERTIFY Pay uses PCI-DSS compliance, tokenization, and real-time fraud detection to safeguard every transaction. For context: industry denial rate averages ~11.8% in 2024. |

| Train and Equip Staff | • Train teams to explain OE and SEP timelines. • Provide a coverage-resource kit including: Healthcare Local Help 211 Org Medicaid |

Ensures consistent patient communication and faster referrals to aid programs. CMS new rules aim for 75% of SEP enrollments to receive pre-verification for 2026. |

| Automate and Optimize the Revenue Cycle | • Use automation for prior-authorization and claims tracking. • Standardize eligibility checks and denial workflows. • Monitor rejected claims by coverage category. |

Streamlines operations and cuts claim denials. Revenue-cycle study shows denial rates typically ~5-10% and automation can reduce this. |

By putting these actions in play now, you position your practice to absorb the 2026 ACA policy shift without disrupting patients or destabilizing your revenue.

2026 ACA OE Risk Prevention Checklist: via CERTIFY Health

Explore this checklist from CERTIFY Health and see how, at every pressure point in the ACA cycle, the platform helps you clear bottlenecks before they become operational failures.

| Risk Area | Indicators to Watch | Prevention Plan via CERTIFY Health |

|---|---|---|

| Subsidy expiration (Affordability Cliff) | Drop in insured patient volume | Uses the Communication & Reminders & Nudges module to send scheduled outreach campaigns (texts/emails) for Marketplace-plan patients. Integrates with the Registration & Intake → Eligibility & Coverage feature to flag and monitor coverage risk. |

| APTC repayment exposure | Mid-year income jumps | The Eligibility & Coverage (real-time eligibility, re-verification workflows) feature identifies coverage or subsidy mismatches. Automation prompts staff for follow-up using the Patient Experience Platform → Digital Intake & Insurance Capture tools. |

| Lost SEP flexibility | Patients missing OE window | Leverages the Reminders & Nudges + Two-Way Messaging / Patient Campaigns capabilities to deliver enrollment-window alerts; Front-desk workflows supported by Practice Management System → Alerts keep staff aware of upcoming deadlines. |

When you’re ready, a quick call with our sales team or a short demo will show how smoothly everything goes together and how transformative it can be for your practice.

Implementation Play for Q4 2025

- August–September: Run billing audit and patient segmentation.

- October: Train staff and update patient communication scripts.

- November–January: Deploy navigator-supported OE outreach.

- February 2026: Review coverage lapse trends and adjust financial forecasting.

Conclusion

The 2026 ACA transition will reward prepared, data-driven practices, and penalize those that are not.

By auditing financial exposure, building navigator capacity, tightening revenue operations, and strengthening patient communication, leaders can protect both care access and fiscal stability amid the policy pivot.

Visit CERTIFY Health to learn more about how you can prepare your practices for the ACA Open Enrollment 2026.