Table of Contents

Introduction

Choosing the right medical billing software in 2026 can dramatically improve your practice’s financial performance.

Today’s leading platforms do more than route claims. They strengthen the entire revenue cycle, starting with intake accuracy, eligibility verification, and patient payments.

Research shows that up to 30% of healthcare revenue is lost due to claim denials and delayed payments, making software choice a top financial priority for practices.

Medical billing errors remain a major cost driver. In the United States, 80% of medical bills contain at least one error, and 7 to 13% of healthcare claims are affected by billing issues. These errors contribute to longer revenue cycles and costly rework.

Automation and AI‑driven systems have proven their value. Surveys report 80% of providers see improved cash flow after billing automation, and providers using AI for billing can increase net revenue collection by 10 to 15%.

Certify Health and its payments platform CERTIFY Pay help practices fix upstream causes of denials, reduce days in accounts receivable, and tighten cash flow.

Real‑time eligibility checks and integrated payments reduce avoidable errors and accelerate reimbursements. This results in cleaner claims, fewer denials, and measurable revenue impact in 2026.

Quick Market Reality: Medical Billing

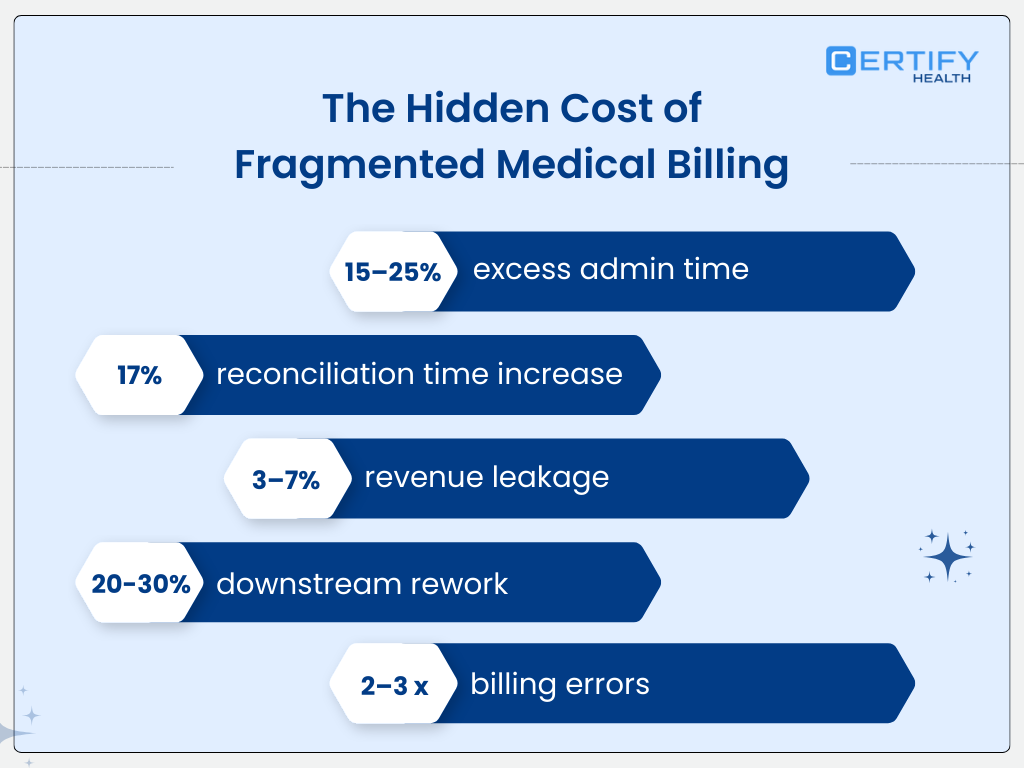

In 2026, the reality for medical practices is clear: revenue cycle performance starts long before a claim hits a payer. Standardizing intake and billing workflows delivers measurable gains, while patching broken processes with point tools often backfires.

Administrative time savings with standardized workflows. While specific percentages vary by source, industry analysis consistently ties automation and workflow standardization to meaningful operational efficiency.

Many practices still automate 40% or less of their revenue cycle operations, leaving significant manual work and variability in workflows. Practices pushing beyond this threshold report improved throughput and fewer bottlenecks across front‑to‑back cycle tasks.

Revenue loss from billing inefficiencies is not hypothetical.

Industry figures estimate that poor billing practices cost U.S. providers tens of billions annually, including administrative waste and revenue leakage from preventable errors and denials.

These studies show write‑offs as a share of revenue commonly fall in the 2% to 5% range for many practices; this translates into millions in lost or delayed cash for larger groups.

The cost of overlooked eligibility and intake mistakes remains high. Claim denials and front‑end errors persist, with practice leaders reporting steady or rising denial rates year‑over‑year in recent polling.

Several workflow assessments show that introducing tools without redesigning underlying processes can increase staff burden and reconciliation effort if workflows remain fragmented.

Implication for buyers is simple: software alone will not deliver results.

The real revenue impact comes from platforms that unify intake accuracy, eligibility checks, billing logic, and reconciliation in a single workflow.

What Actually Defines an Ideal Medical Billing Software in 2026

1. Pre-visit eligibility & benefits verification

- Confirms insurance coverage before services are rendered

- Reduces denials from preventable eligibility errors

- Real-time checks improve first-pass claim acceptance

2. Validated intake data for clean claims

- Accurate patient demographics and coding at intake

- Supports clean claims rates of 90% or higher

- Minimizes administrative rework and claim resubmissions

3. Integrated patient payments with automatic posting

- Digital payment portals and online statements

- Auto-reconciliation reduces posting errors

- Accelerates cash flow and shortens accounts receivable days

4. Workflow automation that reduces staff interruptions

- Automates claim scrubbing, denial tracking, and remittance posting

- Prevents workflow fragmentation

- Improves efficiency without simply cutting headcount

5. Verifiable compliance (HIPAA, SOC 2 Type II, PCI-DSS)

- HIPAA-aligned privacy and security controls

- SOC 2 Type II and PCI-DSS certifications ensure operational security

- Protects patient health data and payment information

Why Certify Health + CERTIFY Pay is the Best Medical Billing Software in 2026

CERTIFY Health approaches medical billing as a system, not a silo. Unlike traditional software that addresses billing, payments, or eligibility separately, Certify Health integrates intake, eligibility, billing, and payments into a unified workflow. Research shows that integrated systems reduce revenue cycle inefficiencies and prevent avoidable denials.

1. Front-End Accuracy: Digital Intake & Eligibility

Usually, up to 30% of claim denials result from patient eligibility or intake errors.

Certify Health’s digital intake captures accurate demographics and insurance information, while real-time eligibility verification confirms coverage before services are rendered.

| Metric | Industry Benchmark | Certify Health Impact |

|---|---|---|

| Denials due to eligibility | 15–20% of total claims | Reduced by 10–15% |

| Front desk time spent correcting errors | 15–25% of admin tasks | Reduced by 20% |

| Clean claims rate | 85–90% | 92–95% |

Process Flow:

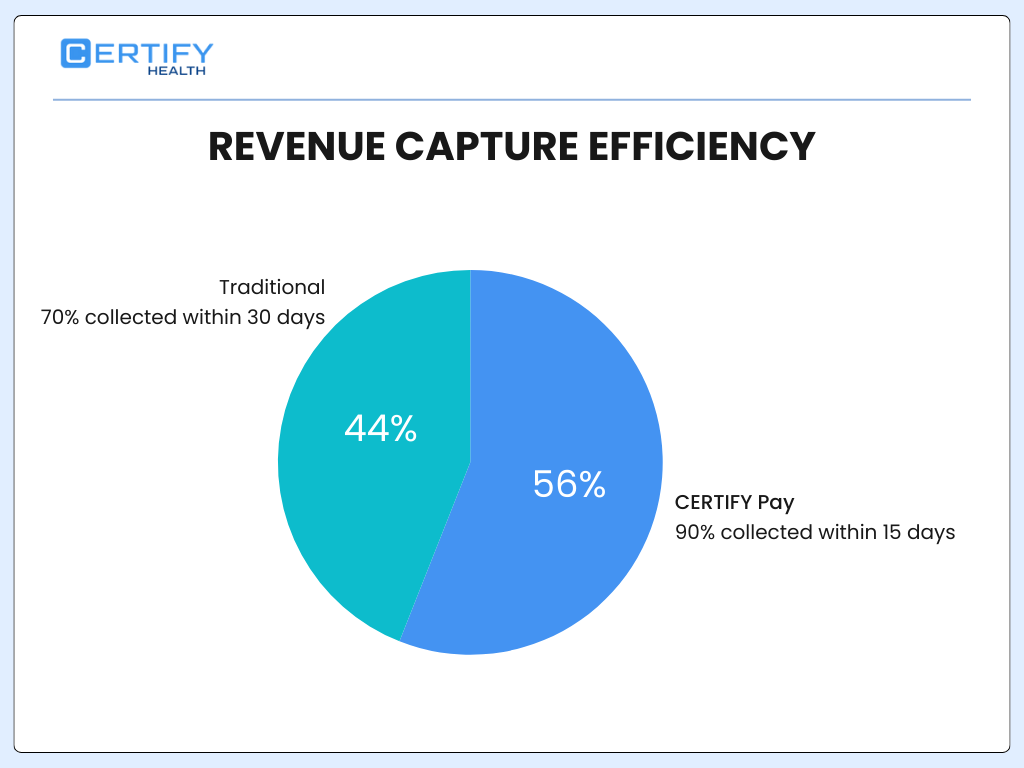

2. CERTIFY Pay: Omnichannel Patient Payments

Traditional payment methods are fragmented, leading to delayed patient collections. 79% of providers require two or more statements to collect a patient balance in full, and many rely on mailed or manual statements.

CERTIFY Pay supports text, web, kiosk, and in-office payments with real-time posting to the billing system.

Key Benefits:

- Immediate reconciliation reduces manual posting errors by 80%.

- Patients pay faster: digital reminders increase payment capture by 15–20%.

- Supports PCI-DSS compliance, protecting cardholder data.

Comparison Table: Traditional vs CERTIFY Pay

| Feature | Traditional Billing | CERTIFY Pay |

|---|---|---|

| Payment Channels | Mail / In-person only | Text, Web, Kiosk, In-office |

| Posting Speed | 1–3 days manual | Real-time auto-posting |

| Errors | High (manual reconciliation) | Low (automatic) |

| AR Days | 30–45 | 15–20 |

3. Lower Accounts Receivable Days

Manual reconciliation and claim corrections extend AR days, slowing cash flow. A research showed that integrated billing systems reduced AR from 90 to 45 days.

Certify Health Impact:

- Auto-posting and clean claims reduce follow-up calls by 40%

- Digital eligibility checks prevent rework, shortening AR days by up to 15 days

- Automated reporting helps managers spot bottlenecks instantly

AR Days Reduction

4. Staff Relief: Fewer Corrections, Fewer Patient Calls

Staff burnout increases with fragmented billing. We are mired in a crisis of administrative excess, where fragmented systems force clinicians to spend nearly two hours on documentation for every one hour of direct patient care, worsening staff fatigue.

Certify Health Solution:

- Automation reduces error correction steps by 20–30%

- Fewer patient billing calls due to integrated payment visibility

- Staff can focus on high-value tasks, improving job satisfaction

5. Enterprise-Grade Trust & Compliance

Compliance failures carry high financial and reputational risks. HIPAA, SOC 2 Type II, and PCI-DSS are mandatory for secure billing and payments.

Certify Health + CERTIFY Pay:

- HIPAA-aligned architecture ensures privacy for all patient data

- SOC 2 Type II and PCI-DSS certifications confirm rigorous security controls

- End-to-end encryption for payments and health records

| Compliance | Traditional Software | Certify Health |

|---|---|---|

| HIPAA | Partial / Manual | Full, automated |

| SOC 2 Type II | Rare | Verified |

| PCI-DSS | Optional | Fully compliant |

6. Integrated Revenue Cycle Wins

| Metric | Industry Average | Certify Health + CERTIFY Pay |

|---|---|---|

| Denial rate | 12–15% | 5–7% |

| Clean claims rate | 85–90% | 92–95% |

| AR days | 35–40 | 20–25 |

| Staff time on billing | 25–30% of admin hours | 15–18% |

| Patient collections within 15 days | 60% | 90% |

Key Takeaway: Certify Health does not just digitize billing; it optimizes the entire workflow, creating a measurable revenue impact, happier staff, and faster collections.

Internal Proof Point

A multi-provider outpatient practice implemented Certify Health and observed measurable improvements across its revenue cycle:

Reduced front-end eligibility errors

- Fewer claim rejections due to inaccurate patient information

- Real-time verification caught coverage gaps before the visit

Shortened reconciliation cycles

- Auto-posting and integrated payments reduced manual follow-up time by up to 40%

- AR days dropped from 35–40 to 20–25, improving cash flow

Reclaimed staff hours

- Staff previously spending 5–8 hours weekly on post-visit billing corrections were freed to focus on patient care

- Staff satisfaction improved alongside operational efficiency

Practice Impact Metrics

| Metric | Before Certify Health | After Certify Health |

|---|---|---|

| Front-end eligibility errors | 12–15% of claims | 5–7% |

| Reconciliation time | 8 hours/week | 4–5 hours/week |

| AR days | 35–40 | 20–25 |

| Staff billing corrections | 5–8 hours/week | 2–3 hours/week |

Compliance & Buyer Due Diligence

When evaluating medical billing software in 2026, buyers should request:

- HIPAA BAA – ensures patient data privacy is contractually enforced

- SOC 2 Type II report – validates system controls for security, availability, and processing integrity

- PCI-DSS certification (for CERTIFY Pay) – ensures secure handling of credit card payments

- Audit logs and payment reconciliation samples – verify accuracy and transparency in practice reporting

Checklist Table: Buyer Due Diligence

| Compliance Item | Reason to Request | Certify Health Status |

|---|---|---|

| HIPAA BAA | Protect patient health info | Provided |

| SOC 2 Type II | Security, availability, process integrity | Provided |

| PCI-DSS | Secure patient payments | Provided (CERTIFY Pay) |

| Audit logs | Verify transactions & reconciliation | Available |

Potential Cost Savings for US Healthcare Clinics

In the United States, workflow automation and revenue cycle optimization offer measurable cost savings for healthcare clinics, especially outpatient and ambulatory practices. This section quantifies savings from reduced administrative costs, lower cost‑to‑collect, fewer denials, and streamlined operations.

1. Cost‑to‑Collect Reduction Through Automation

What “Cost‑to‑Collect” Means:

Cost‑to‑collect is the percentage of revenue spent on billing, coding, claim submission, follow‑up, and collections.

- Clinics and health systems using revenue cycle automation reported an average cost‑to‑collect of 3.51% versus 3.74% without automation.

- This 0.23 percentage point improvement translates into millions saved for larger organizations.

- For a hypothetical organization with $5 billion in revenue, lowering cost‑to‑collect from 3.74% to 3.51% represents a savings of $11.5 million annually.

Cost‑to‑Collect Comparison

| Scenario | Cost‑to‑Collect | Annual Expense (on $5B Revenue) | Savings |

|---|---|---|---|

| No Automation | 3.74% | $187 million | — |

| With Automation | 3.51% | $175.5 million | $11.5M |

Even smaller practices see proportional savings when administrative costs shrink relative to revenue collected.

2. Broad Administrative Savings Through Workflow Automation

- The US healthcare system could save approximately $16.3 billion annually through workflow automation in eligibility verification, claim submission, prior authorization, and payment posting.

- Digital automation already accounted for $122 billion in savings prior to this estimate.

Even with just a fraction of these efficiencies realized at the clinic level, practices can cut administrative waste significantly; especially for tasks like insurance verification, claims submission, and eligibility checks.

3. Reduced Manual Processing Costs (Claim Efficiency)

Industry data shows:

- Manual medical billing costs roughly $25 per claim, while electronic processing costs about $3 per claim.

- Automation can reduce errors by up to 75%, directly lowering the need for rework and denied‑claim handling.

Estimated Cost Impact

| Process | Average Cost per Claim | Estimated Savings per Claim |

|---|---|---|

| Manual | $25 | — |

| Electronic/Automated | $3 | $22 (88% reduction) |

Clinic Example:

A clinic processing 10,000 claims per year could theoretically save up to ~$220,000 annually by transitioning manual billing to automated processes.

4. Efficiency Gains with AI and RPA

Multiple industry analyses suggest:

- Automation, AI, and data analytics could cut between 25% and 50% of administrative costs across healthcare settings, including billing, claims, and eligibility workflows.

- Broader application of automation and analytics might eliminate $200 billion to $360 billion in overall US healthcare administrative spend.

Smaller outpatient practices benefit proportionally when staff time is redirected from repetitive manual tasks to value usage, reducing overhead while maintaining compliance and accuracy.

5. Denials, AR Days, and Revenue Impact

Other automation research highlights:

- Automated platforms can reduce denial rates by as much as 40–60% and shorten accounts receivable (AR) days.

- Shorter AR cycles improve cash flow, decrease the need for collection efforts, and reduce overhead costs related to labor and follow‑ups.

Savings Potential Table

| Improvement Area | Impact | Example Savings Effect |

|---|---|---|

| Denial reduction | 40–60% fewer denials | Fewer rework costs & write‑offs |

| Faster payments | AR days drop | Lower financing/interest costs |

| Staff efficiency | 30–40% fewer hours on billing | Reduced overtime and hiring needs |

Cost Savings Summary: Quick Takeaways

- $11.5 M savings on cost‑to‑collect per $5B revenue with automation vs no automation.

- $16.3 B potential national savings from workflow automation.

- Up to 75% fewer billing errors, cutting rework costs.

- 25–50% reduction in administrative expenses with advanced automation.

- Significant reductions in AR days and denials, leading to better cash flow.

How Clinics Can Translate Research into Dollars

Clinic Cost Savings Model (Digital Billing + Payments)

| Total Claims/Year | 10,000 |

|---|---|

| Manual Cost/Claim | $25 |

| Automated Cost/Claim | $3 |

| Total Savings | $220,000 |

Add Revenue Gains:

- Clean claims → higher first‑pass payments

- Reduced denials → fewer appeals

- Faster payments → lower AR days

Clinics that implement integrated billing + payments + eligibility automation, like CERTIFY Health + CERTIFY Pay, can realize measurable cost savings and revenue gains rooted in real industry data.

Final Takeaway

In 2026, the best medical billing software is not just digital; it prevents revenue loss before claims exist.

Why Certify Health + CERTIFY Pay Wins:

- Aligns intake, eligibility, patient payments, and billing into one system

- Reduces denials and claim corrections with pre-visit verification

- Shortens AR days and accelerates cash flow with integrated payments

- Frees staff from low-value work while ensuring enterprise-grade compliance

Key Metrics Recap:

- Denials reduced to 5–7% of claims

- Clean claims rate: 92–95%

- AR days: 20–25

- Staff time on billing tasks: 15–18% of admin hours

- Patient collections within 15 days: 90%

Certify Health + CERTIFY Pay delivers measurable, research-backed advantages for practices aiming to maximize revenue, reduce staff burden, and maintain full compliance in 2026.

Book a demo to learn more.